Inspired by Stephen Bland's recent HYP post, I thought I would suggest a different approach to putting together a HYP. While I understand that Stephen's focus is on income alone and a hold forever approach, neither of these fit my personality or investing style. So is it possible to have a HYP that seeks to give a great income but also is likely to bring capital appreciation at the same time? Can I have my cake and eat it?

To keep this as simple as possible I have put together a portfolio with a simple 4 factor rules based approach.

BUY RULES:

- Market Capitalisation > £350,000

- Yield > 4% and < 7.5%

- StockRank >=85

- Hold 12 shares with equal cost value and with one in each economic sector and the other two in the sector(s) most represented in the scan.

SELL RULES:

- Yield falls below 4% especially if profit warning or large absolute dividend cut occur. This may also take out stocks that have appreciated in value faster than their dividend growth.

- Stock Rank falls below 70.

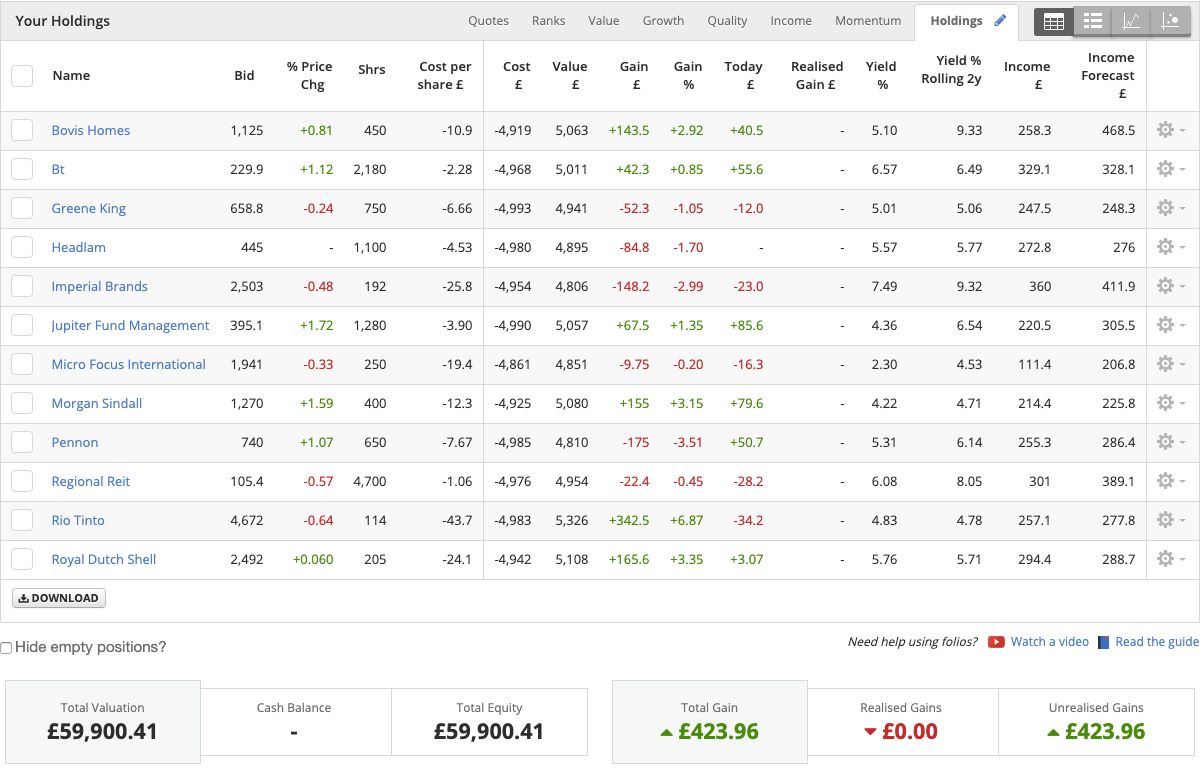

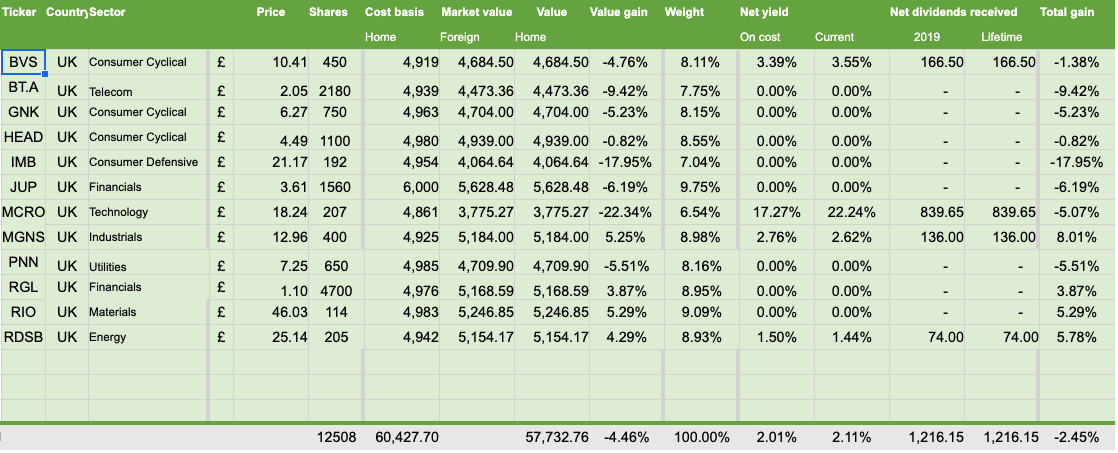

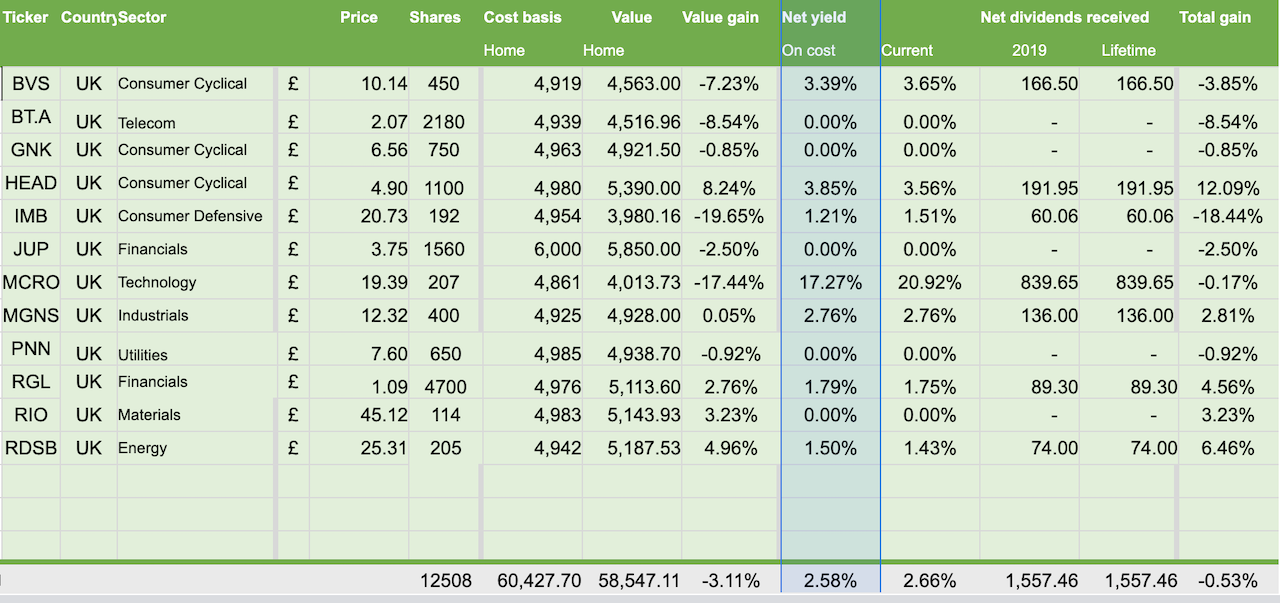

I have made a very simple screen for this here that currently gives 44 shares to choose from. From this list, I will feel free to use my judgement regarding the final choice. So far I have bought nine stocks: Bovis Homes (LON:BVS), Headlam (LON:HEAD), Imperial Brands (LON:IMB), Micro Focus International (LON:MCRO), Morgan Sindall (LON:MGNS), Pennon (LON:PNN), Rio Tinto (LON:RIO), Royal Dutch Shell (LON:RDSB), £BT . I'll choose the other three stocks in the next day or so and let you know in the comments section.

I'd love to know if anyone else is trying anything like this or if you have any thoughts or comments.

M.