The oil price crash has created some interesting investment opportunities, but timing new buys has not been easy.

With the benefit of hindsight, the oil market crash seems to have bottomed out in January when Brent dropped to just $45 per barrel. It’s now about $62.

Investors in oil futures might have missed the big rally, but I don’t believe the same is true for equity investors.

I’m convinced that there will be some big winners (and losers) over the next 12-18 months, as we see who can really make money at lower oil prices.

One company I personally think could do well in this environment is rig builder Lamprell. This Dubai-based firm specialises in building jackup drilling rigs, which are used in shallow water.

One company I personally think could do well in this environment is rig builder Lamprell. This Dubai-based firm specialises in building jackup drilling rigs, which are used in shallow water.

A turnaround play

Lamprell has had some problems over the last couple of years, culminating in a $120m rights issue one year ago. However, this influx of fresh cash enabled the firm to clear the majority of its debts and invest in upgraded facilities.

Lamprell ended 2014 with a order book of $1.2bn. This is lower than at the time of the firm’s profit warning in May 2012 ($1.6bn), but substantially higher than at the end of 2013 ($0.9bn).

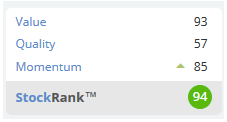

This suggests to me that Lamprell’s turnaround could be gaining momentum. The Stockopedia StockRanks certainly support this view.

Lamprell boasts a StockRank of 94, with a ValueRank of 92 and a MomentumRank of 86.

This combination of value and momentum - the two most powerful factors that drive stock returns - is a classic recipe for outperformance, as Ben Hobson discussed last week in this article. Lamprell was also one of Stockopedia founder Ed Croft’s top picks for 2015.

Value: Is Lamprell still cheap?

At this point, investors may point to the 31% gain made by Lamprell shares this year and ask whether it’s still cheap enough to buy.

After all, Lamprell stock now trades on a forecast P/E of 14.7, according to Stockopedia. That’s higher than the sector average of 12.

Although true, this doesn’t necessarily mean that Lamprell is not good value. Traditional value metrics tend to use historical data, rather than forecasts.

Lamprell trades on just 8.5 times last year’s earnings and a price-to-sales ratio of 0.8.…