The Asia Pacific Fund: Striving for Growth and Value

As U.S. stock markets rally to new records, investors are increasingly looking to Asia for new growth opportunities. One example of a fund that has achieved stable, diversified exposure to expanding markets is the Asia Pacific Fund (NYSE: APB), which is a closed-end fund managed by Value Partners.

Asian equities have traded under pressure in recent months, as trade war discussions have weighed on investor sentiment. During the second quarter, the MSCI Asia ex-Japan Index declined by 1%, and the selling pressure dragged the performance of APB down by 2.4%.

What the declines have failed to reflect, however, are the region’s relatively solid economic fundamentals and how the trade rhetoric is not expected to cause sharp growth corrections. Some Asian economies, like South Korea, are largely insulated from the US-China trade standoff as sales, exports, and productivity figures remain robust. Nevertheless, the selling pressure has helped to create a number of buy-on-the-dip opportunities.

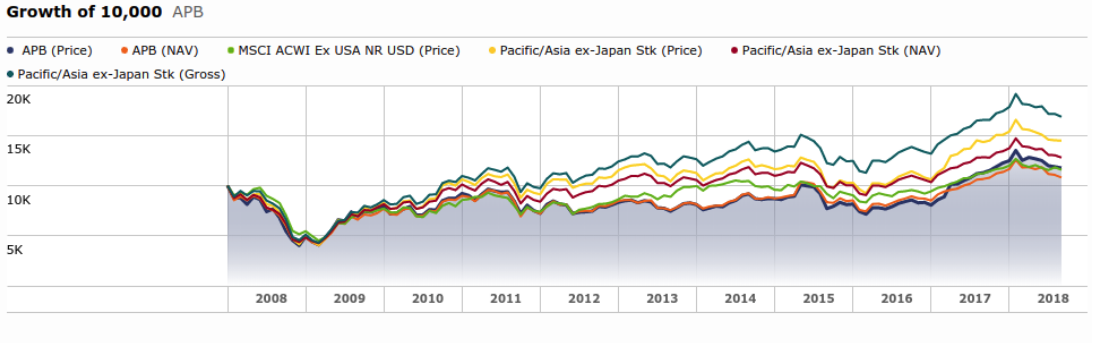

Since 2016, the fund’s NAV recorded an exponential growth of 9.4% (despite the shorter-term downside fluctuations that have been present in 2018). In contrast, the Morgan Stanley Asia-Pacific Fund (NYSE: APF) generated NAV growth of only 5.4%. The Voya Asia-Pacific High Dividend Equity Income Fund (NYSE: IAE) showed even lower NAV growth of 0.8% over the same period.

Global trade tensions have created added pressure for many stocks in the asset class. Through the beginning of October, this downside pressure caused year-to-date losses in both IAE (-11.93%) and APF (-10.98%) compared to APB (-7.66%). This shows that APB is better positioned for global volatility.

Narrowing NAV Discounts

On the surface, it may seem that global tensions are negatively impacting investments. But when we look at these assets through the lens of a broader time horizon, the rising global tensions have actually had a fairly limited impact.