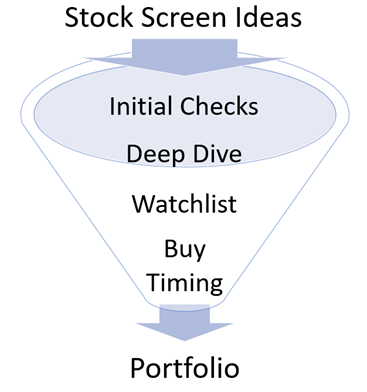

Over the past few weeks, I have been looking at some stocks making 52-week lows. I've been following the funnel from the initial screen, doing some initial checks, which ruled out some companies, and am now at the stage of deciding which companies should make (or stay on) my watchlist.

One of the best ways to get to the meat of this is to start to look into the details of what a company does, and writing a Stock Pitch article is a great way of doing this. Our Stock Pitch articles all tend to follow the same format, and it is for a good reason: the consistent layout means that all of the major considerations when investing are likely to be covered. This week, I have picked Synthomer (LON:SYNT) for the simple reason that this is the stock from the screen ideas that I know the least about. The gains in potential insight for me are greatest in my area of least knowledge.

Summary

- Synthomer (LON:SYNT) is a small-cap, Main Market-listed speciality chemicals producer which sells its products to other businesses. It has a history dating back to the 19th Century, and some investors may remember it by its former name, Yule Catto. It has three divisions: Coatings and Construction Solutions, Adhesive Solutions, Health & Protection and Performance Materials.

- With a StockRank of just 45, this won't appeal to quant investors. The Momentum Rank is one of the lowest in the market, at just 1, reflecting a weak share price and broker downgrades over the last year.

- I am always fascinated by this type of stock. Shareholders who held shares at the peak price four years ago have lost almost 99% of their money. The company paid a dividend per share in 2021 greater than the current share price. (Although there has since been a rights issue, so the total amount paid out in dividends would be less than the current market cap.)

- On the surface, the company's quality metrics are uninspiring. However, in the period 2010-2019, it had an ROE that averaged above 20%. A combination of weak EBIT and acquisition accounting, increasing their book value due to goodwill and acquired intangible assets, makes the current figures appear much worse.

- The large acquisitions the company made in the past couple of years have built scale, but…