About three months ago I covered Strix (LON:KETL) (here) . Quite a lot has transpired since then.

The group has just released its FY20 annual report and I’m interested to see how it is getting on in this COVID-19 era. In my view Strix is a very promising company and could become much larger in time.

I think this because:

- Strix occupies an important position in the global domestic appliance value chain,

- It has world class facilities,

- It has patents that it vigorously defends, and

- It is investing millions in research and development,

The group has a total of 14 new products set to be launched in the coming year. With a market cap of less than £400m, I think there is plenty of scope for steady growth.

In the meantime, this is a high quality, cash generative, modestly valued company that rewards shareholders with an attractive yield and is well placed to defend its favourable market position. Its shares have rebounded strongly after tumbling in late March and its StockRank is also showing signs of recovery.

What can we take from the FY accounts?

Headline results

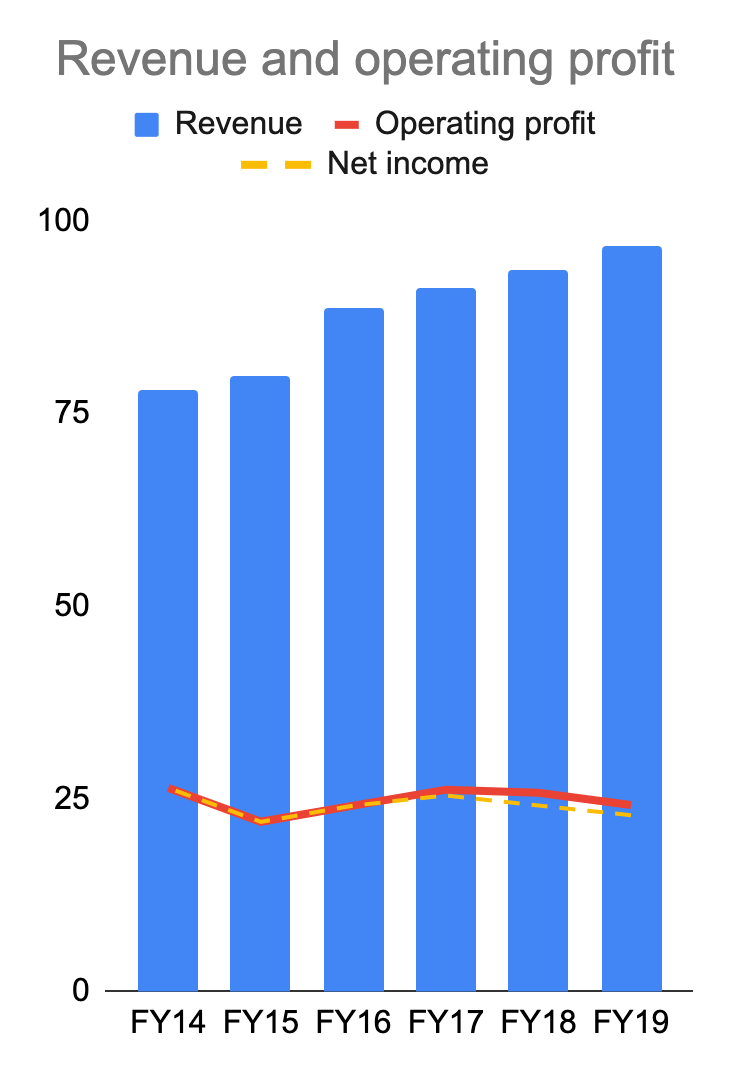

FY19 has been a continuation of established trends. Growth has been lacklustre and even negative on an unadjusted basis:

- Revenue +3.3% to £96.8m

- Operating profit -6.1% to £24.2m

- Adjusted earnings per share +2.1% to 15.2p (adjusted PE ratio of 12x)

- Total dividend per share +10% to 7.7p (4.2% dividend yield)

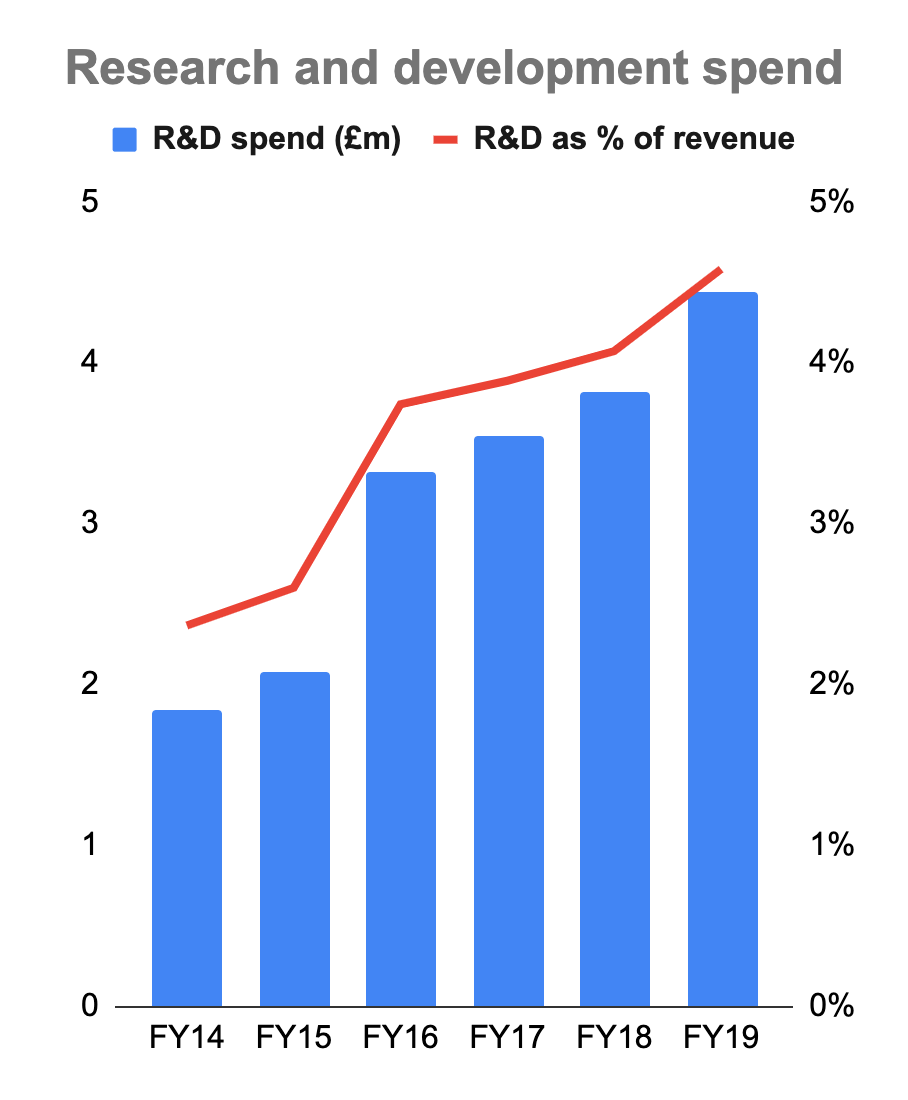

The company has strong long term prospects though thanks to its entrenched market position and increasing levels of research & development spend (in both relative and absolute terms):

With 14 new products slated for FY20, investors will be expecting to see signs of growth in the next year or two.

I’m not overly concerned with the current lack of profit growth because of the following points:

- Strix is high quality - it is financially sound, cash generative, and profitable,

- It is expanding its operations, investing in R&D, and bringing down net debt,

- Its market position is strong and is backed up by valuable IP that is vigorously defended,

- The group pays out an attractive and comfortably covered dividend to its shareholders, and

- New product launches are imminent.

COVID-19 (lack of) disruption

It is perhaps surprising that the two companies I have recently looked at with large manufacturing bases in China - Strix and Volex -…

.jpg)