IG Group was pitched to the Stockopedia Staff Investment Club (SIC) in late July. On 23rd July, shares were purchased for the club at the price of £7.89.

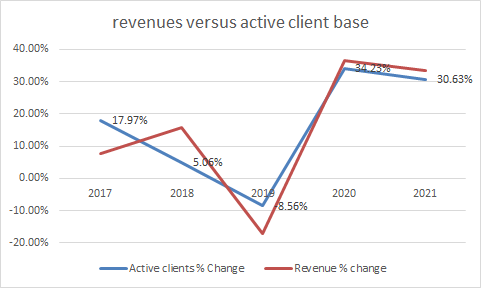

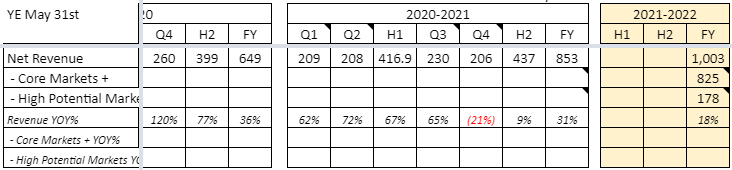

One of the leading leveraged financial instruments providers globally, IG Group, has been on a strong run this year. The company has been a beneficiary of the volatile markets we have experienced over the past year, with greater trading volumes being seen globally.

IG has been a high ranking stock for several years now, due to its excellent all round quality, value and momentum metrics. As a balanced, large cap, super stock, the size & risk diversification offered by IG Group was also considered by the SIC.

In this article, we will assess the factors that contributed to our decision to add IG Group to the SIC portfolio, but also the potential risks/threats that were considered.

Summary

Bull Points - Industry-leading quality characteristics, strong revenue & profitability growth, solid dividend backed by substantial net cash & free cash flow generation, product diversification & international expansion, beneficiary of current market volatility.

Bear Points - Increased regulatory pressures, recent director selling, poor medium-term growth guidance, OTC leveraged product reliance, volatility subsiding after vaccine news.

Profile

IG Group (LON:IGG), a constituent of the FTSE 250, operates within the Investments Services & Investment Banking industry. The company specialises in the provision of leveraged products such as CFDs (Contracts For Difference) and Spread Betting, but also provides traditional brokerage services for purchasing/selling financial instruments.

IG Group is currently classed as a Balanced, Large Cap, Super Stock and trades at a price of 837p per share. Given the 371m shares in issue this equates to a market capitalisation of just over 3.1bn.

The StockRank scores a near perfect 98 at the time of writing, led by strong Quality and Momentum Ranks of 99 and 98 respectively. The Value Rank stands at 66.

Whilst the company sits on a modest 12m forecast P/E ratio of 14.4, the forecast dividend yield is an enticing 5.16%.

The strong all round attributes of the company means that it currently qualifies for 3 Guru Screens, across Value and Growth investing.

Business & Model

What is the company history…