On Thursday Patrick Vallance, the UK government's scientific adviser, suggested that the UK was 4 weeks behind Italy in terms of positive case incidence of COVID-19.

Italy has taken a number of draconian lock-down measures including closing all retail outlets apart from pharmacies & food stores.

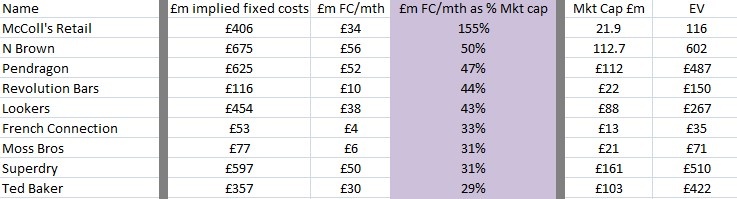

I decided to attempt to calculate the impact on UK pubs & retailers if this measure was to occur in the UK.

Firstly I screened for leveraged UK retailers as defined by Enterprise Value at least 2x Market cap.

To calculate Fixed costs I multiplied Sales by (gross margin minus operating margin).

Dividing this number by 12 crudely reveals monthly losses that would occur in the instance where an enforced business shut-down prevented any revenue being generated.

If you are of a nervous disposition, please look away now.

Taking Pendragon (LON:PDG) as an example, the company has annual Fixed costs of approx £625m, or around £52m per month. If it closes its doors for two months, it's losses would be similar to its current market cap. A material outcome.

This would be no problem if Pendragon (LON:PDG) had a large net cash pile, but instead the company would appear to have significant liabilities (Enterprise Value 4x market cap).

So clearly it is now necessary to assess the scale of its cash in hand, available credit lines, scope for working capital squeezes & ability to sell surplus assets.

McColl's Retail (LON:MCLS) stands out as being the extreme case, though it may classify as a food store & hence its doors might remain open in an enforced shut-down scenario.

Caveat. The above analysis is simplistic. For example it assumes

- all fixed costs are fixed, yet some may be avoidable

- all sales would be lost - clearly not the case if e.g. a business has an online operation (assuming home deliveries are still possible).