One of the hardest parts of running the rules-based SIF portfolio is forcing myself to respect momentum. By nature I’m mostly a value investor. The urge to buy fallen stocks that look cheap is almost irresistible at times.

However, while I’ve missed the occasional bargain, buying into a falling trend can be a recipe for further losses. My SIF screen’s momentum rules have certainly saved me from more than one large loss over the years.

I mention this now, because as often happens in falling markets, my screening results have dried up. There are no eligible stocks I can consider for the portfolio, so instead I’m going to look at a share I think could be a profitable recovery play when supply chain problems start to ease.

To find this business, I disabled the one-year relative strength rule in my screen. This rule requires stocks to have outperformed the market over the last 12 months. Disabling this rule usually opens up the floodgates, as it has here – the number of stocks qualifying for the screen rose from nine to 34.

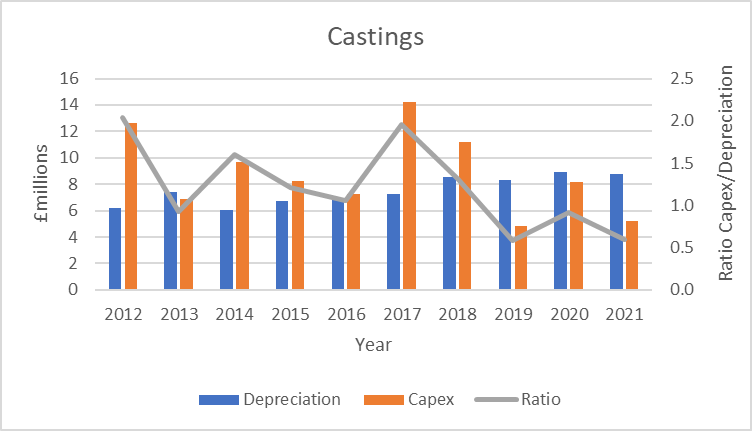

The company I’ve chosen to look at is engineering group Castings.

This century-old business is based in the West Midlands. It operates two foundries and a machining operation which make metal castings and other engineered parts. The majority (70% of revenue) are produced for truck manufacturers.

In a sector where so many British businesses have disappeared, Castings has survived. So I have to assume that it has benefited from both good products and decent management over the years.

Past performance: Looking back over the last 20 years, I calculate the shares have delivered an annualised total return of 5.7% per year (including dividends). That’s not a disaster, but it’s not amazing either.

Order backlog: Castings’ customers have bulging order books. But they can’t get the parts they need to build these lorries, so they’re reducing Castings’ scheduled production volumes.

Assuming truck manufacturers’ order books remain robust in the face of a possible recession, then it seems fair to assume that Castings could see a strong recovery in 2023 as these order backlogs are cleared.

This is what broker forecasts are suggesting – but note the multi-year slump in profits prior to the pandemic. Castings’ woes aren’t solely due to Covid…