Investors will have noticed how strong many UK stocks have been over the last couple of months. Take Volex (LON:VLX) , for example. The share price here has almost doubled from April lows:

The reasons are written in the DSMRs over the past year. The market experienced indigestion as Volex attempted to acquire TT Electronics in November 2024 in a deal that would involve part payment in Volex equity. Despite this being rebuffed, the market never recovered. Then, in April this year, the market worried that Volex would be severely impacted by trade tariffs. When the risk of the worst tariff levels subsided and Volex clarified that they would successfully pass on any tariff-related costs, the shares made a slow recovery. Last week's beat of expectations caused a significant rise that completed the share price recovery to levels before all this began.

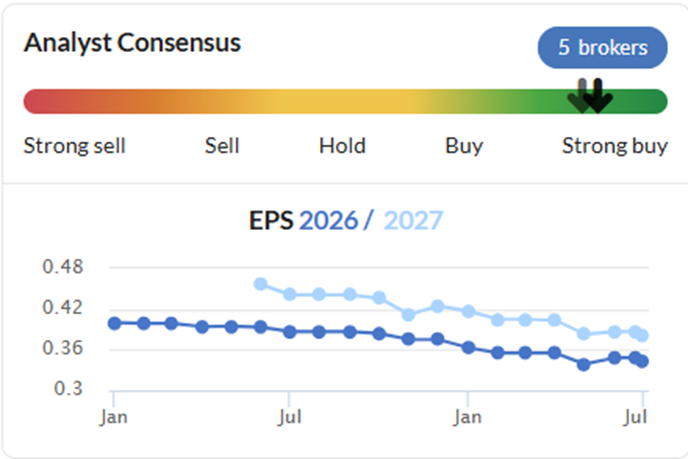

The most interesting part, at least for me, is that this recovery goes against the long-term trend in fundamentals, as measured by future year broker EPS forecasts:

The individual share price movements here may be logical based on the news. However, collectively, they mainly represent the shifting sentiment toward the stock, rather than any fundamental change in future expectations. The stock sold off until it was simply too cheap, and the improvement in sentiment has generated an almost 100% return to shareholders who bought when the tariff news looked bleakest.

Subscribers will undoubtedly have their own stories to share about this momentous period. If such swings can occur in a £700m market cap company, such as Volex, some of the moves in smaller companies will have been even more substantial. Many stocks have followed a similar pattern of recovery as investors became more enthusiastic about the prospects for the UK following the US trade deal. However, such moves have been far from universal. There have been a few reasons for this:

1. Profit warnings

Let's face it, conditions are still tough out there for a number of businesses. Any UK company with retail, hospitality or even industrial exposure is likely to have struggled recently. It's not just limited to the near term, either. This week, MPAC (LON:MPAC) issued a profits warning due to a weak Q2 order book. This meant that full-year revenue…