The Big Dipper

This is the title of a Stocko virtual portfolio, which due to the limited number of portfolios one can hold in a Stockpedia account has recently replaced the Silver Coffee Can. My Coffee Can was leading me to believe its route to riches would take longer than the remaining years I have so shortly before last Christmas there was another Big Think. Another virtual portfolio that got the chop was my Gold Rush, constructed when gold miners were all the rage in 2019/20. Lots of lessons learned there but I digress. I’m ever the Optimist, even underwater as in the state I am, but always searching for the golden grail. The Big Dipper is made up of the best-performing shares of year 2022 held in the 6 portfolios I run. I just don’t have the expertise of say, Paul Scott, to reverse-engineer numbers of company reports but mostly go by trends and in particular, Momentum.

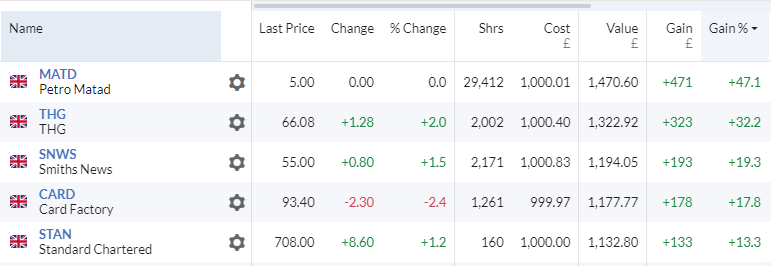

So, getting back, the holdings in the Big Dipper number 26, plus there’s a further 6 fancied. Buying these virtually at around a thousand pound apiece, the total came to £32127. Now, not counting dealing charges and spreads, after just over two weeks the value of the Big Dipper stands at £33972, a gain of £1845 or 5.74% according to my unreliable math. This virtual portfolio is doing a lot better than my real ones although of course those are hampered by a lot of water-logged timber.

I do fear that the Big Dipper will grind to a halt just a few yards up the next big incline, some readers no doubt will suggest I sling the lot into 2 or 3 Funds, but where would be the fun in that?

Many thanks to Megan Boxall who on January the 10th 2023 wrote Traits vs Trends: Searching for success in 2023, her exceedingly useful Post that brought this one on.

Silver