Best Of The Best (LON:BOTB) was pitched to the Stockopedia Staff Investment Club (SIC) in early April. On the 8th of April shares were purchased at 400p.

This wasn't the first stock pitched at the Stockopedia Investment Club - but it has played the biggest role in the SIC's performance to date and so is worth revisiting.

What we saw back in April was a cash generative micro cap with shareholder management, double-digit historic earnings growth, high returns on capital, a strong balance sheet, and a clear catalyst in the form of its pivot to a pure online business model.

What we didn't expect was such a rapid and material rerating. Since April, BOTB's performance has prompted useful discussions in the Club around position sizing and whether to run your winners or rebalance.

Here's why I think we should continue to hold at 1,750p.

Profile/Category/Style

What is the company's name and ticker symbol and on what exchange does it trade?

This is BOTB, formerly Best of the Best. It trades as BOTB on the Aim Market.

In which sector & industry group does the company operate?

It's in the Consumer Cyclicals sector under Hotels & Entertainment Services. Though we don't think this classification accurately captures BOTB's operations or market opportunity.

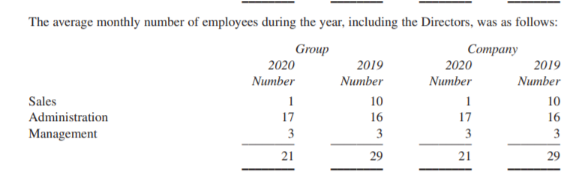

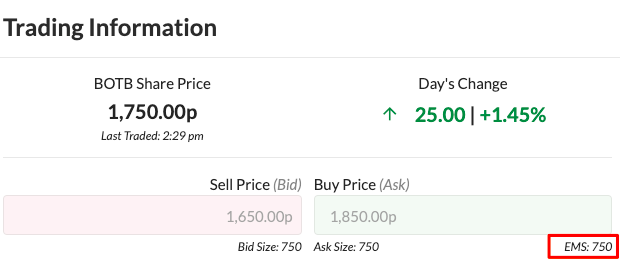

What is the share price, market cap, size group, liquidity and risk of the stock?

BOTB has had a fantastic run so far in 2020, with shares up nearly 400% year-to-date. Today its share price is 1,750p and its market cap is £160m, making it a small cap.

It's a Speculative stock so share price volatility should be expected.

Liquidity might be an issue for some. The exchange market size (EMS) is 750, meaning you can invest just over £13,000 (750 * £17.50).

What is the opportunity style/type/classification?

Quantitative: This is a cut-and-dry High Flyer. It has a high Quality Rank and high Momentum Rank with low Value Rank.

A period of share price consolidation is dragging the Momentum Rank and StockRank down, meaning BOTB no longer qualifies for the Club's watchlist - but it did at the date of the original pitch and purchase, back in April.

Qualitative: Peter Lynch framework

BOTB qualifies as a Fast Grower, with earnings growth comfortably in excess…

.jpg)