We’re working on some internal data research tools at Stockopedia which will contribute to a lot of editorial insights, and we hope, some really great product launches in future. Here’s a few insights from my own recent research into the performance of UK StockRanks strategies in the last few years.

(Disclaimer: Past performance not an indicator of future results etc).

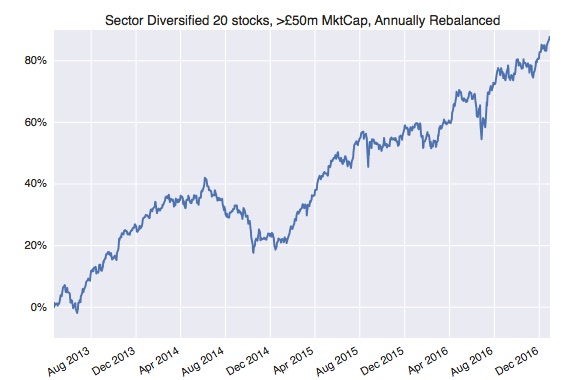

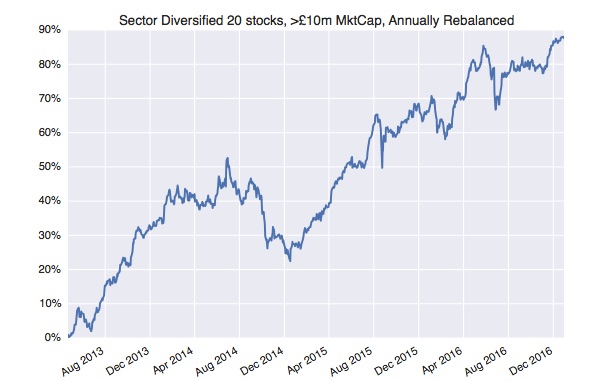

1. Sector Diversification - does it reduce returns ?

How did a NAPS portfolio process (picking the top 2 stocks from each sector) stack up against selecting the top 20 ranked stocks without any additional diversification ? Here’s a chart of the NAPS based approach…

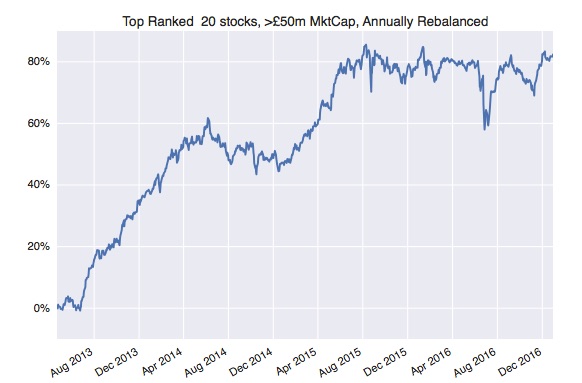

Meanwhile the top 20 by StockRank without additional diversification:

The performance was very similar, but the sector diversified portfolio performed much more smoothly. The “Top Ranked” portfolio was only invested in an average 3 sectors throughout the whole period, whereas the NAPS invested in 10 sectors consistently. Essentially, the NAPS process led to stronger risk-adjusted-returns.

The observant will know that my New Year’s NAPS portfolio (written up here) returned only just over 5% in 2017. The reason it didn’t keep up with the first chart above was because I meddled with my original rules ! Meddling with rules hasn’t paid.

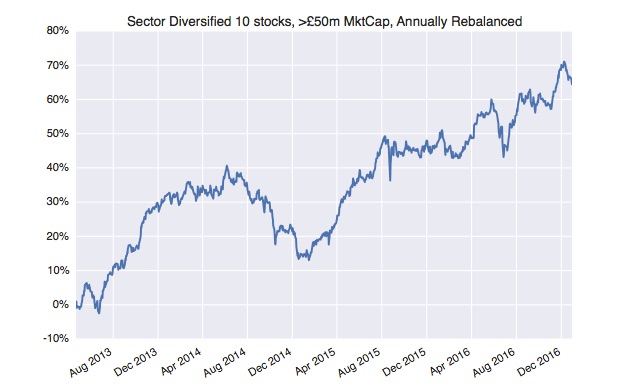

2. Just 10 stocks - do concentrated portfolios outperform ?

Does extra breadth in a portfolio really add any performance ? I’ve long argued that if you are a systematic investor it makes sense to broadly diversify. If you are genuinely a talented stock picker (which you probably aren’t) then you should concentrate. Here’s a chart of a Top 10 only NAPS portfolio.

A nice performance, but it shows a significantly reduced return versus a more broadly diversified 20 stock portfolio and a lot more volatility. Concentration hasn’t paid.

3. Microcaps - is there an edge in hard to trade shares?

All the above tests have a minimum £50m market cap cutoff - i.e. they are excluding the microcaps. If we drop that to a £10m cutoff to let in the top ranking microcap shares how would it have done ?

It’s squeezed a bit more performance, but I’d argue that the additional transaction costs and volatility may not…