Chancellor Rachel Reeves’ promise to have just one major fiscal event a year has been somewhat scuppered by an unfortunate hole in the public purse. A hole that has opened up, according to Reeves, because of global economic instability.

To give the chancellor a soupçon of leeway, her budget and spending plans were set out just one week before the election of Donald Trump, whose first few months of his second term have been dominated by economically destabilising trade tariffs.

But it was perhaps a bit ambitious to give just 1% of headroom in the budget, given it isn’t just the re-election of a rather radical president which has thrown global economies into disarray. Geopolitical tension has been raging in the Middle East and eastern Europe for several years. While political instability in Europe has been threatening trade ties there well before Trump started using his “favourite word”.

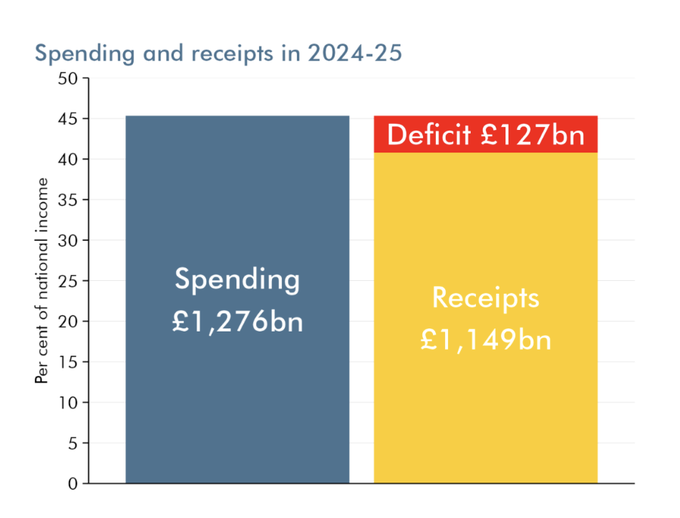

The headline from today’s announcement is that rising borrowing costs (the yield on government bonds) means that without further taxes or cuts, the government will fall short of its target to balance the deficit. That puts Reeves and her team in Labour HQ in something of a pickle - further cuts (or austerity measures) are a solution for the Tories, but further taxes go against what she promised in the Autumn.

The solution - tiny tweaks to spending plans, cuts to welfare spending (dressed up as an altruistic plan to ‘get people back to work’) and the promise to kick the can down the road until June. Speaking to the Financial Times, a senior portfolio manager from Axa’s investment management warned that rebuilding just £10bn of headroom was unlikely to be enough. The spending review in June (another one of the non-major fiscal events the chancellor has planned to keep everyone focused) will likely come with more spending cuts to meet the fiscal rules.

Market impact

The statement received a mixed reaction from the financial markets, with the domestic-focused FTSE 250 dropping sharply as the chancellor started speaking before rallying again.

That rally might have been supported by the share price movement of the defence companies and housebuilders, which were the only sectors to get a direct callout in this review.

Defence (which has had a pretty strong start to…

.JPG)