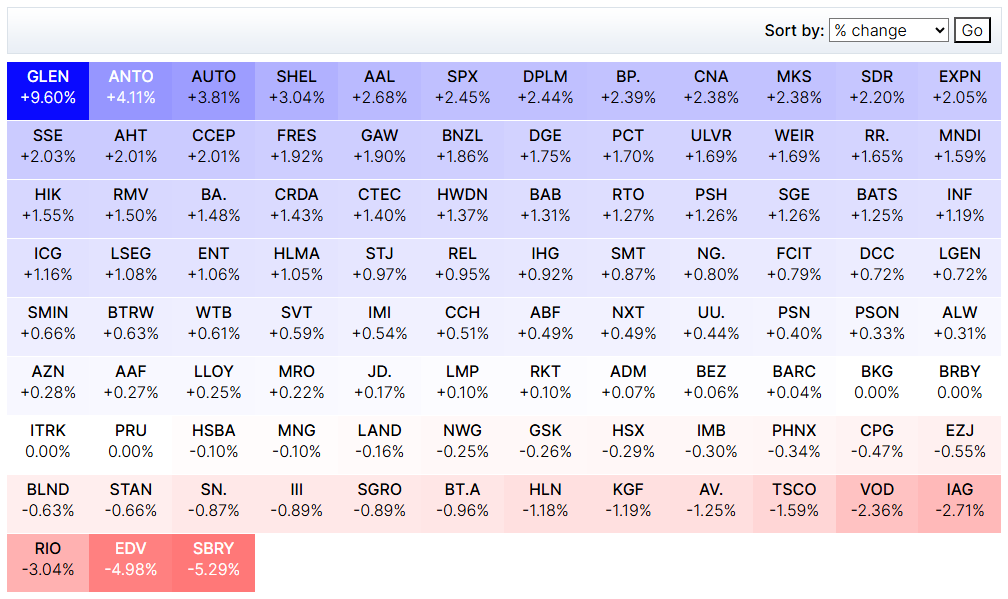

..STOP PRESS..2020 Portfolio up +10.6% compared to the FTSE All-Share down -18.8%..STOP

I am a subscriber to Stockopedia with a Mechanical Trading Strategy that is achieving great returns. In 2019 the ME Way investing in the FTSE250 produced +32.9% compared to the FTSE All-Share +18.2% and so far in 2020 to end of September +10.6% compared to the FTSE All-Share down -18.8%.

I wanted to develop a model that could buy and sell according to a screen based criteria; consistently apply the same criteria time after time with no emotion, full discipline and back tested to prove model. This led me to develop model after model after model until I reached the ME Way. A simple and successful Mechanical Trading Strategy.

The most famous Mechanical Trading Strategy is probably Michal O'Higgins best selling investment classic Beating the Dow. The logic is simple; markets over-react to bad news and the aim is to exploit the gap between reality and the markets distorted view. The ME Strategy is very similar in the opposite manner; markets under-react to good news and the aim is to exploit the gap between reality and the markets distorted view. Not 'Dogs of the Dow', but 'Stars of the FTSE'.

HOW I INVEST - THE ME WAY

'ME' goes against the efficient market hypothesis in a Momentum and Earnings led way.

- M is for Momentum. Winners keep winning; great companies keep on growing and outperforming the market. Money is made by buying shares at high prices and selling at even higher prices.

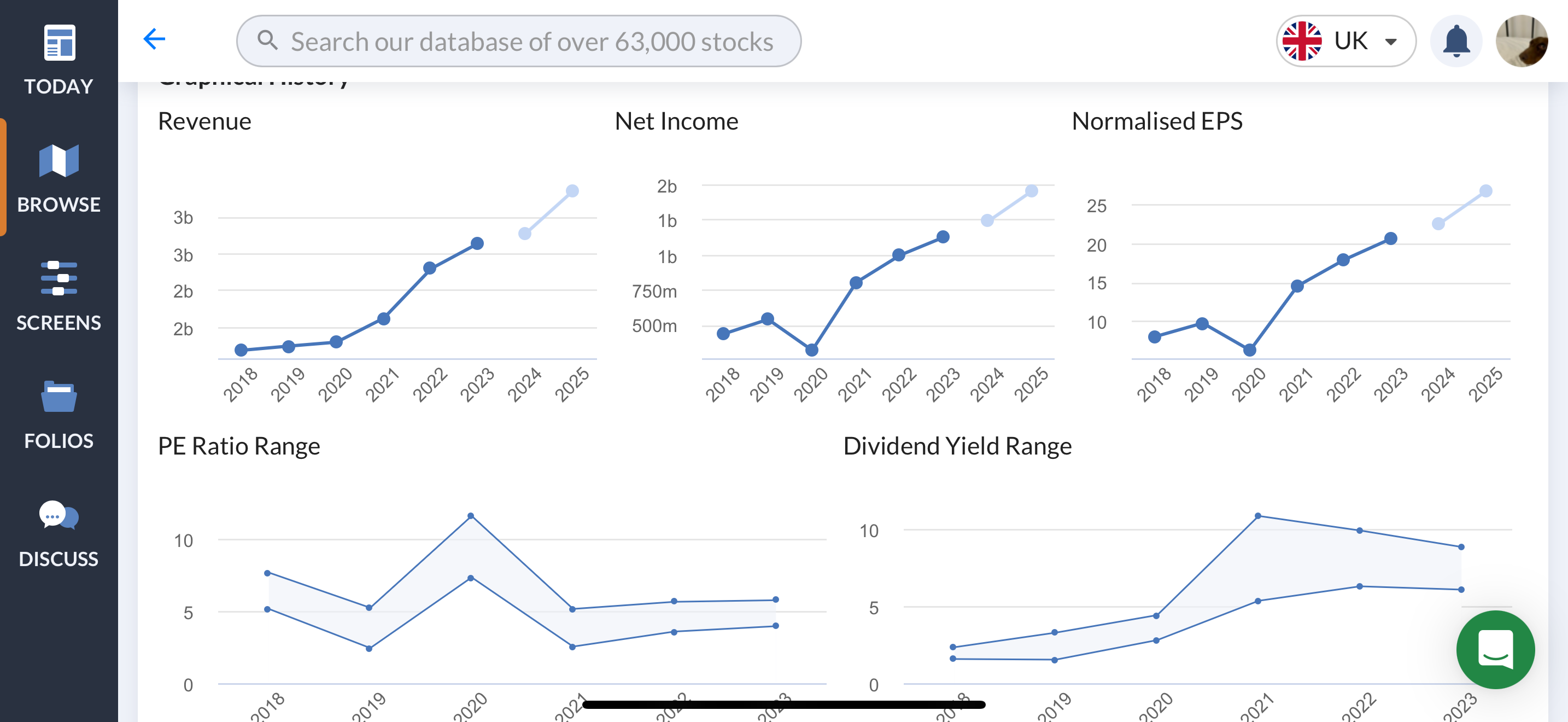

- E is for Earnings. The number one factor in the short and medium term that drives a share price forward. A PEG Slater helps ensure that the earnings/growth is established and consistent.

ME METHOD

The search method is 5 simple steps.

- Step 1. Momentum. Strong momentum that is established with positive twelve months relative strength. Twelve months is a key driver. One month can just be a short term one-off blip. Three months provides reassurance but is still relatively short term. Twelve months the momentum is established. Winners must keep winning. (RS 1y greater than 0).

- Step 2. Earnings. Highest earnings forecasts for next 12 months for growth companies (PEG Slater greater than 0), (EPS Gwth % Rolling 1y greater than 0).

- Step 3. Comfort. Pays a dividend so not all cash is being used to generate earnings growth. (DPS greater than 0).

- Step 4. Large…