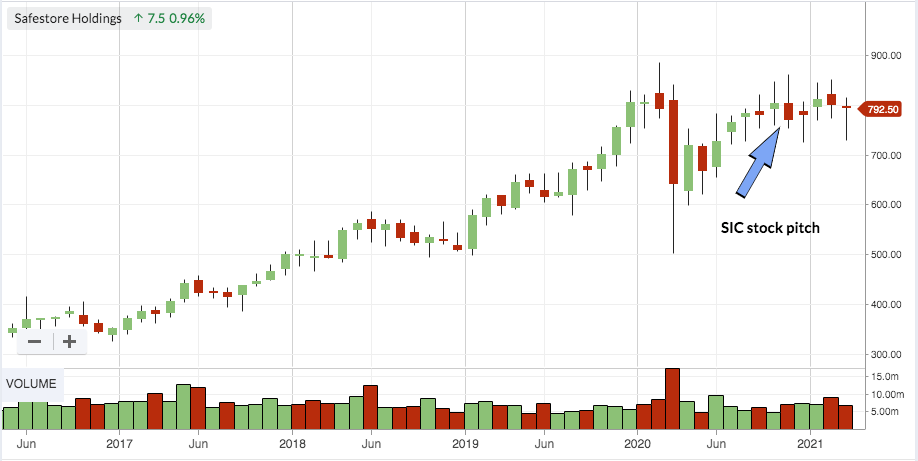

Safestore (LON:SAFE) was pitched to the Stockopedia Investment Club on 2 March 2021.

With a cautionary eye on the club's growing exposure to cyclical small-caps, Safestore was pitched as a mid-cap play that's perhaps not being given a fair shout by the market.

Safestore is a Real Estate Investment Trust with a portfolio of properties that it develops and rents out as multiple storage units to the public and businesses. Its share price had been strong before Covid, but it was hit hard by the crisis. With a brighter economic outlook on the horizon, could this be a moment to buy a stake in a group with a solid record of organic and acquisitive growth?

Summary

Bull points: Apparently good growth potential in fragmented markets, especially in the UK and France; a solid record of buying and developing properties profitably; growth potential without the small-cap/cyclical growth risk we're exposed to elsewhere in the portfolio; cash income.

Bear points: REITs are a rather specialist topic, which can make them hard to understand and value; the market doesn't get excited about stocks like this; Safestore has been affected by Covid restrictions.

Profile

Safestore is a self storage business. It acquires large buildings and rents out space in them to people and businesses that want to store things. Some properties are owned freehold, others are on long leases. Its asset value/ income is derived from the upward valuation of owned property as well as its rental income.

Safestore has a market cap of £1.72 billion, an enterprise value of £2.24 billion and is quoted on the FTSE 250 under Financials/ REITs*.* EMS is 3K. This is a Balanced, Mid Cap, Super Stock with a current StockRank of 71.

Safestore is a Real Estate Investment Trust - but what does that mean?

REITS are a tax-efficient structure for companies that make money as property rental businesses. It means they can benefit from exemptions from UK corporation tax on profits.

As part of this structure, REITs are compelled to pay 90% of tax-exempt income profits (not capital gains) out to shareholders as dividends. Often, this manifests in quite high yields from REITs. But SAFE only has a forecast yield of 2.5% because it's redirecting a lot of that income back into growth.

REITS like SAFE are often geared (with net…

.jpg)