The Stockopedia Investment Club (SIC) is Stockopedia HQ's own investment club. We pitch stocks to each other and to the site so you can see our (evolving) research process and give your two cents on the Club's decisions.

You can see all the SIC posts here and read Ed's introduction to the Club here. We hope to bring many more pitches in 2021 - but first, let's revisit the final pitch of 2020: Polar Capital Holdings (LON:POLR) .

Polar was pitched on the 18th of November 2020 when its share price was 609p and its StockRank was 97. Since then, shares have appreciated by c14% and the StockRank has come down slightly to 94.

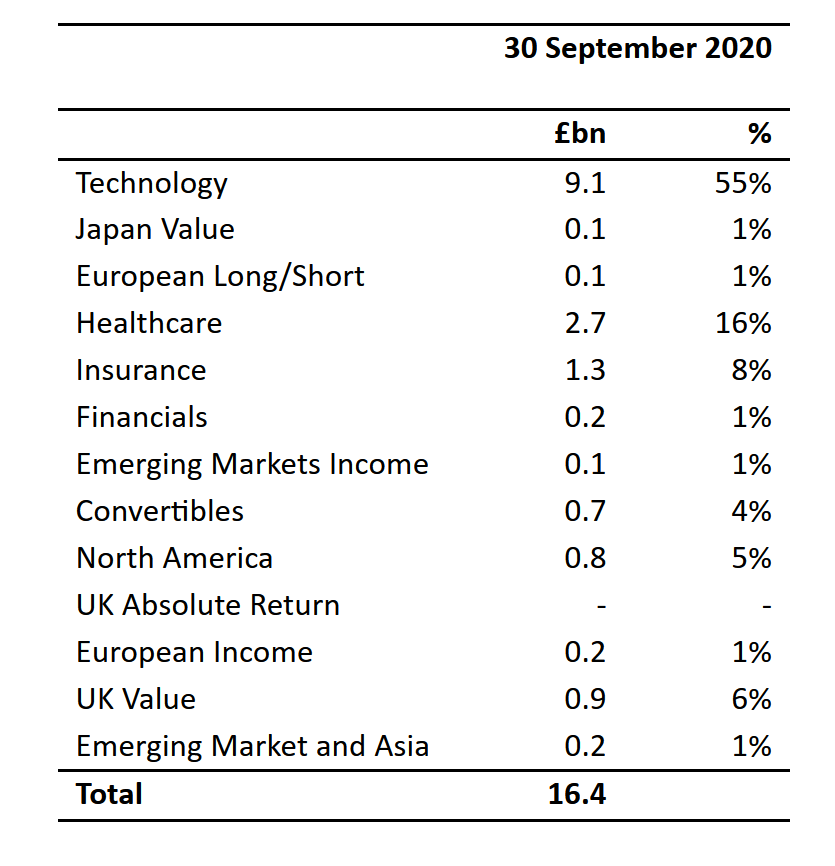

This growing specialist fund manager aims to be a leading global investment management boutique and backs up its ambitions with a track record of top quartile investment performance over multiple time periods.

Supported by a robust, net cash balance sheet and spearheaded by its best-in-class Technology Trust, Polar is growing organically and via the acquisition of talented investment teams.

But the rise of passive funds is driving down sector margins. So is there room for sustained outperformance from the likes of Polar, or has active fund management had its day?

Summary

Bull Points - Modest forecast earnings multiple given history of double digit operating margins, returns on capital, and compound revenue and earnings growth; Strong cash flow generation and healthy net cash balance sheet; scalable, capital-light business model; positive investment track record.

Bear Points - Low-cost passive funds are taking market share and driving down margins; key person risk; vulnerable to stock market or economy downturn; overweight exposure to big tech.

Profile

Polar Capital Holdings (LON:POLR) trades on the AIM Market, in the Financials Sector under Investment Services. A StockRank of 94 is made up of:

- A Quality Rank of 90,

- A Value Rank of 44, and

- A Momentum Rank of 99.

Stockopedia classifies this as an Adventurous Mid Cap High Flyer. It brings high quality growth to the Investment Club portfolio and, as a fund manager, is viewed as a geared play on a stock market recovery.

The group's EMS of 750 means you can expect £4,500 of stock tradable on bid/ask, so liquidity could be an issue for some. It has an average volume of 196,000 shares which…

.jpg)