My SIF stock screen is delivering a fairly minimal set of choices this week. Just eight companies satisfy all of my screening requirements. Of these, four are in the portfolio, two are ruled out on diversification grounds, and the final two are overseas stocks.

This situation arises periodically and doesn’t concern me. Indeed, I see it as a sign that the screen is working as intended, filtering for affordable growth. What I often do at times like this is to experiment with disabling individual rules in the screen.

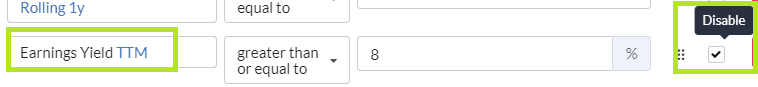

I usually find that there’s one rule in particular which is limiting my choice of stocks. This week is no exception. By disabling the rule requiring a trailing earnings yield of more than 8%, the number of stocks in the results jumps from eight to 44.

By making this change, I was hoping to find companies whose operating profits were hit by one-off costs last year. These might have been related to the pandemic or some other factor. Such companies might normally pass all of my rules and could potentially be cheap.

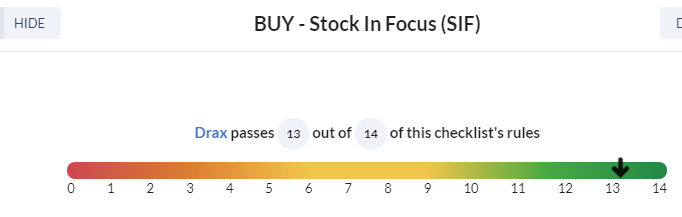

One example appears to be utility group Drax (LON:DRX), which is also a member of this year’s NAPS portfolio.

Drax booked £226m of “coal and other asset obsolescence charges” in 2020. Without these, the company’s underlying operating profit would have left it with an earnings yield of 7.4% -- close to my 8% minimum.

Last year’s losses reflect the company’s final farewell to coal generation, which substantially ended in March 2021. Most of the company’s generating capacity has now been converted to biomass (wood pellets) and Drax now provides c.15% of the UK’s renewable electricity.

Opinions vary on how sustainable biomass generation really is, but that’s a debate for another place. The reality is that biomass is supported by UK government policy and by a subsidy scheme that runs until 2027.

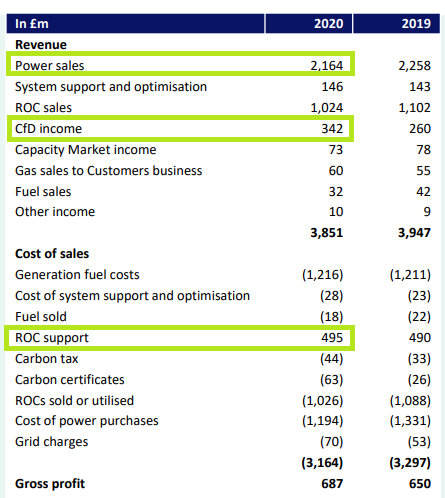

In 2020, Drax received a staggering £837m of subsidy payments from the government, against power sales of £2,164m.

Source: Drax FY20 presentation

With this kind of tailwind, I reckon Drax could be a potential cash cow.

Stockopedia rates Drax shares quite highly too, with a StockRank of 83. However, individual factor scores are mixed, with a…