News that Lorcán Ó Murchú has quit as chief executive of Snoozebox is the latest twist in a sorry saga. Snoozebox makes portable hotel rooms that can be used at festivals and events. By all accounts, the product is pretty impressive - but the business model has proven very suspect. It floated on AIM in 2012 at 40p a share but has struggled to get much traction. With today’s news driving the price down by 23% to 1.25p, that’s a 97% loss for anyone who’s held on since the start.

After a long on-off affair with the Snoozebox, our own small cap expert Paul Scott washed his hands with it last December when it announced a £5m placing but no Open Offer for existing investors. At the time, he pointed out that the chairman and chief executive were on remuneration packages that were completely out of whack with Snoozebox’s stage of development.

A month later, the non-executive chairman resigned and another NED left because of ill health. These board changes may not have been amiss, but they were hardly good for stability.

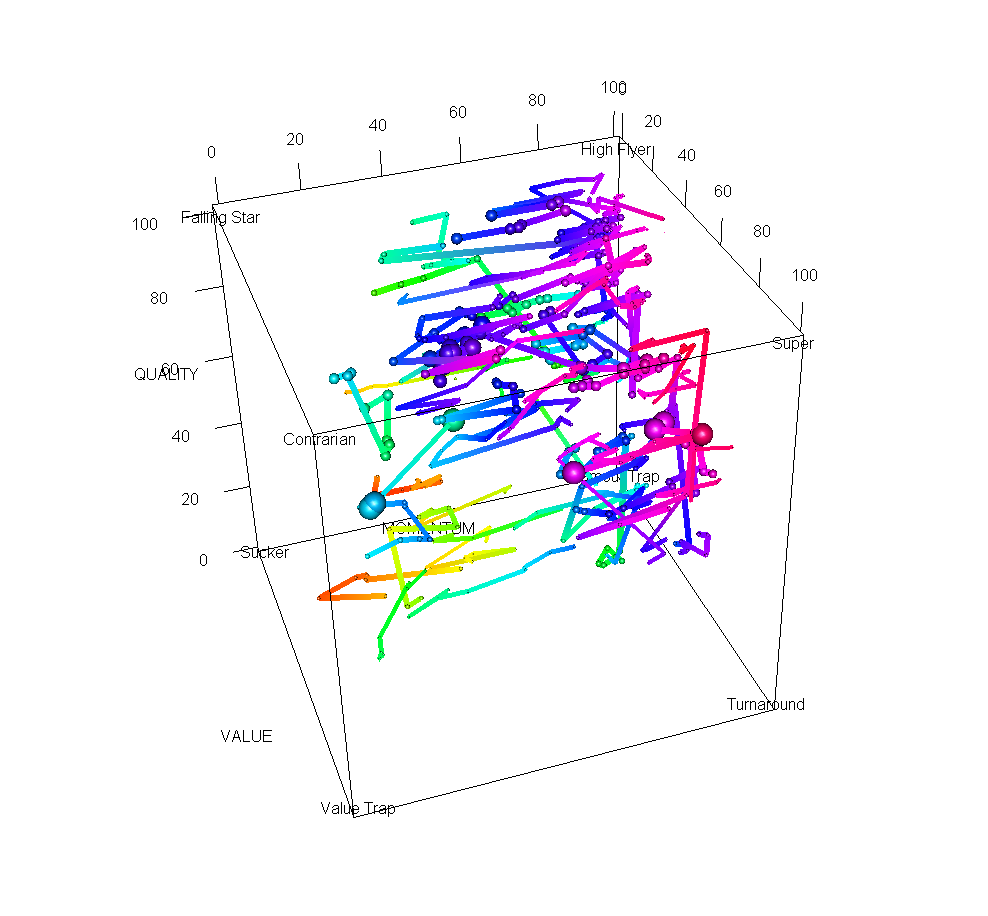

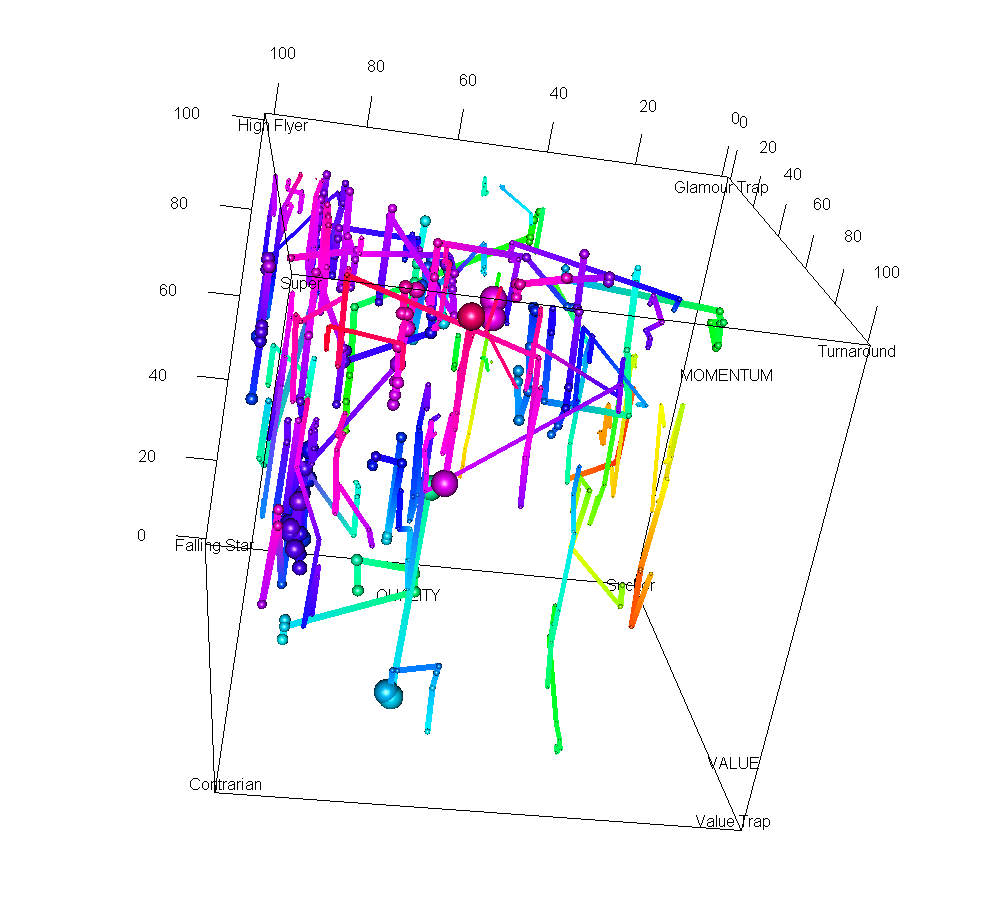

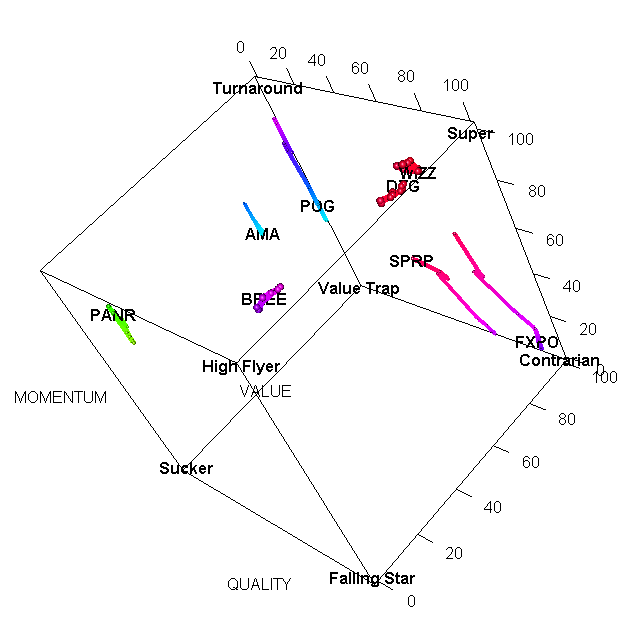

This is precisely the sort of speculative business that is statistically unlikely to end well for those that invest in it. At Stockopedia we call them Sucker Stocks. They generally come with a great story, but offer very little exposure to the Quality, Value and Momentum factors that you tend to see in market beating stocks. So where were the warning signs at Snoozebox?

1. Very Low StockRank

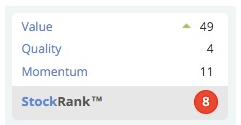

The simplest red flag that a stock is a ‘Sucker Stock’ is a low overall StockRank, which analyses the company’s Quality, Value and Momentum across the board into a single number. Snoozebox has a StockRank of 8, ranked worse than 92% of the UK stock market.

As we can see the StockRank for Snoozebox has never been outside of the bottom 25% of the market which has put its expected stock market performance amongst the most dismal.

Using Stockopedia’s analysis framework we can dig deeper into the company’s Quality, Value and Momentum and find a set of red flags across the board. All of these red flags are easily calculated from publicly available information and should have been simple to see regardless of whether they use investing software like Stockopedia’s.