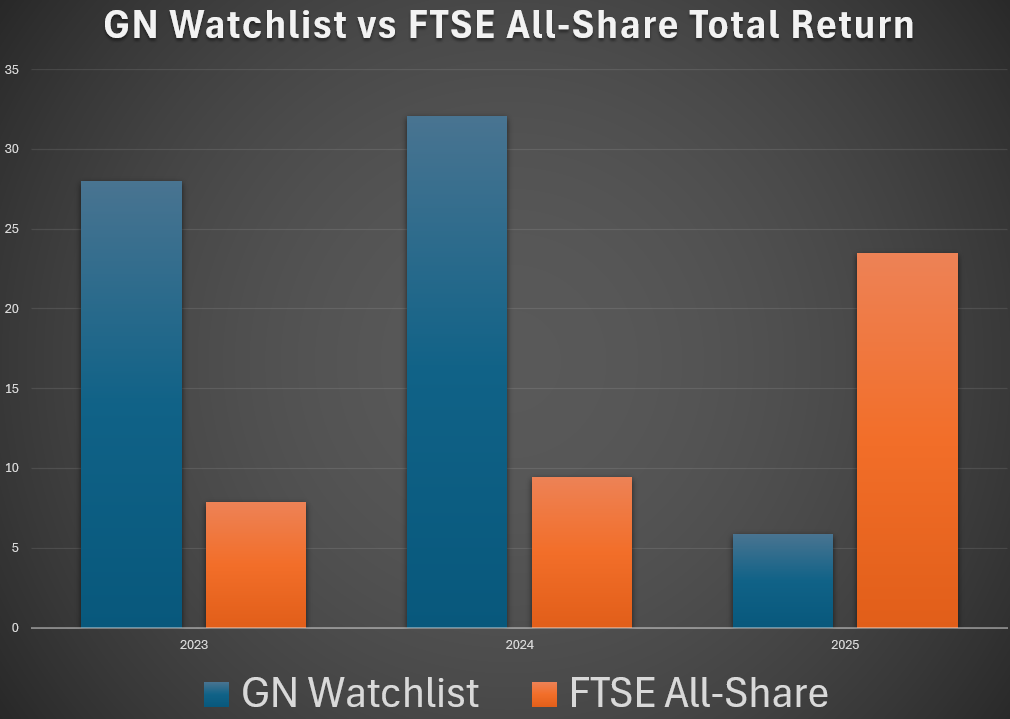

2025 was a year in which the return of my watchlist finally reverted to mean, after a few years of exceptionally strong performance. It was a period of substantial underperformance against the FTSE All-Share Index.

In 2025 so far (as of 21st December), my watchlist has generated an average total return of 5.9%, significantly underperforming the FTSE All-Share’s 23.5%.

Here are the returns of my watchlist vs. the FTSE All-Share and the AIM All-Share over the past three years:

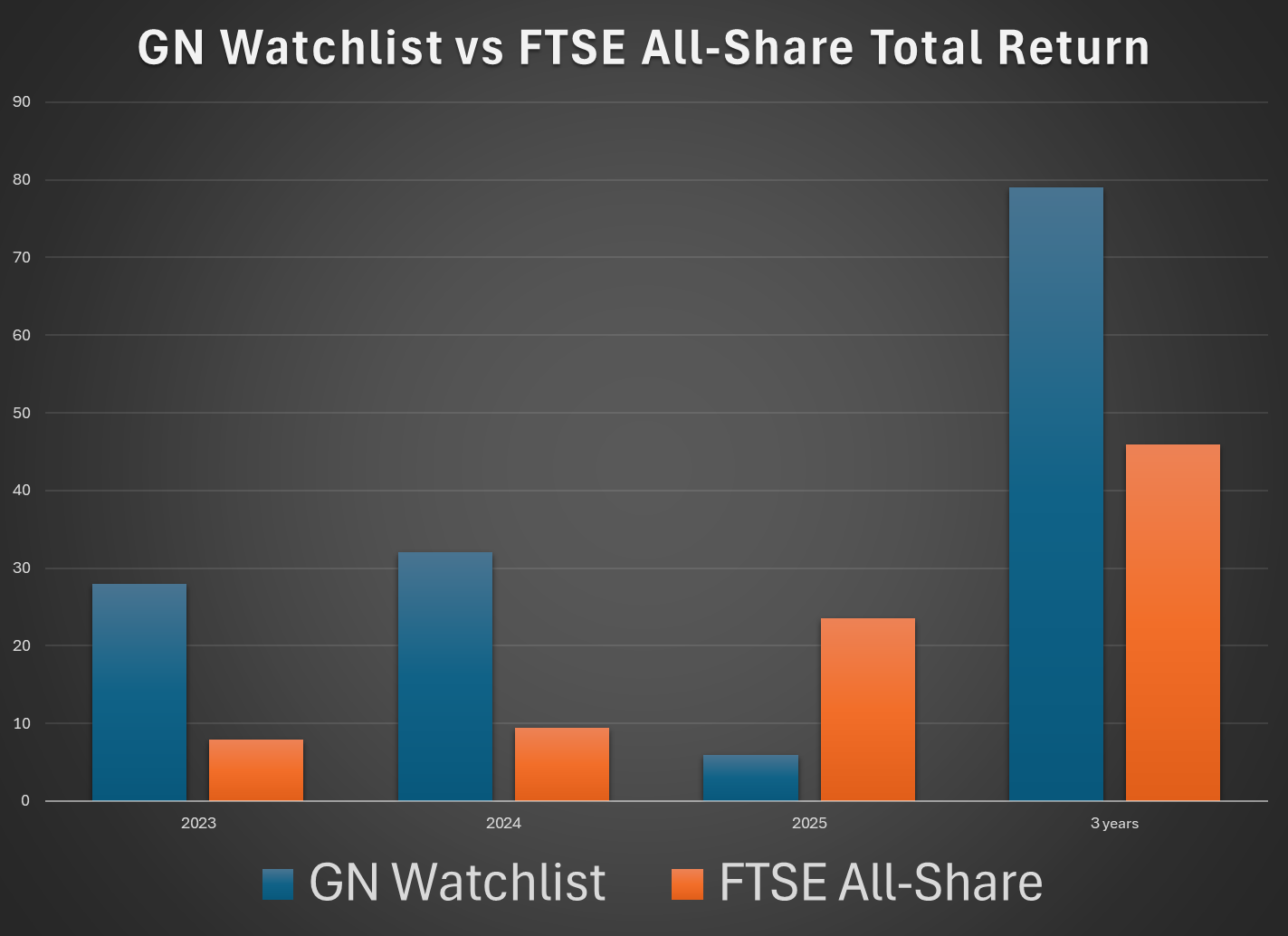

It looks better if we include the compounded return over the three years:

It’s time for a post-mortem: what went wrong in 2025? What went right? This will tee us up nicely for my 2026 watchlist.

Please note that I won't be going into the stories in detail - that is for the daily report!

What went wrong?

This is going to be the longest section.

1. PayPoint (LON:PAY)

Total Return YTD -33%.

Market cap as of writing: £294m.

Much of the return from PayPoint comes in the form of its enormous dividend yield, but that was not enough to offset a very weak share price performance.

I covered the company's November profit warning here.

Two major issues were identified: 1) reduced volumes through the parcel service Collect+ due to problems at its courier partner Yodel/Inpost. 2) difficulties in growing the obconnect business (where PayPoint is the majority shareholder).

I lowered my stance on PayPoint to neutral, which is standard operating procedure in our daily reports after a profit warning.

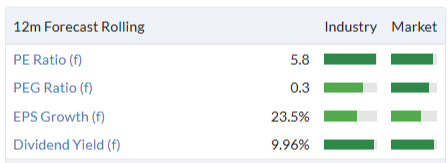

However, as I said in our daily report on the day, I find the potential value here tempting:

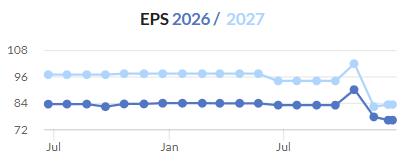

The profit warning reduced the FY27 earnings estimate from 102p to 83p:

The problems at Collect+, as far as I can tell, were the fault of Yodel/Inpost, not PayPoint. PayPoint’s error was accepting commercial terms which assumed higher volumes, as those volumes did not materialise.

But has this changed the long-term opportunity at PayPoint and its Collect+ business? I’m inclined to think not. It will be very helpful when we learn of the performance at this…