What did I learn from the 2015 success of rules-based portfolios such as Ed Croft’s original NAPS portfolio (+43%), grindertrader’s StockRanks portfolio (+38%) and gundroos’ rules-based portfolio (+31%)?

The big lesson was perhaps that to make more money, I may need to rely more heavily on decades of statistical evidence about what works in investing -- and what doesn’t.

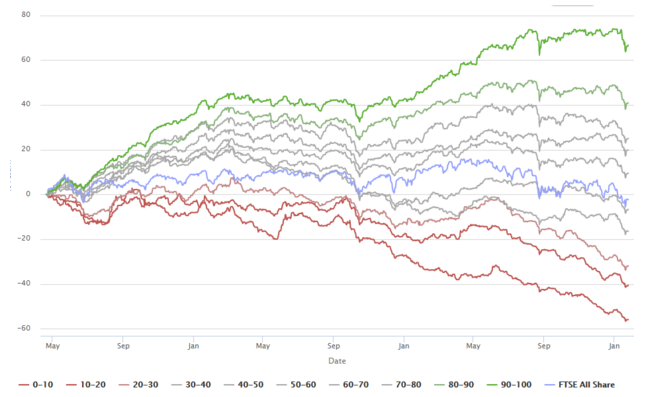

The same sets of rules may perform badly this year. But in its first 2.5 years, the results from the StockRanks system have backed academic evidence that stocks which demonstrate value, quality and momentum tend to outperform.

This chart shows the performance of the StockRanks since their launch in 2013:

A test of character

In this vein, I’ve decided to look at a company this week which boasts a StockRank of 98 but about which I have serious misgivings.

If you’re not familiar with this business, Games Workshop sells high quality, expensive miniature models to collectors. They then build and paint them, and in some cases use them to play complex war games such as Warhammer.

I was never interested as a teenager and from my detached viewpoint, I’m amazed this business has survived so far into the internet age. I cannot imagine how it can have a long-term future. Yet I may be wrong. I’m not a customer so I don’t understand the appeal. Specialist niche businesses can sometimes be successful investments, thanks to their loyal customer base and lack of competition.

Quit jumping to conclusions

With a StockRank of 98, Games Workshop was only a whisker away from being chosen as a consumer cyclical stock for Ed’s 2016 NAPS portfolio.

Games Workshop also qualifies for four of Stockopedia’s Guru Screens. Of Stockopedia’s universe of 2,717 UK stocks, only 21 qualify for more than four screens.

Games Workshop reported sales of £119m last year and a net profit of £12m. Free cash flow per share exceeded earnings per share and provided backing for a generous dividend. The group’s operating margin has averaged 13% over the last six years, and is fairly stable.

All of which suggests that perhaps I should focus on Games Workshop’s numbers, and stop trying to predict the future?

Is it good value?

Games Workshop’s ValueRank of 77 suggests few serious problems in the value department. The stock’s historic numbers seem…