I suspect I am not alone in the view that the recent stock market highs are masking some deeper economic problems that may give rise to a sharp market correction. In the past, I've tended to take quite a simple approach to investing either holding long positions in shares and funds or liquidating into cash when the market seems expensive and the "fear" emotion overtakes the "greed". Selling individual stocks, however, can be quite time consuming and expensive, especially for small caps with their dealing costs, wide spreads and limited liquidity.

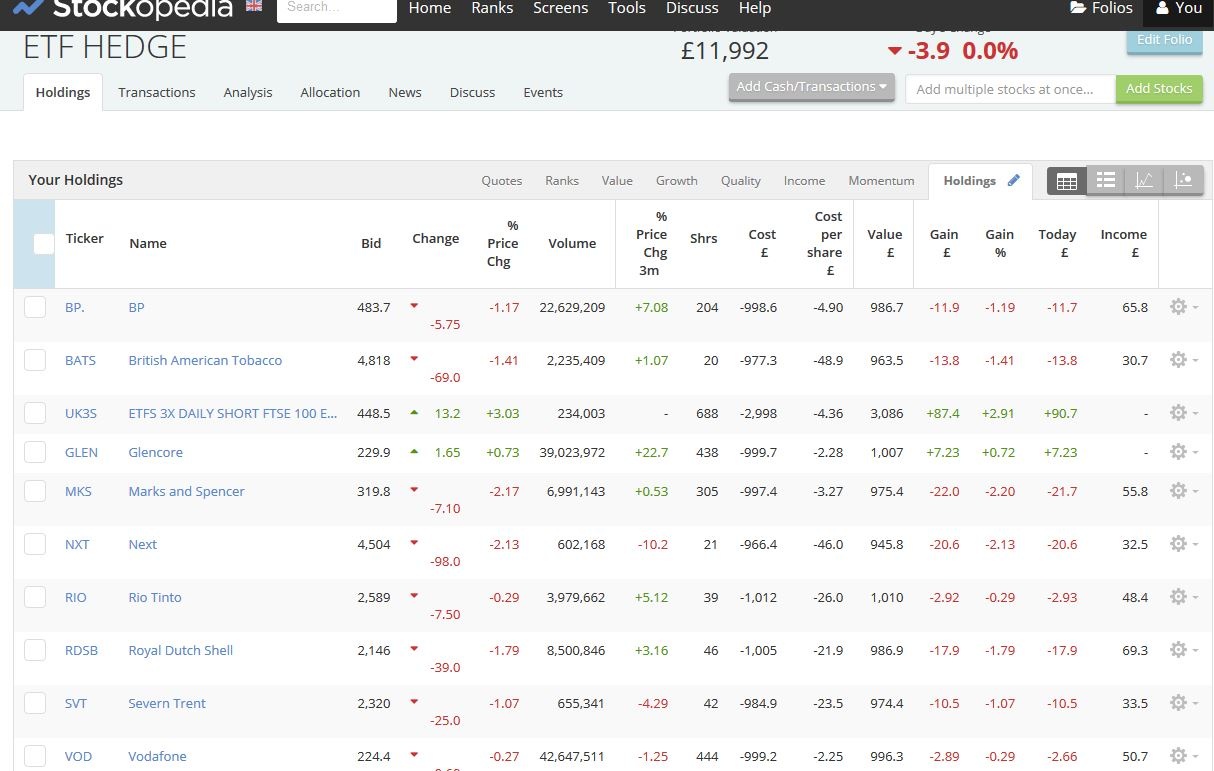

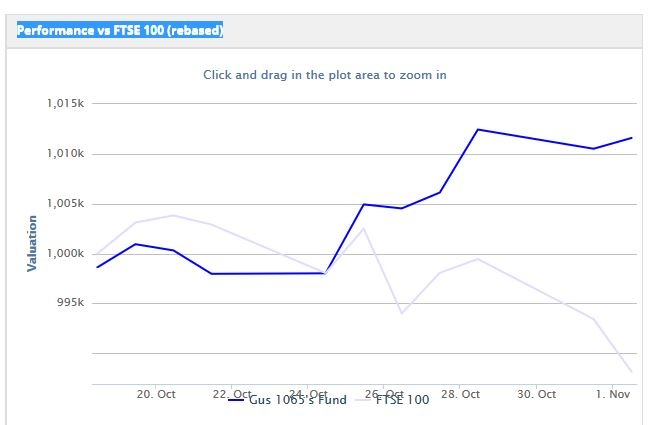

As an alternative, I've been thinking of using short index ETFs such as £UK3S (ETFS 3X Daily Short FTSE 100 Fund) which is a derivative based instrument that effectively acts as a geared inverse tracker to the FTSE 100. In essence, if the FTSE falls 1% on a given day, this instrument's value rises by 3% (and if FTSE rises by 1% it falls by 3%). The trading spread (about 0.3%) seems reasonable as does the liquidity given the small size I am looking to place as a toe in the water exercise. The 3x gearing is attractive in that it requires a relatively smaller position to offset a movement in the long share portfolio, although clearly the potential for loss is geared as well. There is basis risk (my shares and funds' composition is markedly different to the FTSE 100) but I am happy with this given the hedge is being used as an approximate insurance cover for my portfolio against a "catastrophe" event. There is no dividend type income from the instrument so there is a carry cost, but my intention here is to use it as a relatively short term hedge until the markets either correct or become a bit less skittish.

I wondered if anyone on the board has any views (positive or negative) on either the general costs and benefits of this kind of hedge strategy or this particular instrument or indeed any other recommendations either for putting in place some protection and/or an instrument that would more closely match up to a FTSE 350 or AIM based portfolio

Best,

Gus.