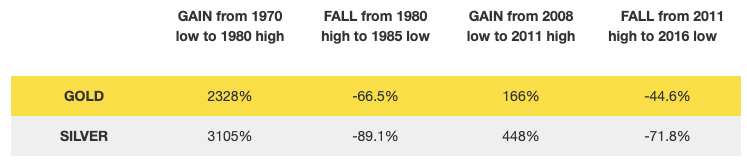

There are a number of entrenched dynamics that make gold an attractive proposition these days - and where gold goes, silver tends to follow (but with added rocket fuel).

In fact, some call silver the long shadow of gold. It’s a riskier and more leveraged play on the same dynamics of widespread currency debasement and non-existent bond yields.

The correlation is slightly obscured by larger industrial demand for silver, but they are correlated nonetheless.

Silver is more volatile because it is a smaller market with lower liquidity. Back in the 70s and 80s the Hunt Brothers cornered the entire private market, taking a huge leveraged position and causing the dramatic price spike in the chart below.

They allegedly held one-third of the entire world supply of privately held silver.

This remarkable situation prompted the jeweler Tiffany's to take out a full page ad in The New York Times, saying "We think it is unconscionable for anyone to hoard several billion, yes billion, dollars' worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver".

This standoff was ultimately resolved through a combination of changed trading rules on the New York Mercantile Exchange (NYMEX) and Federal Reserve intervention. By 1982, the London Silver Fix had collapsed by 90% to $4.90 per troy ounce.

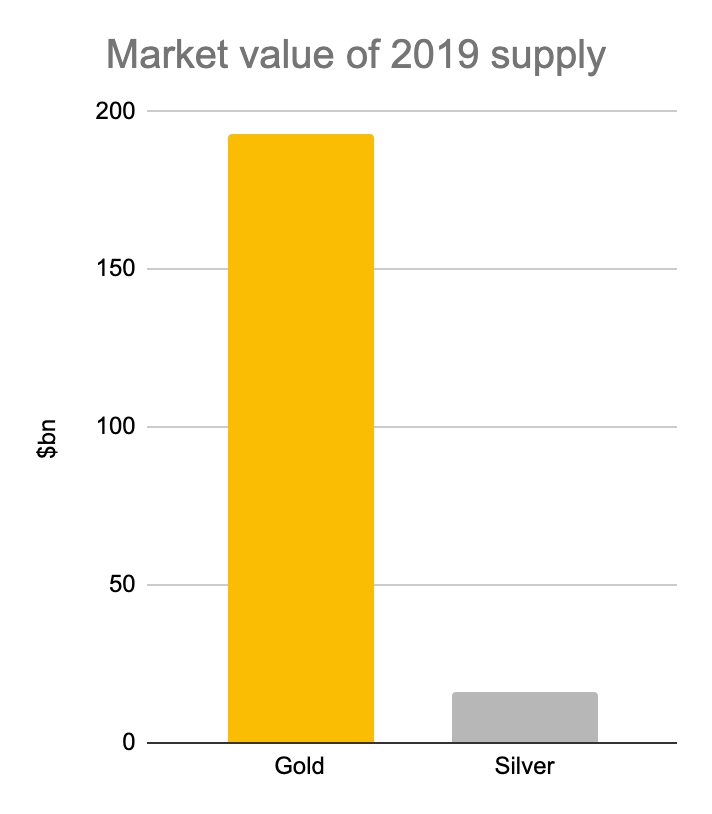

In conclusion: a smaller and more volatile market. You can see below that even today total annual silver supply is a fraction of that of gold.

With everyone talking about the gold price hovering around the $2,000 mark, there are signs of life in silver as well.

This is purely anecdotal, but I’ve heard a couple of institutional investors in the space throw out some eye-catching silver price predictions that blow historic norms out the water. They are talking their own book of course, but what’s more concrete is that they are seeing considerable inflows right now.

Investment demand shows a 10% gain so far in 2020 as investors actively accumulate silver. As of June 30th, global ETF holdings reached a fresh all-time high of 925 million ounces (Moz).

The two spot prices are taking a breather, but the sheer tectonic scale of modern monetary theory (QE, negative interest…

.jpg)