Reach (LON:RCH) is attempting to extricate itself from a structurally challenged Print industry and aims to re-focus on Digital Advertising - a change driven in part by its new Board, which is spearheaded by Jim Mullen.

The company is very cheap at just 4.1x reported FY19 EPS (3.2x normalised FY19 EPS) - but it has remained resiliently cash generative throughout its trials and tribulations. It's not all roses at Reach, but a valuation of just 4.6x TTM free cash flow does suggest a margin of safety.

Among the top four of the UK's digital assets (Google, Facebook, Amazon, and Microsoft), Reach estimates that more than 90% of customers have signed up and provided their data.

In contrast, Reach has gone from just 2% of customers to 8% between FY19 and H1 20. Increased customer engagement will enable Reach to better tailor advertising. Importantly, a lot of the necessary technical resource is already in house. Reach does not anticipate significant capex spend. In fact, it is actively cutting costs in its Print business.

As Mark Twain once wrote of a prematurely published obituary: Reports of my death are greatly exaggerated. The pitch is that there is life after Print, and Reach can successfully monetise its digital content to such an extent that the current valuation makes it cheap.

The share price has moved fast: from initial research for a related article (see here) through to Investment Club buy/sell decision, RCH has appreciated by around 20% (from 104p to 124p). So has the window of opportunity closed, or is there still value on offer?

Profile

Reach, formerly known as Trinity Mirror, is in the Consumer Cyclicals sector and owns and operates a portfolio of Print and Digital newspapers and magazines. It trades on the London Main Market.

What is the opportunity type?

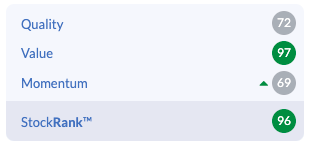

Reach has a strong blend of Ranks.

It's classified as a Speculative Mid Cap Super Stock, with a low forecast PE and strong historic cash generation. It is a turnaround situation, as shown in the longer-term share price chart below.

What is the business model?

Reach produces and distributes content through paid-for and free newspapers, magazines, and websites.

Source: company website

Digital (15% of revenue) is a network of over 50 sites providing 24/7 coverage of news,…

.jpg)