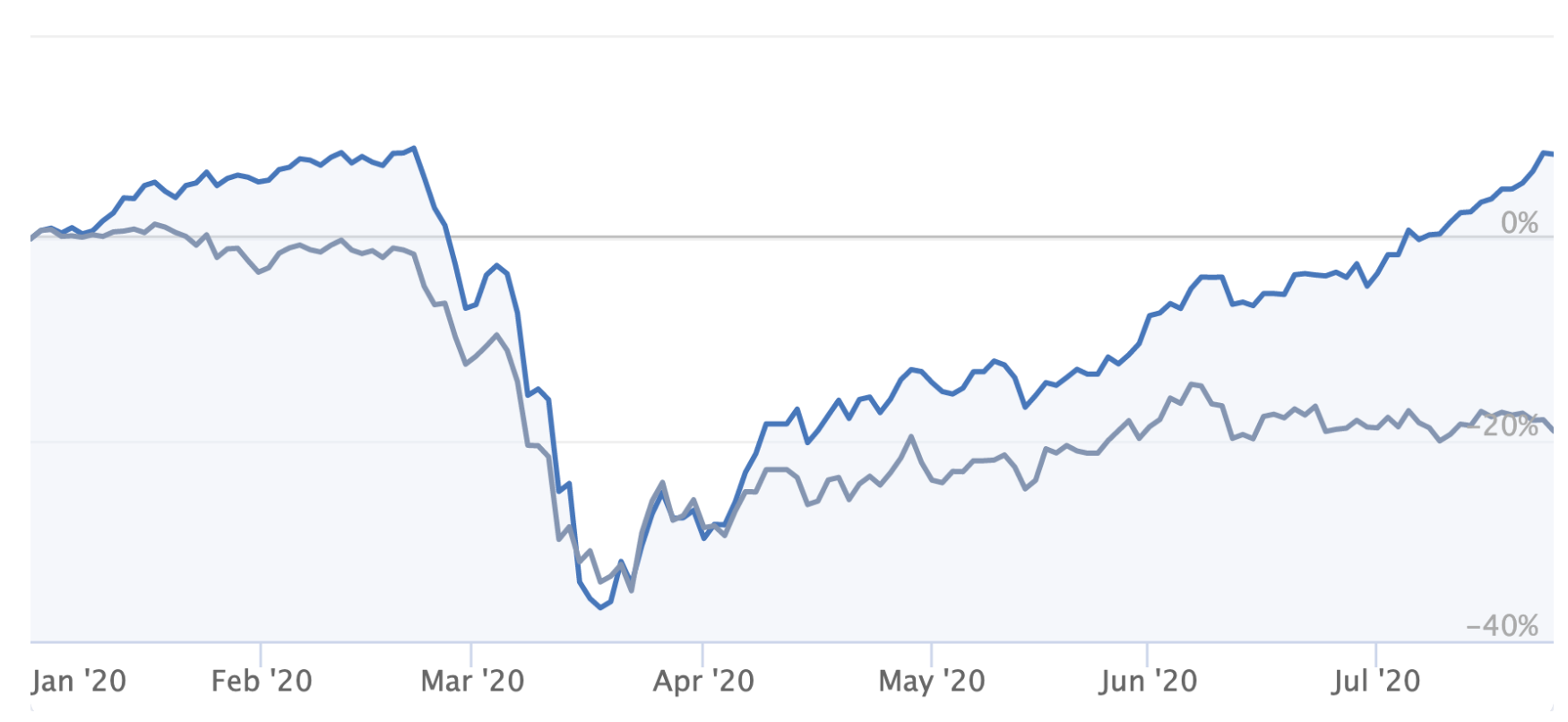

As of July 25th, this year's NAPS portfolio has done rather well. The NAPS are currently up 8.5% year to date, versus a FTSE All Share benchmark that is down 19.1%. That's a 28% outperformance in the first six months. While the portfolio is still below its high watermark from June 2018, it's actually broken out to new highs relative to the benchmark. I'd love to say it's been a smooth ride, but as we all know there's been a nasty virus knocking about and the markets stumbled badly in March.

One of the great benefits of the NAPS process is that embedded within it is this idea of only checking once (or twice) per year. If we'd just gone to sleep for 6 months and woken up to check the NAPS valuation, we'd have had the pleasant surprise of seeing it grow. In this article I'll explore the fact that it's been to hell and back in the interim and whether that matters.

If you are a new reader, you may have missed the journey I've had with the NAPS strategy over the last five and a half years. In essence it's a systematic, diversified, 20 stock portfolio based upon the StockRanks that only takes an hour per year to put together - accordingly, I've titled it the "No Admin Portfolio System" or NAPS for short. You can learn much by going through the NAPS Archives or watching one of the old Youtube Webinars. I do hope to create a course about the methodology in due course.

[This is a long piece, if you want a PDF version you can download it by clicking here]

Recent Performance

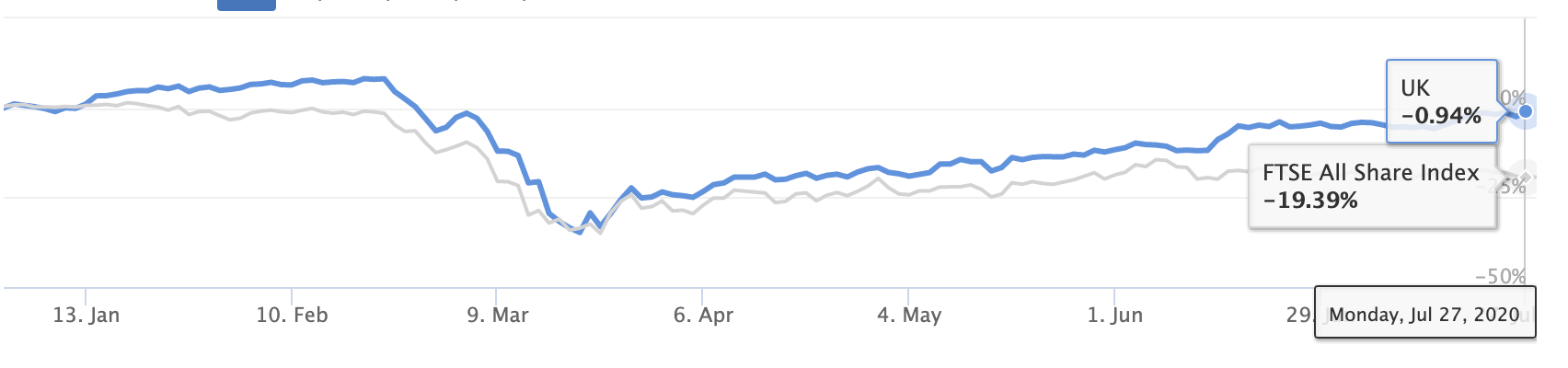

After a useful early run, a fairly brutal viral attack knocked 40% from the portfolio in February and March. Serendipity then provided a 70% rally over the last 4 months. The line in grey is the FTSE All Share which I always use as a benchmark. There is fairly strong and enduring momentum recently, which has been driven by a 10% allocation to gold stocks.

Here's the five and a half year performance history of the portfolio, a 118.5% performance excluding dividends. This chart illustrates the extent of the whipsaw we've seen of late.

I couldn't help but subtract the FTSE All Share's…