Good morning, it's Paul & Jack here, with the SCVR for Wednesday.

Timings - should mostly be done by official finish time of 1pm. Let's revise that to 5pm, there's a lot going on in the markets that is distracting me, sorry about that. Today's report is now finished.

Agenda - this is what has caught my/our eye(s) today. Jack has come up with an idea for he & I to collaborate on file sharing in google docs, so we can both contribute sections to the same article. We’re testing that out today, let’s see what happens!

Shoe Zone (LON:SHOE) - I hold - as discussed in the reader comments below, a full year trading update

Sylvania Platinum (LON:SLP) - this section written by Jack - Q1 Report

Tribal (LON:TRB) - Trading statement - looks positive

M&c Saatchi (LON:SAA) - Half year report

.

Shoe Zone (LON:SHOE)

Share price: 38p (down 16% at 10:36)

No. shares: 50.0m

Market cap: £19.0m

(I hold)

Shoe Zone PLC ("Shoe Zone") reports on trading for the 52-week period to 5 October 2020 ("FY20"), prior to entering its close period.

Preamble - It’s remarkable to see the market cap of Shoezone down to only £19m, given that this business used to consistently make £8m+ profit per year, and paid out generous divis. It has entrepreneurial management, Anthony & Charles Smith, who together own 50% of the business. Its leases are short, and fit-out costs are low, so it actively manages the store estate, avoiding the long tail of loss-making sites that plagues (and often destroys) other retailers. Product is cheap & cheerful, and is manufactured in China.

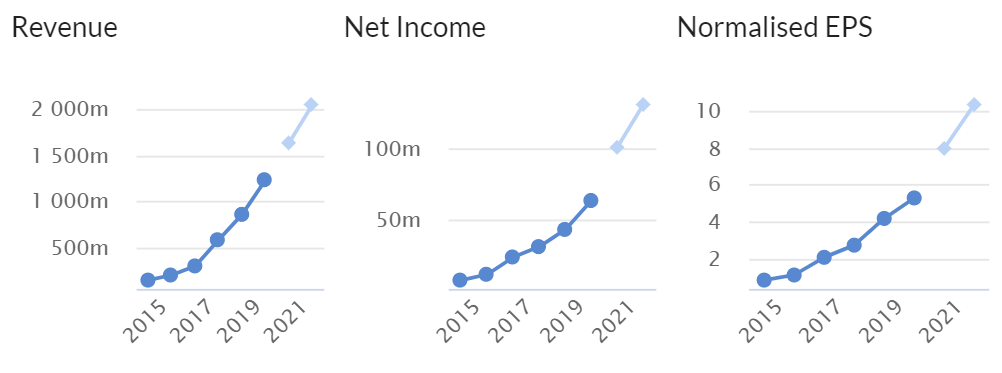

The light blue blobs below look outdated forecasts, so ignore those. Otherwise you can see that, in normal circumstances, this is a decently profitable business. The big question is, can it survive, and recover from covid/lockdown? IF it can, then buying now could lock in a wonderful future dividend yield, and capital appreciation too. If not, then the company could end up going bust, or being taken private for a song.

.

.

I’ve just re-read my notes from 23 June 2020, covering SHOE’s interim results to early April 2020. I concluded that liquidity…