It’s been quite a year for UK markets. After several challenging years marked by political uncertainty, inflation fears, and global instability, 2025 finally delivered the rally investors had been waiting for. UK large-cap stocks, led by the FTSE 100, climbed 25.8%, and many private investors in the Stockopedia community enjoyed exceptional results.

We recently surveyed over 825 subscribers to find out how they fared - and the findings are genuinely impressive.

Strong returns across the board

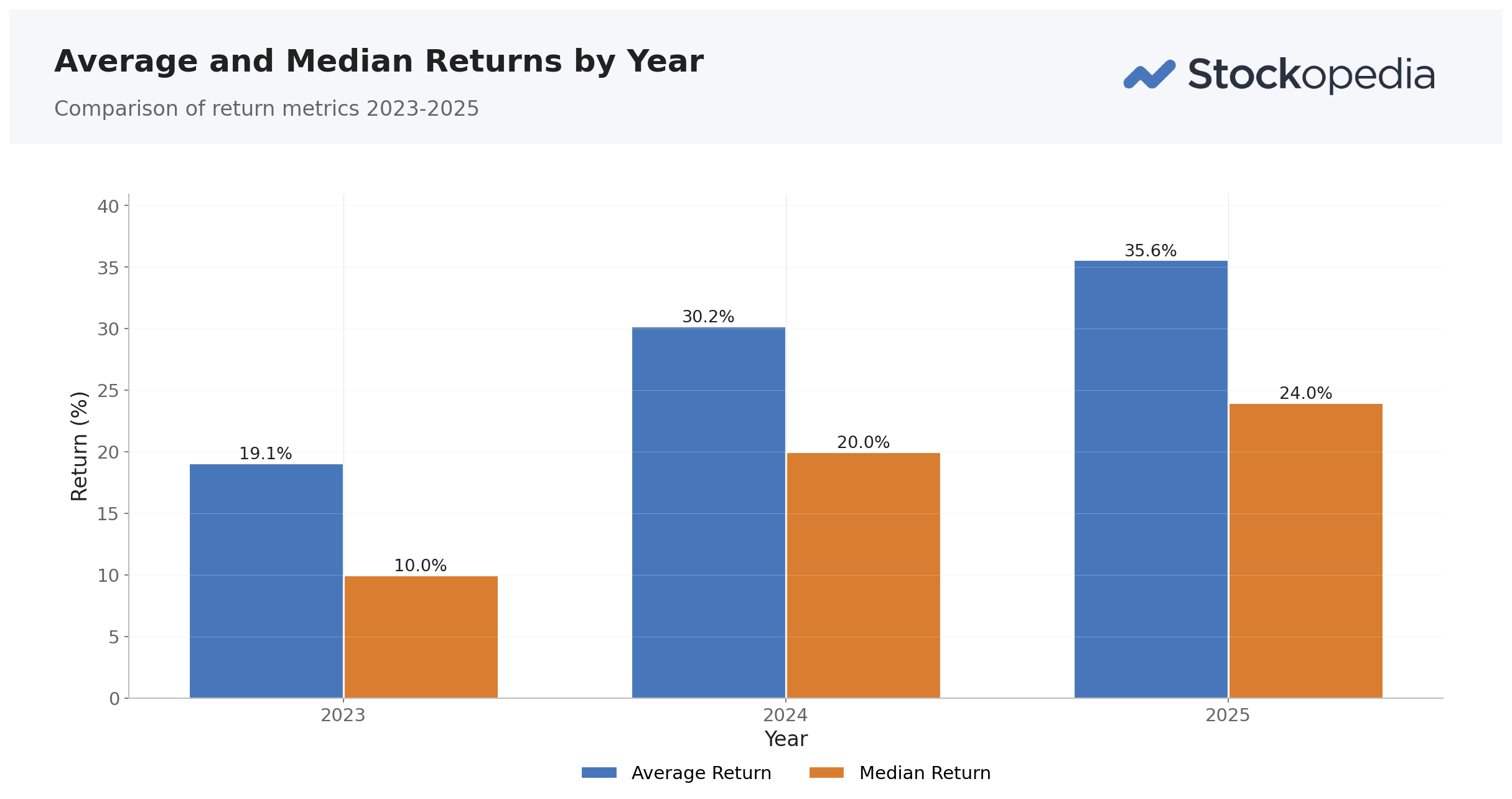

Let's start with the headline numbers. When asked about their portfolio performance in 2025, the average return reported by subscribers was 35.6%, with a median of 24%. That's a remarkable result, particularly when you consider that fewer than 5% of respondents reported a negative year.

For context, even in our best previous surveys - like the pandemic recovery year of 2020 - the average return was closer to 29%. This year's figure suggests that many subscribers have captured the rally effectively, likely through disciplined stock selection and sticking to process.

Of course, strong markets help everyone. But it's worth noting that over the longer term, the story remains consistent.

Long-term outperformance continues

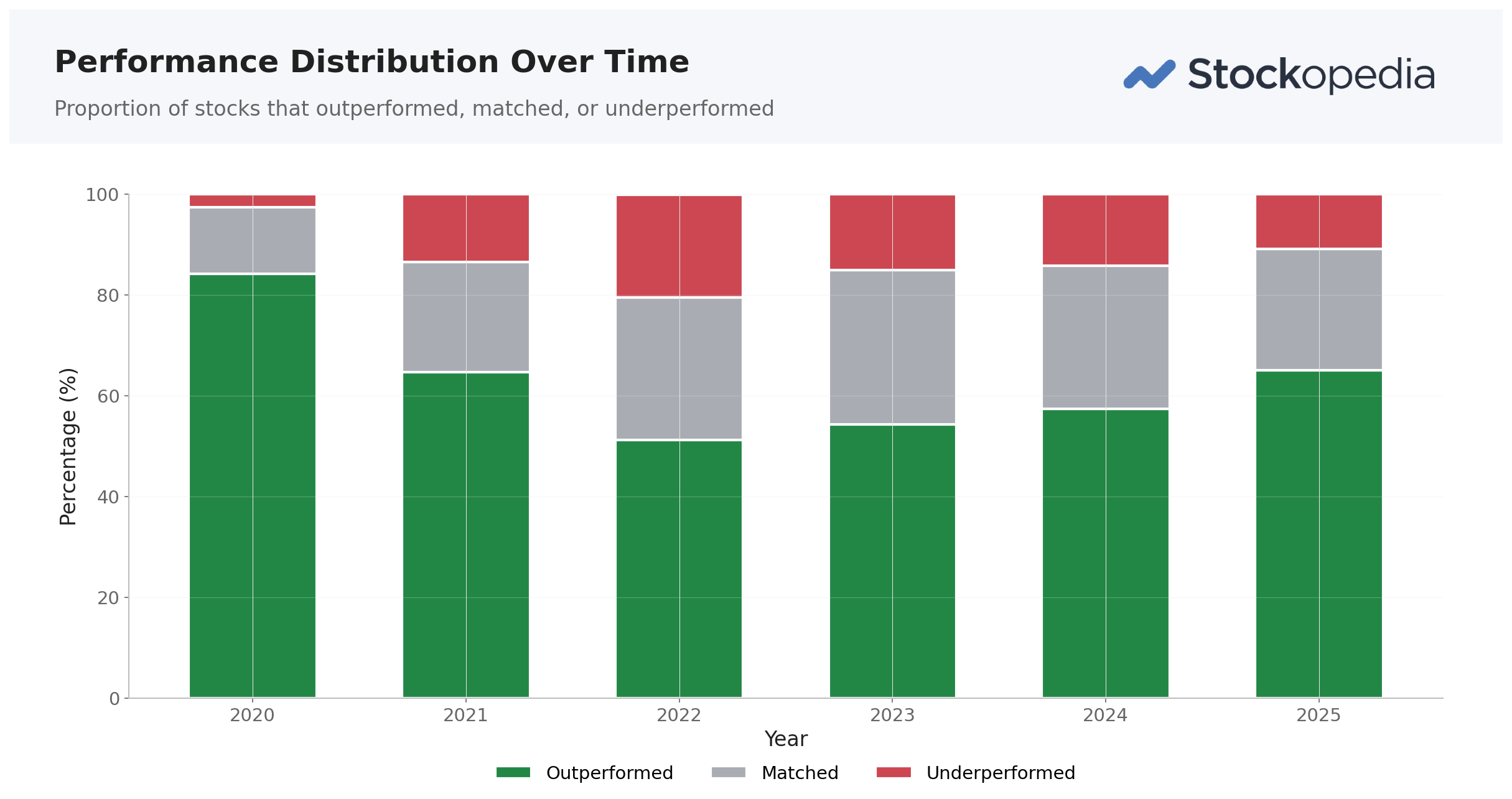

We've asked the same question for nearly a decade now: Since subscribing to Stockopedia, has your performance outperformed, matched, or underperformed the market?

In 2025, 65% of respondents said they had outperformed or significantly outperformed the market since joining—up from 57% last year and the highest figure since 2020's exceptional run. Just 11% reported underperforming.

What I find most encouraging about this data is the consistency. Markets go up and down, styles rotate in and out of favour, yet the majority of subscribers report beating their benchmarks over time. That suggests something systematic is working.

Confidence at a decade high

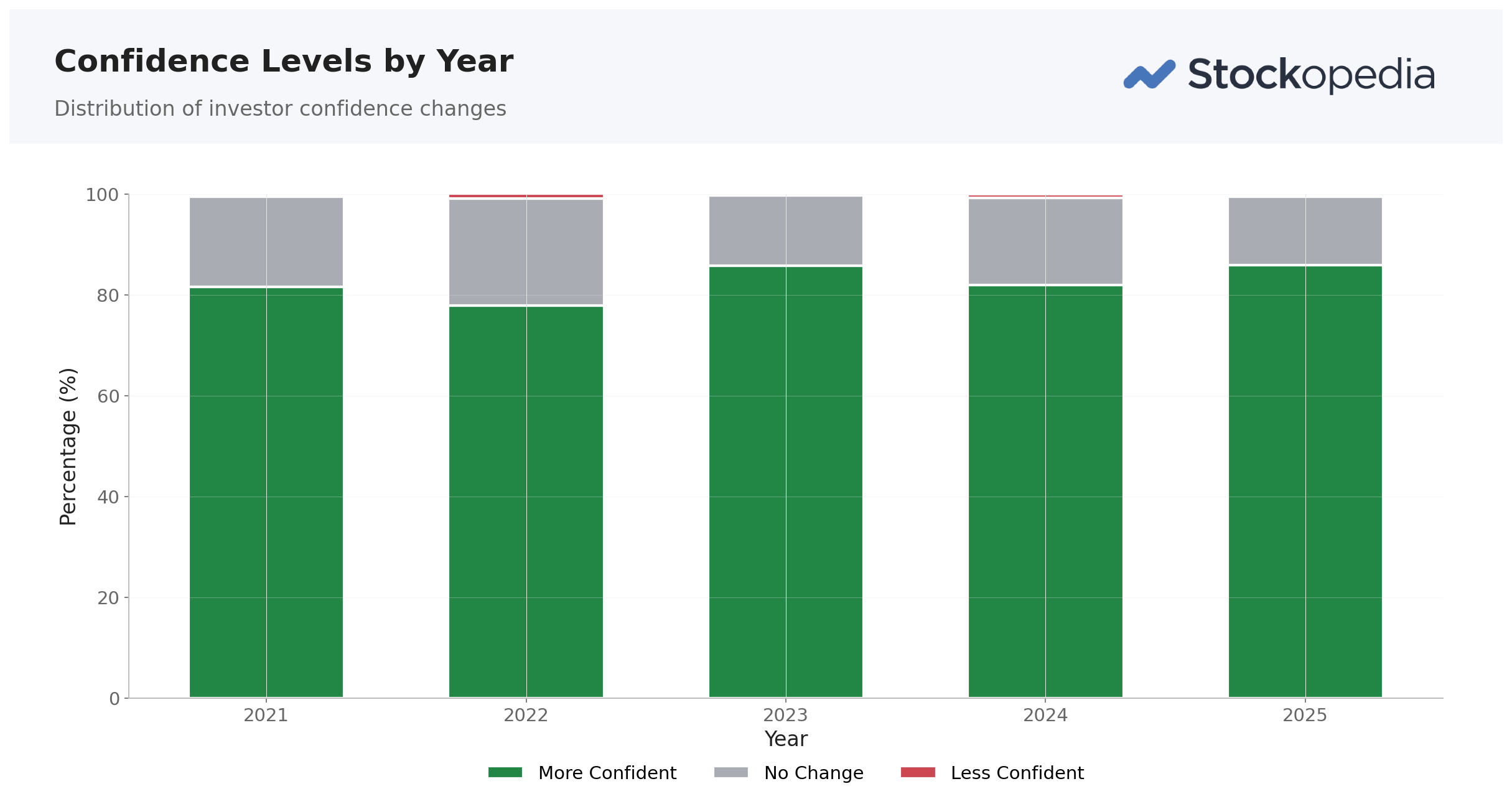

Perhaps the most meaningful measure in the survey isn't about returns at all - it's about how investors feel.

When asked whether they feel more or less confident in their understanding of the stock market since using Stockopedia, 85.9% said they feel more confident. That's the joint-highest figure we've recorded in ten years of running this survey, matching 2020's post-pandemic peak.

Fewer than 1% said they felt less confident.

This matters because confidence - when grounded in process rather than hubris - leads to better decision-making. It means investors are more likely to…