The rally in global equities has also lifted the SIF folio to a new record high. I’ll look at the picture in more detail in my portfolio review at the end of the month, but for now I’m not sure if I should be pleased or worried.

The reason for this is that SIF’s recent surge higher has corresponded with a dearth of new stocks qualifying for my buying screen. That means fewer stocks than usual passing are my tests for affordable growth. This might be a coincidence. But it might also imply that the market is heading for a correction, or perhaps that the economic outlook is worsening.

A genuine turnaround?

Time will tell. In the meantime I want to take a fresh look at building services contractor Sureserve (LON:SUR). This £100m AIM-listed group owns operating businesses in sectors such as gas compliance, electrical contracting and lift maintenance. Customers include housing associations, schools and other public buildings.

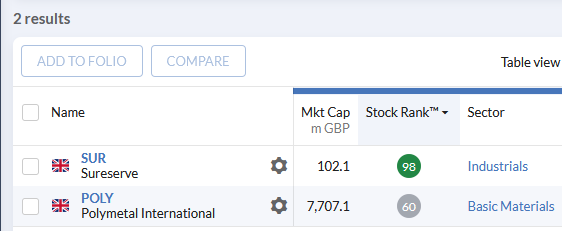

This stock has made regular appearances in my screen results recently and is one of only two qualifying stocks at the time of writing:

Sureserve Group was floated as Lakehouse plc in 2015. Soon after, various problems emerged and the stock crashed. Although the shares remain well below their IPO level, shareholders have enjoyed a gradual recovery over the last two years:

Funnily enough, when I added rival Bilby to SIF in 2018, I commented on Bilby’s outperformance against Lakehouse. You can probably guess what happened to Bilby after that - Bilby also suffered post-IPO problems, leaving me with no choice but to sell for a stonking loss.

Through bitter experience I have become biased against contracting companies of this kind. However, I don’t have a fixed rule on sectors to avoid and there are always exceptions. Indeed, SIF currently holds FTSE 250 engineering and construction group Morgan Sindall which I rate highly.

Sureserve’s turnaround has also attracted some small-cap specialist investors, suggesting that the current management team is viewed credibly by shareholders:

Given this, I’m happy to give Sureserve a fair review in case I might want to own the stock in the future.

Sureserve (LON:SUR)

Sureserve issued its preliminary results on 3 February for the year ending 30 September 2020. Not…