Hi, this may be useful to investors who receive dividends. I recently contacted Linkgroup by email for the form for £PAF. I am unsure if it is linkgroup that needs contacting for other shares but may well be. Perhaps someone can answer that question. It may be useful if investors tell others here so we can create a list, of companies that have a different tax.

Also, I presume not so many investors realise all this, so it would be helpful if someone says whether it will effect investors who hold in a sipp or isa, or will the tax only effect those using an ordinary account?

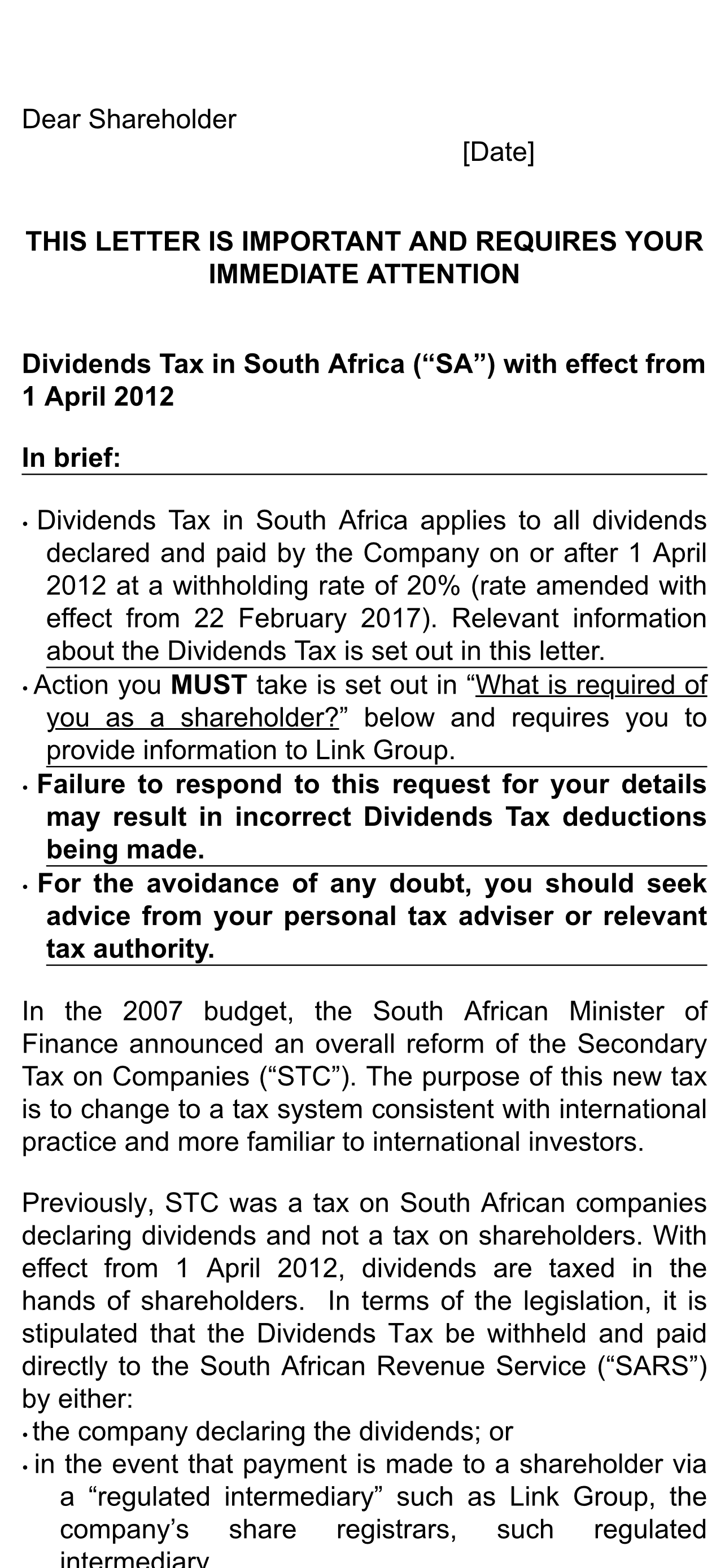

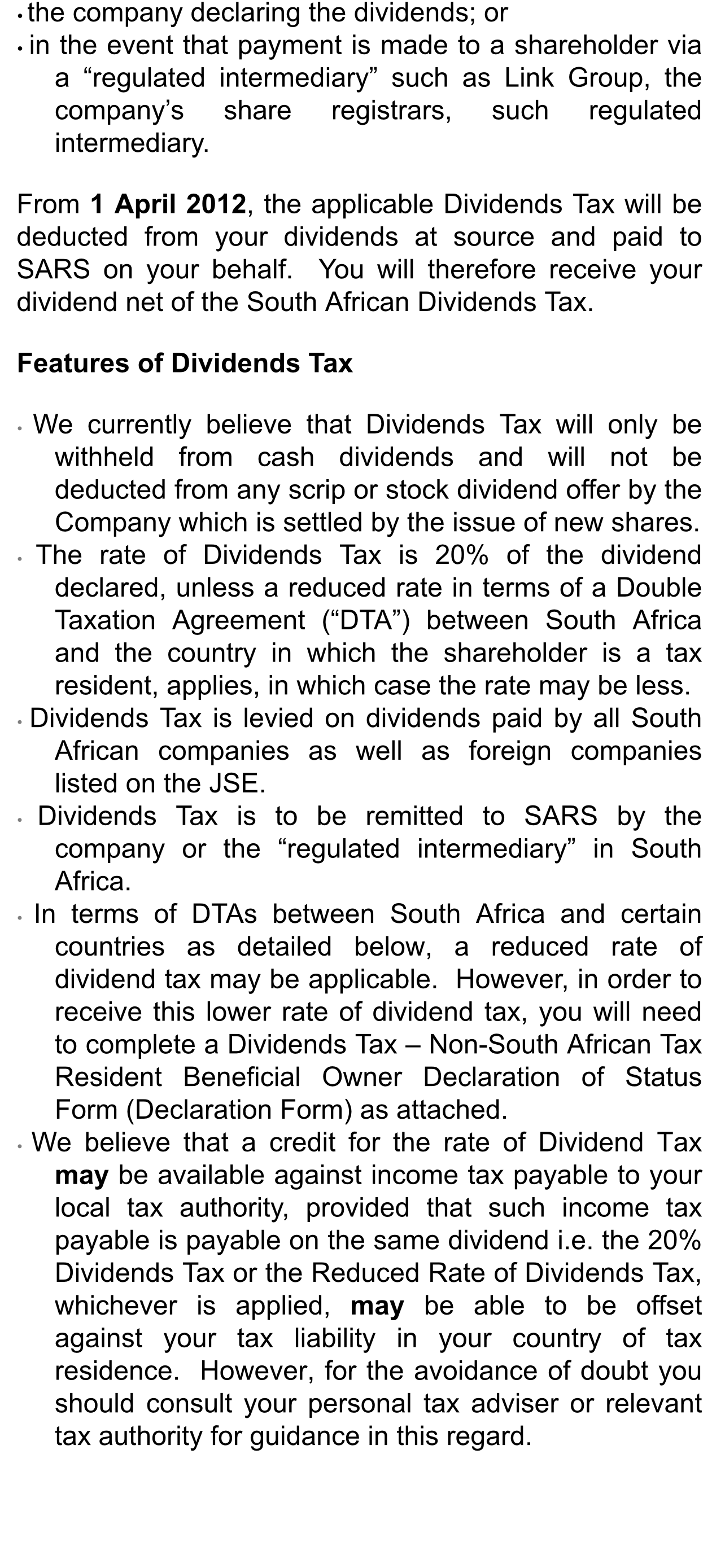

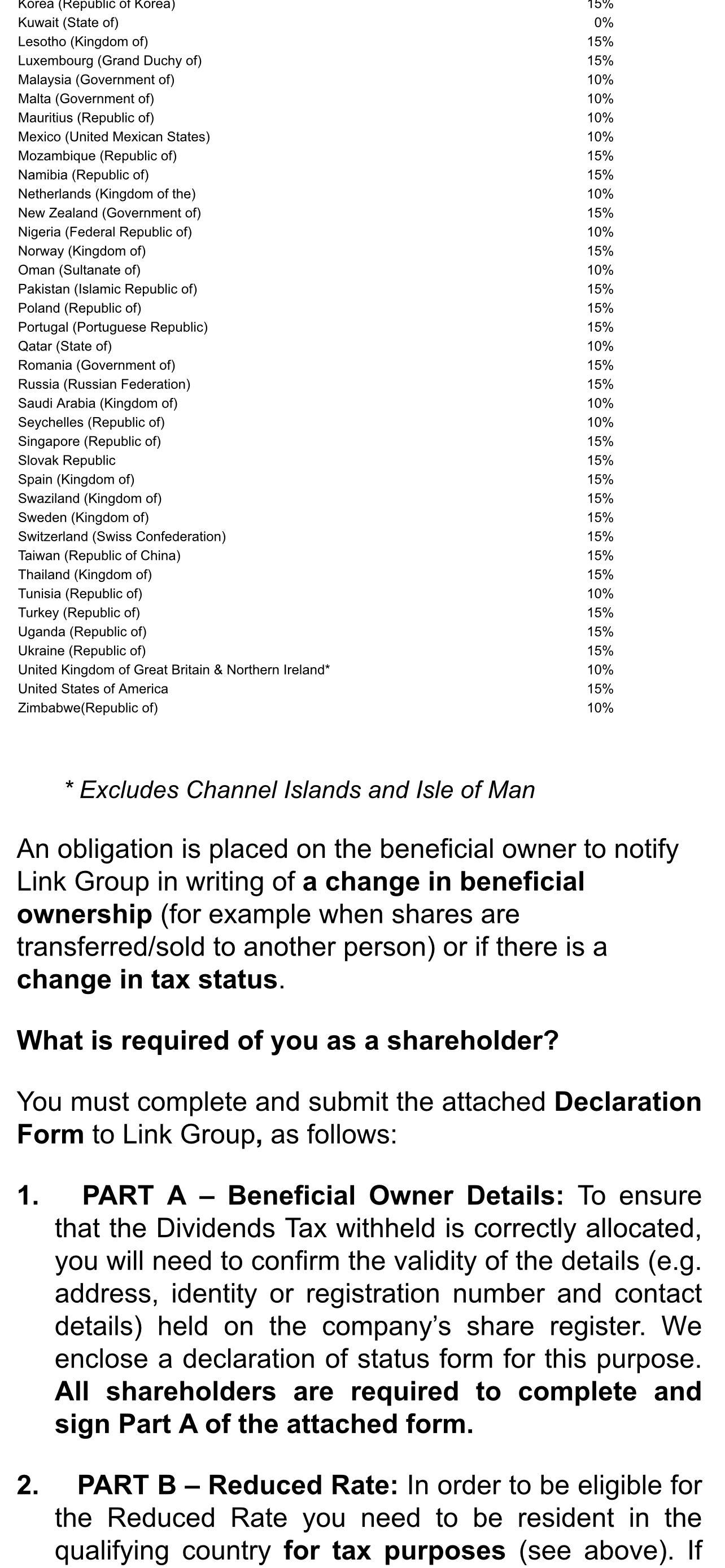

The letter below explains all. Most of us probably hold shares these days in a nominee account. The nominee has the responsibility of sending off the tax form. Unfortunately they do not inform the shareholders to this tax and so it is up to you to get the form, send it to your nominee to check and send off.

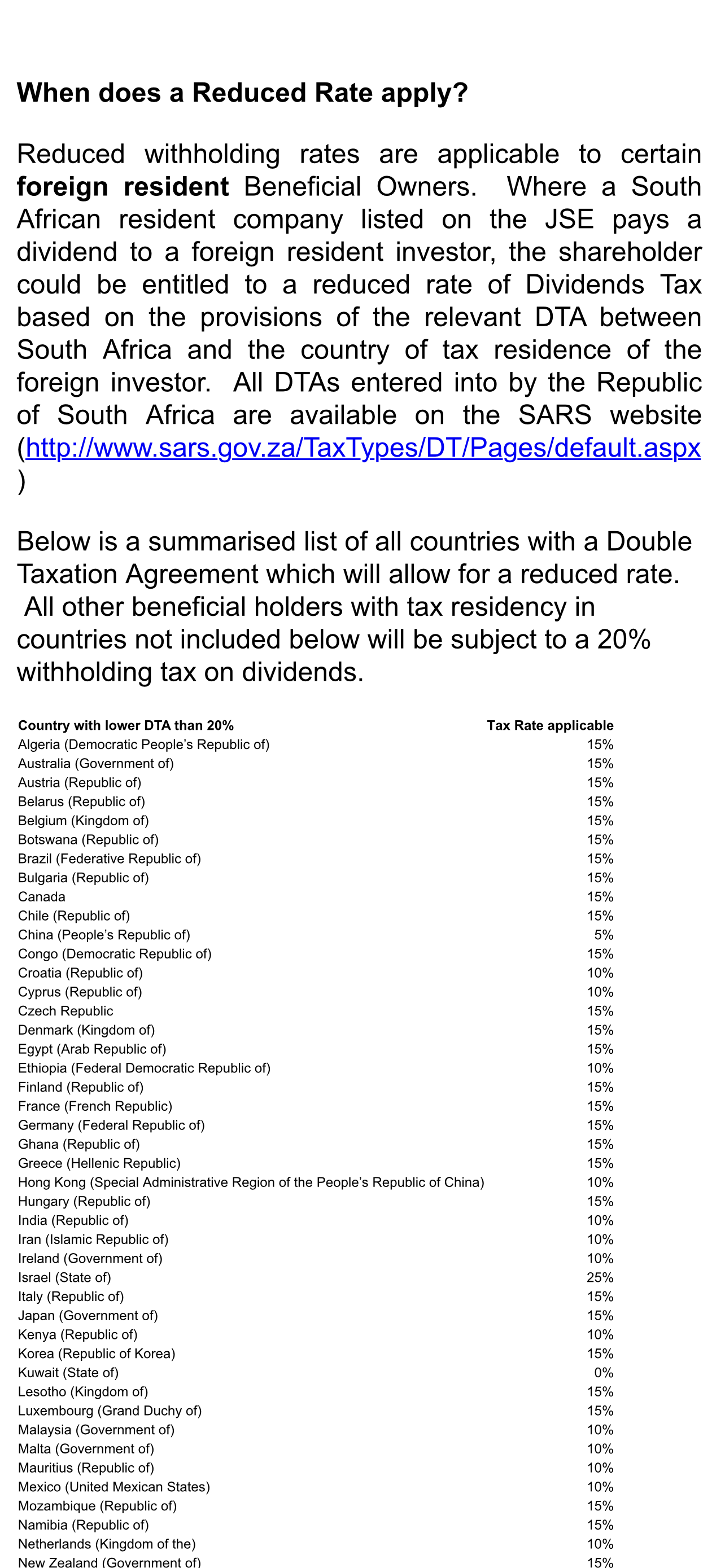

Companies that are taxed at a different rate for those that live in the UK:

Pan African Resources (LON:PAF)

Atalaya Mining (LON:ATYM)

Ferrexpo (LON:FXPO)

Plus500 (LON:PLUS)

Tharisa (LON:THS)