Back in 1955 Ben Graham, known as the ‘father of value investing,’ was summoned to Washington DC, into the corridors of the Capitol Building. The Senate Banking Committee wanted to understand how the stock market worked. Politicians managed to get their head around the idea that there was a difference between a stock’s price and a stock’s ‘intrinsic value’ - i.e. it’s ‘true’ value. But politicians couldn’t quite understand how or why the price eventually came into line with the intrinsic value. Senators grilled Ben Graham, who responded by putting on his politician’s hat and refusing to give a direct answer…

Senator: When you find a special situation and you decide, just for illustration, that you can buy for 10 and it is worth 30, and you take a position, and then you cannot realise it until a lot of other people decide it is worth 30, how is that process brought about – by advertising or what happens?

Graham: That is one of the mysteries of our business, and it is a mystery to me as well as to everybody else. We know from experience that eventually the market catches up with value. It realises it one way or another.

Ben Graham was revealing less than he knew…

Markets as voting machines

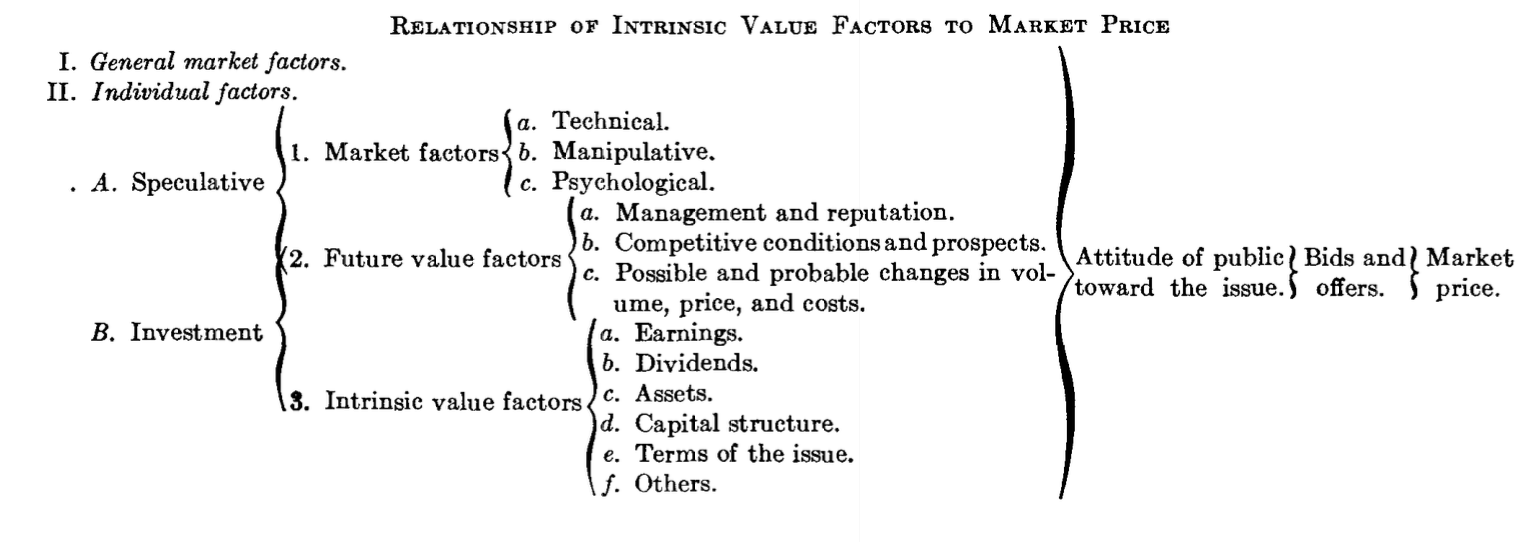

In his tome, Security Analysis, Graham laid out the various factors that culminate in the market price…

Fundamental factors, like earnings, dividends and assets, all have a role to play. However, their impact is mediated by an intermediary factor: public opinion. At the end of the day, share prices are not driven by financial data per se, but by people's perception and awareness of that data.

Ben Graham put it like this:

It will be evident from the chart that the influence of what we call analytical factors over the market price is both partial and indirect: partial, because it frequently competes with purely speculative factors which influence the price in the opposite direction; and indirect, because it acts through the intermediary of people's sentiments and decisions.

Public opinion is harder to understand than cold hard data. Things would be straight forward if we all acted in accordance with the rational economic model. According to that model, individuals make decisions by evaluating options and selecting the best one. However, if we have…