Sprue Aegis (LON:SPRP)

Share Price 112.75p (-9.5%)

Bid/Offer 111.5p/114p (current live dealing spreads)

Market Capitalisation £56.4m No of Shares 45.9m

Enterprise Value £46.5m NMS 1,500

About the Company

A company focused on providing market leading smoke detectors, carbon monoxide detectors and other home safety products, serving international markets. Major brands include AngelEye, FireAngel and Sona brands.

BRK/SPRUE Dispute

Normal practice was simply for Sprue Aegis to return any unsold stock worth £4.3 million gross value to BRK at the end of the contract period. However, BRK pulled a rabbit out of the hat, claiming breach of contract just 8 days before the contract was due to terminate and a few days just before Sprue's final results were to be released.

A large adjustment to full-year profits would be needed if BRK's claim of trade infringement was successful. The value amount for the trade infringement is very small in value terms, but more importantly it gets BRK out of having to take back millions of pounds in unsold stock under their distrubitive agreement.

Sprue decided to delay the release of their final results in order to sort out the matter. At the time, looked to be the correct course of action, but unfortunately the dispute has dragged on.

In worse case scenario, Sprue is free to do what they wish with BRK products and could threaten to flood BRK's local markets. This could be done by placing stock on supermarkets shelves at discounted prices for months on end. A rather messy way but would allow Sprue to retrieve as much as possible of the £4.3 million of stock held.

For BRK this would in hindsight be a pyrrhic victory at a long-term cost to their brand. There is no win-lose situation here, only win-win or lose-lose. Sense on both sides should prevail in time.

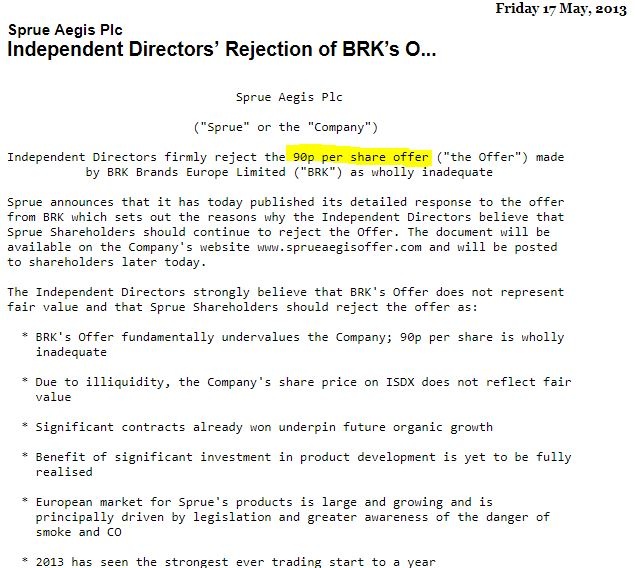

This spat is a falling out on a partnership going back years that should have ended up with Sprue being acquired at a takeover premium by BRK in 2013. BRK was unwilling to pay up then and apparently not now either as BRK looks to thwart Sprue's new independence.

If my analysis is correct, the risk/reward for Sprue shareholders is immense with…