This time last year, the entrants to Stockopedia’s first ever Stock Picking Challenge were assessing the damage from one of the sharpest stock market plunges in living memory. This year, much of the uncertainty has gone and equity markets have been kinder.

In fact, despite the terrible problems that Covid is still causing, many international markets are back to their bullish best. This time last year, growth and momentum strategies had capitulated in the face of so many unknowns. Today, they’re in recovery mode.

Back then, a handful of smaller, more speculative stocks (particularly in pharma, mining and cleantech) were some of the few bright spots at a very dark time. We’ve since seen momentum build across markets, earnings forecasts beaten and a growing sense of optimism. But how are the funds in this year’s Stock Picking Challenge doing?

A new challenge for 2021

The Stock Picking Challenge is our annual invitation to investors everywhere to come up with their five Top Stock Picks for the year ahead. At stake is the prestige of outperforming thousands of the smartest stock-pickers around, and the chance to win some impressive prizes too.

Last year, we had over 2,100 entries and the overall winning fund managed a gain of 632.7%. In 2021 the competition grew by more than 1,000 entries, with 3,285 five-stock selections submitted to us before the turn of the year

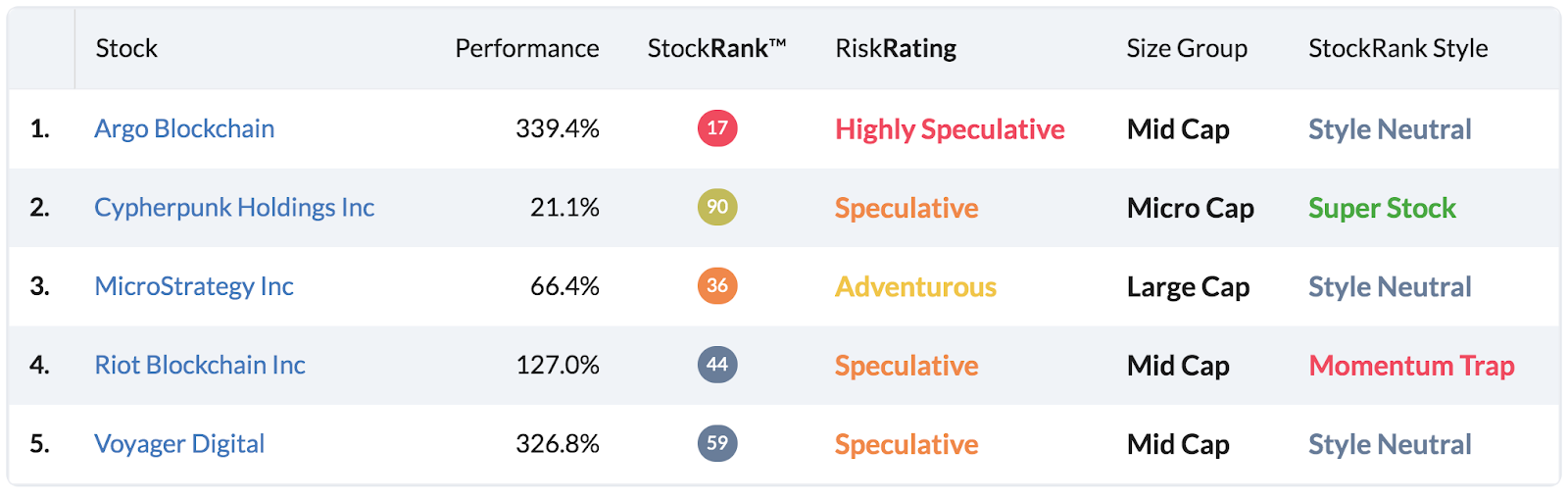

With the first three months behind us, the Q1 winner this year was jamesy227 with a gain of 265% - and here’s the five-stock fund that delivered it:

There’s no hiding the fact that jamesy227’s picks have been propelled by the surging interest in cryptocurrencies. With Bitcoin, Doge and other crypto coins soaring in value, some of the related stocks in this area have done extremely well. UK based crypto miner Argo Blockchain is one that has seen its shares soar since late last year.

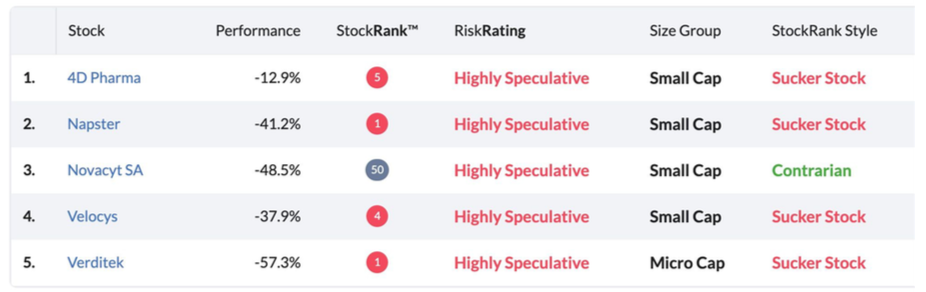

At the other end of the spectrum, the fund in last place in Q1 was from Parin Chudasama, with a -39.6% return. What’s interesting about this fund, though, is that these kinds of small-cap pharma and tech shares (the likes of 4D Pharma, Novacyt and Verditek) had a habit of performing well last year. So things have changed here - the frenzy in these sectors may have subsided.