In last Friday's letter, I said that I had not bought any single stocks in the last decade, preferring funds and managers, and in general I still do. However, I am now going to start buying a specific asset class this month and currently plan to add to those holdings at least every quarter for several years. This is the high risk portion of my portfolio, so it will not be all that large a percentage. (Do not write and ask me what the right percentage is. It will be different for everybody. For some of you the answer will be none, as you need to be taking very little risk. Consult your investment professionals.).

Let me state emphatically that I am not going to become a stock picker. My regular letter will remain focused on the macro economic environment and investments in general. This is not my recommended advice to you but what I am doing as an individual investor. I simply know that many readers are interested in what I am doing personally and in my investment ideas. If this doesn't make sense to you, then by all means hit the delete button later. With that thought, let's dive right in.

In the 70s, we had a bubble in gold and commodity stocks. Some stocks had huge run-ups because of major gold finds coupled with the price of gold going up over 20 times over the period. A gold mine became a hole in the ground with four promoters standing around it telling you a story about why there was gold in the hole. Sometimes there was, but often the "gold" was the stock the promoters sold. I was too young and poor for that bubble, although I did get into a few (sadly too few) later winners.

Then we had the tech bubble. And the internet craze. Obviously, some of those stocks are still around and have been longer term winners, but the number of stocks that went public with crazy offerings, no revenues and valuations from left field eclipsed anything I have ever witnessed. I missed that bubble as well, as I was bearish about the markets in general and tech in particular, as I wrote in my first book (1998).

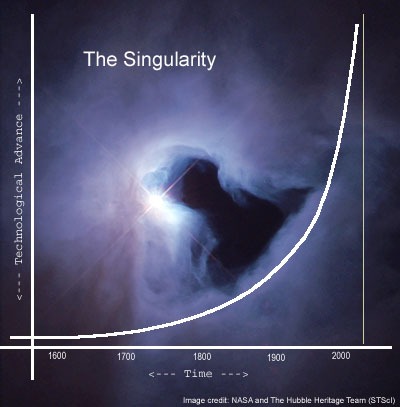

I think there is a potential for another bubble over the next decade. There will probably be several, but there is one I am particularly…