Sportech (LON:SPO) http://www.sportechplc.com/investors is a sports entertainment company and one of the world's leading pool betting organizations, focusing on highly regulated markets worldwide with a presence in over 30 countries and licensed to operate in over half of the US States. Put simply, it's a gambling group comprised of three business divisions: Sportech Racing and Digital, Sportech Venues and The Football Pools.

- Share price: 60p

- Mkt Cap: £124m

- P/E (Fwd 2016): 11.8

- P/E (Fwd 2017): 7.7

- Yield: Nil

- Net Debt: £57.7m

- Negative Tangible Assets

- Gross Margin 42%

- Operating Margin 29%

Several years ago the company embarked on a turnaround strategy to arrest the decline of the core football pools business hit by the introduction of the National Lottery. This has partly been achieved by transferring the pools business from an offline paper model to an online system. Net debt has been steadily albeit, slowly, declining over the years.

Each division roughly contributes an equal part to the overall revenues but in terms of profitability, 60% is derived from the Football Pools

The most recent breakdown of the company's business shows:

Turnover:

North America: 51%

UK: 39%

Europe: 9%

Other 1%

Pre-Tax Profit:

Football Pools: 71%

Racing & Digital: 22%

Venues: 7%

As can be gleaned from the above, although North America provides half the turnover , it's the Football Pools (UK) that provides the majority of the profits. However there seems to be something of a push into expanding the US markets; "...making good progress ...continues to provide exciting growth opportunities", and the Football Pools are arriving at an 'inflection point' following changes in technologies used. Post Brexit, the increase in overseas business is likely a fortuitous strategy.

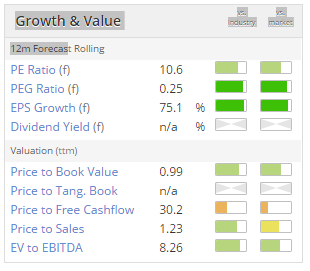

Reviewing Stockopedia data we see:

So in terms of value and growth things look quite appealing. However over the years the company has acquired various other businesses and there is a reasonable amount of Depreciation,amortisation and impairment of assets plus exceptional costs to be wary of. It's worth reading the Independent AuditorsReport contained in the last Annual Report for a comprehensive review of these factors

Also, although net debt has been falling, it is still at £57.7m which for a£123.7m mkt cap company is not so comfortable for a value investor. Also note the 'n/a' against the P/TBV.

Sportech said it has seen a positive start to…

.png)

.JPG)