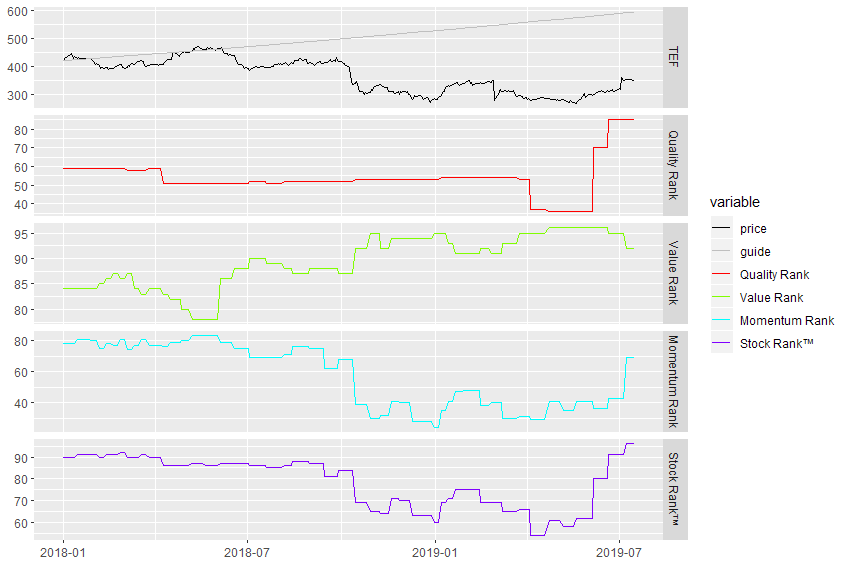

On 26 March I sold Telford shares which Stockopedia (SP) rated as a Value Trap at the time at 263p.

Today they are now rated as a Super Stock with a Stock Rank of 93 and the price is 351p.

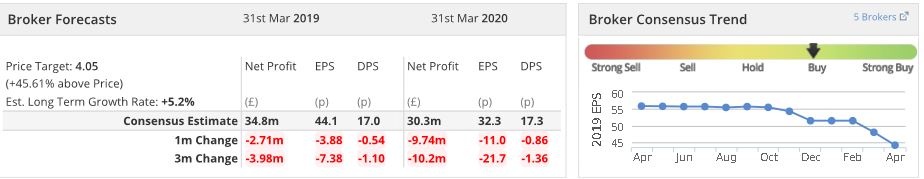

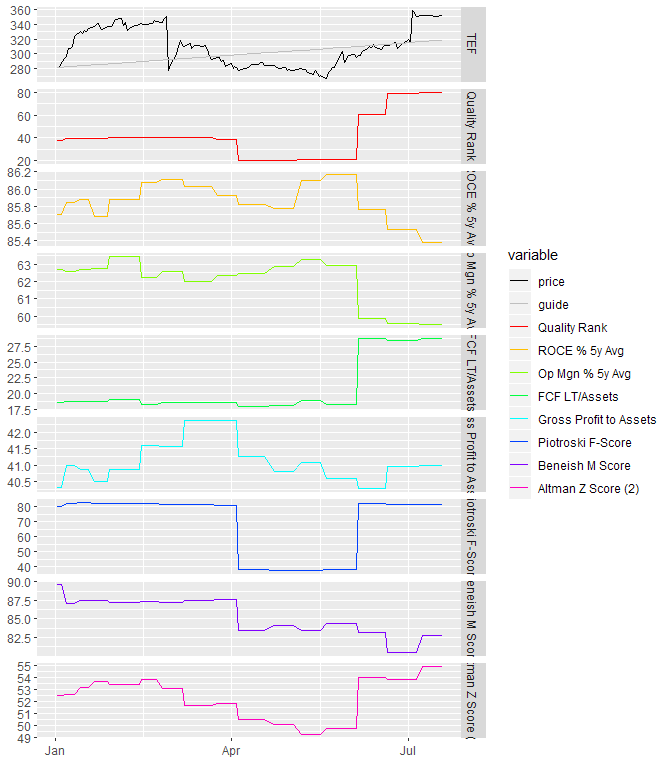

As the results for the year to 31.3.19 were pretty much in line with SP's forecast how sound are either of SP's assessments?

Maybe the thing to have done would have been to set some alarms to tell you when the style changed or any of the factors improved??

Carey