The American business magnate, John D. Rockefeller once said: 'Do you know the only thing that give me pleasure? It's to see my dividends coming in.' Dividends are of course cash payments that companies pay out to shareholders on an interim or annual basis. All other things being equal, a company that pays a dividend could, in theory, be more attractive to many investors. This week we explore whether investors can make money by investing in high StockRank stocks that pay maiden dividends.

The Maiden Dividend Anomaly

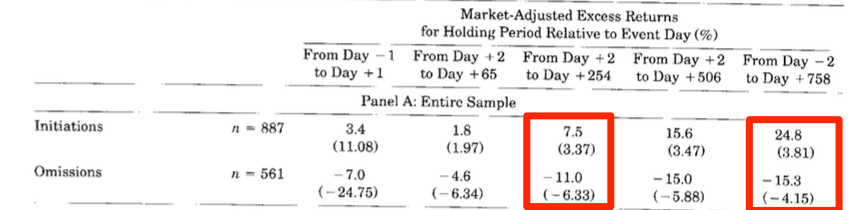

How does the market respond when companies announce maiden dividends? Research by academics Michaely, Thaler and Womack (1995) looked at the share price performances of companies that initiated - or omitted - the payment of cash dividend payments between 1964 and 1988. They found that:

- The returns for firms initiating dividends were 7.5% after 1 year and 25% after 3 years of the dividend announcement;

- The returns for firms omitting dividends were -11% after 1 year and -15% after 3 years of the dividend omission.

These trends may in part be down to something called the 'clientele effect' - the observation that investors tend to be attracted to different types of companies. A stock that introduces a dividend will naturally broaden its appeal to income investors. For example, institutions could have a preference, or even a requirement, to buy shares in dividend-paying companies

More anecdotal evidence suggests that companies with improving fundamentals may be better placed to support dividend payments. This has been particularly evident during the past five years in the housebuilding sector, with companies like Persimmon and Barratt Developments quick to respond to improving conditions by rewarding shareholders. Another construction firm that's set to notch up its third consecutive year of dividends is Redrow….

Redrow (RDW)

Redrow (RDW) is a relatively new dividend payer. 2015 is expected to be the third consecutive year that Redrow pays a dividend (6p per share). The company paid out 1p per share in 2013 and 3p per share in 2014. Redrow has notched up dividend payments as fundamentals have improved across the board. Over the last twelve months:

- Gross profit margins have risen from 19.8% to 22.5%;

- Operating profit margins have risen from 15.9% to 17.3%;

- The Return on Capital Employed has risen from 14.6% to 17.7%. …