When I wrote The Week Ahead recently, I was surprised to see that the large cap indices, such as the FTSE 100, had significantly outperformed those that track smaller companies so far this year. Having had a poor start to the year, smaller companies bounced back strongly from the Trump Tariff Tantrum in April, catching up with larger caps by the start of July. However, over the last two months, the FTSE100 has continued to be on fire, whereas smaller companies have wilted in the heat:

The FTSE 250 has tracked the smaller stocks rather than joined in the FTSE100 rally, meaning that this outperformance has been concentrated in the largest stocks.

Fund Flows

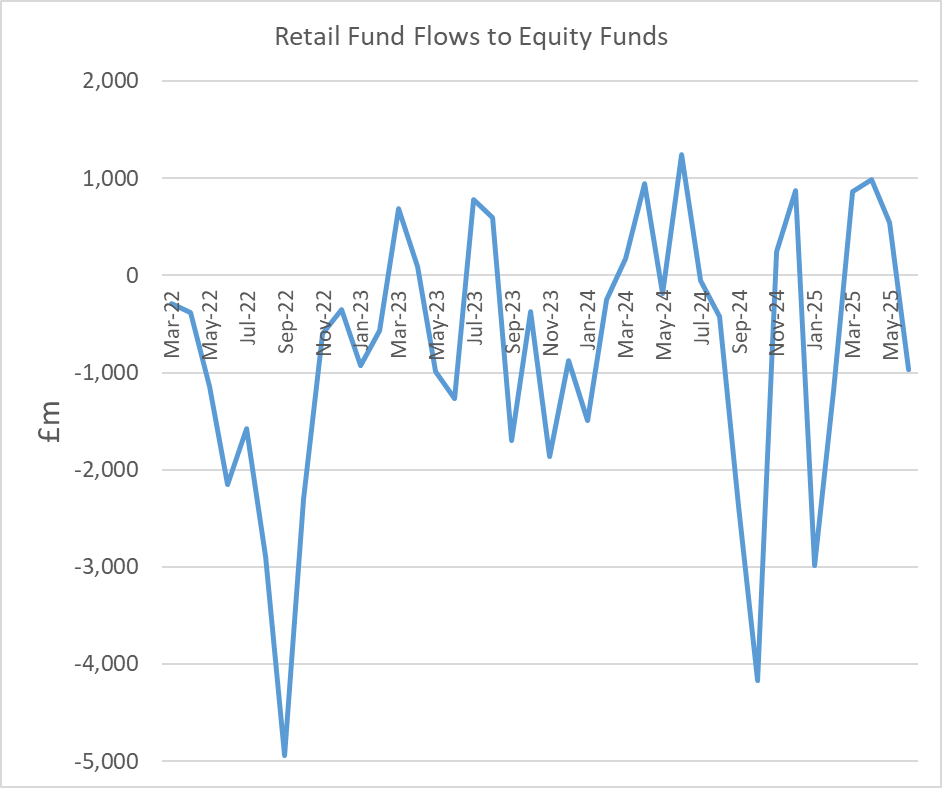

The malaise surrounding UK stocks, and small caps in particular, is well known. Retail fund flows out of UK equity funds have been pretty much continuous over the last few years, and this has severely impacted smaller companies. Here is the monthly figures for fund flows from the Investment Association:

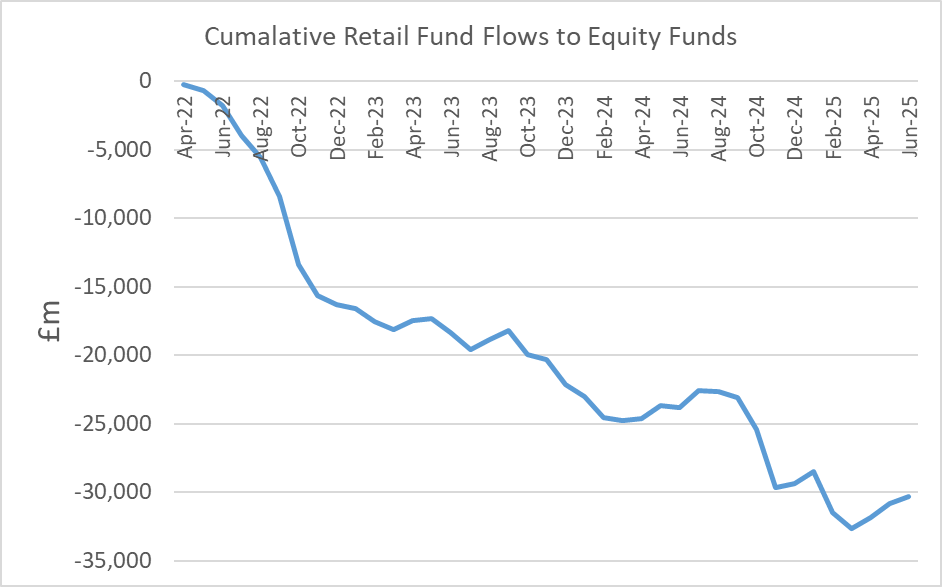

The data here is noisy, and there is the occasional positive month, but the cumulative figures show that this is really just bumping along the bottom:

The AIM market was particularly badly hit last year by the partial removal of some of the tax reliefs its constituents enjoy, and the rumours of that change in the run-up to last Autumn’s budget. Over a two-year period, we see that FTSE Smallcap Ex Its Index (FTSE:SMXX) has largely kept pace with FTSE 100 Index (FTSE:UKX), and the FTSE AIM 100 Index (FTSE:AIM1) started to underperform when the new government came to power:

This effect shouldn’t be the cause of this year’s underperformance, as regulation is unlikely to change again so soon, and AIM has been joined by similar-sized non-AIM stocks in underperforming. This is particularly frustrating for those of us who tend to focus on smaller companies where we think we have a better chance of having an investment edge. However, it is possible that such moves may be logical. Larger companies tend to have economies of scale, global operations and better management. These may mean…