With painful memories of Globo, Plus500 and Quindell fresh in the minds of many UK investors, I made sure that I had some wriggle room when I designed the Stock in Focus portfolio. I am allowed to reject qualifying stocks if I think that Stockopedia’s rankings don’t accurately reflect the risks involved.

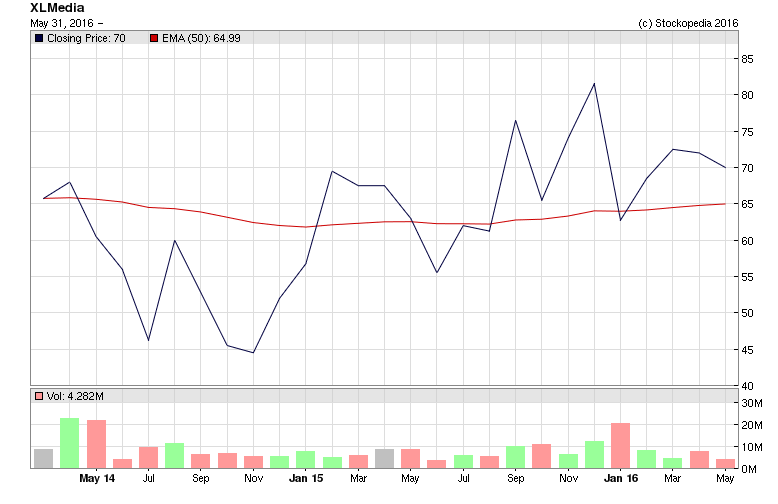

This week’s stock is a possible example. XLMedia is a new qualifier for my screen, with a StockRank of 99. The firm’s fundamentals seem strong and both cash flow and generous dividends are real. Yet this is an AIM-listed Israeli tech stock that operates in the gaming sector. Recent history suggests it could be a risky buy.

I’m going to explore the arguments for and against adding XLMedia to the SIF portfolio. But first, it’s worth understanding exactly how XLMedia makes money.

How do you achieve 51% annual sales growth?

XLMedia’s revenue has grown at an average of 51.5% per year since 2010. Profits have risen by an average of 39.4% each year.

The company generates its revenue by supplying new users to online gaming sites. According to this video presentation, these include big names such as Ladbrokes, as well as smaller online casino operators.

XLMedia doesn’t get a flat fee to supply a certain number of users. Instead, the firm spends its own money generating leads for its customers. This is known as performance marketing. XLMedia attracts potential gaming site users through its own websites and with paid advertising such as Google AdWords and Facebook ads.

For each new player who signs up with a gaming operator and meets certain other criteria, XLMedia receives a share of the revenue from the player’s activity. In the online gaming sector it’s common for this performance payment to be a share of lifetime user revenue. This means that good quality users will generate revenue for XLMedia for many years after their initial signup. This can be very valuable: XLMedia said in 2014 that its average revenue-sharing rates were 35-55%.

Risks vs rewards

Performance marketing has become an important industry that’s grown up alongside ecommerce. Price comparison businesses such as Moneysupermarket.com are performance marketers, as are cashback and discount code websites.

It’s also a sector I understand well, as I’ve worked in performance marketing…