On 7 October, internet television technology firm Amino Technologies was a high-flying share with a StockRank of 94.

Just 20 days later, Amino’s share price fell by 30% in one day after the firm warned that second-half sales would miss expectations, due to unsatisfactory “sales execution efforts”.

Amino provided no explanation for this mysterious and sudden loss of sales. Nor was the firm’s December trading update any help. Amino simply announced that its sales team had been restructured to address the problems experienced during the second half of 2015.

One possible clue is that Amino’s new sales team is being led by Steve McKay. Mr Mckay’s previous role was as chief executive of Entone, which Amino acquired last year. The Entone acquisition was announced in July and completed in August. Amino’s sales problems appear to have started immediately after this, as there was no hint of trouble in July’s interim results. Yet by October, the firm was forced to issue a profit warning.

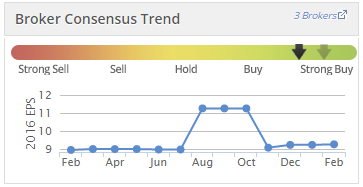

I’m guessing, but I wonder if the rapid acquisition of Entone left Amino’s salesforce with a new range of products they struggled to sell. It’s clear from changes to broker forecasts that the Entone acquisition was expected to make a significant difference to 2016 earnings, but isn’t anymore:

(I’m assuming that the revised earnings per share forecasts after the Entone deal made allowance for the £21m of new shares used to fund the deal.)

Amino published its full-year results last week. These seem to have contributed to a spectacular 48-point decline in Amino’s StockRank, which has fallen from 75 to just 27 over the last month.

As far as I can see, this makes Amino the biggest 30-day StockRank faller in Stockopedia’s universe of 2,729 UK stocks. Such a big decline seems worth a closer look, in my view.

Is this a stonking sell signal or a contrarian opportunity?

Uncertain value

A glance at Amino’s StockReport suggests that the stock’s one remaining value credential is a trailing yield of 4.8%. But it’s not immediately clear whether this is backed by earnings.

Based on the Thomson Reuters data used by Stockopedia, last year’s normalised earnings were just 4.95p per share. This gives a trailing P/E of 23 and fails to cover last year’s 5.5p dividend payout.

These normalised…