Gear4music Holdings (LON:G4M) is a leading UK based online retailer of musical instruments and equipment that is expanding quickly across Europe.

Launched in 2003 by current CEO and c30% shareholder Andrew Wass, revenue has grown every year since inception and has increased from £12m in FY13 to £157.5m in FY21. The Europe market for musical instruments is estimated to be around £5bn, so that suggests room for further growth.

There is competition with the likes of Thomann, but G4M has been built from the ground up as a website-based e-commerce platform and has invested in its own software and logistics capabilities.

Despite this evident specialisation and the recent rerating, G4M trades at a notable discount to other online retailers such as BooHoo and Asos. On this basis, the shares were pitched to the Stockopedia Investment Club on the 18th of May 2021 at 890p per share.

There’s no doubt business has been helped by Covid lockdowns, so it’s possible that the recent outperformance might revert to some degree.

That said, brokers expect net profit to fall by more than 50% in the year ahead. Is this caution warranted, or are G4M’s growth prospects being unduly discounted?

Summary

Bull points: multi-year revenue growth and market share gains across multiple territories (sales growth every year since 2003); improving profitability; trades on P/S discount to other e-commerce stocks; UK and Europe operations; proprietary e-commerce end-to-end platform; founder-owner CEO; own-brand product range built up over 17yrs; efficient logistics system

Bear points: Covid trade boost might subside; profitability has been an issue in the past; looks expensive on TTM basis; easy rerate has already happened

Profile

About the Stock:

Gear4music is a Consumer Cyclicals company in the Specialty Retailers industry group.

It trades on the LSE AIM market, with a market cap of £183.3m. Liquidity is a slight issue - although you can buy around £6,500 worth of stock on the market, the spread is 343bps.

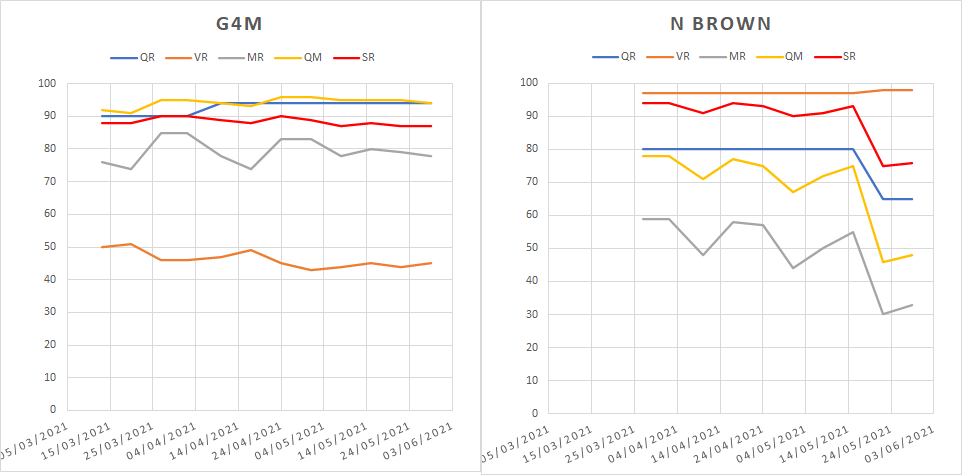

The group is classified as a Speculative Small Cap Neutral, although it is on the verge of High Flyer status, with a Q Rank of 93, a V Rank of 45, and an M Rank of 76.

The share price has plateaued recently after a dramatic rerating, but the relative strength measures remain positive. Meanwhile the 5Y revenue CAGR is 37.8% and the operating profit CAGR…

.jpg)