Readers will be familiar with the story of Goldilocks, the curious girl who wanders into the house of three bears and eats their porridge. One bowl is too hot, one bowl is too cold, and one bowl is just right. The story serves as a kid-friendly illustration of the ‘happy medium’ principle — the idea that the best outcome lies in the balance between extremes. The principle is relevant in many fields, including investing, and particularly in the context of portfolio diversification. Investors often wonder how many stocks are ‘too many’ (’too hot’) or ‘too few’ (’too cold’)?

Various gurus offer advice. For example, Peter Lynch argues that ‘the average person can concentrate on a few good companies.’ He cautioned that ‘by owning too many stocks, you lose this advantage of concentration.’ It’s solid advice, but it still leaves lingering questions: what exactly counts as ‘concentrated,’ and when does ‘too many’ become a problem? We’re going to tackle this question with a particular focus on factor investing strategies. These strategies can help private investors beat the market, but only when the portfolio size is carefully managed…

This portfolio is too big

A large body of research suggests that factor investing strategies do outperform the market. Cheap stocks typically outperform expensive stocks. This is known as the value effect. Stocks that have gone up often keep going up. This is the momentum effect. And finally, profitable, cash-generating stocks outperform unprofitable, cash-burning ones. This is the quality effect. Our StockRanks give a higher score to companies with exposure to all three factors - i.e. quality, value and momentum (or QVM).

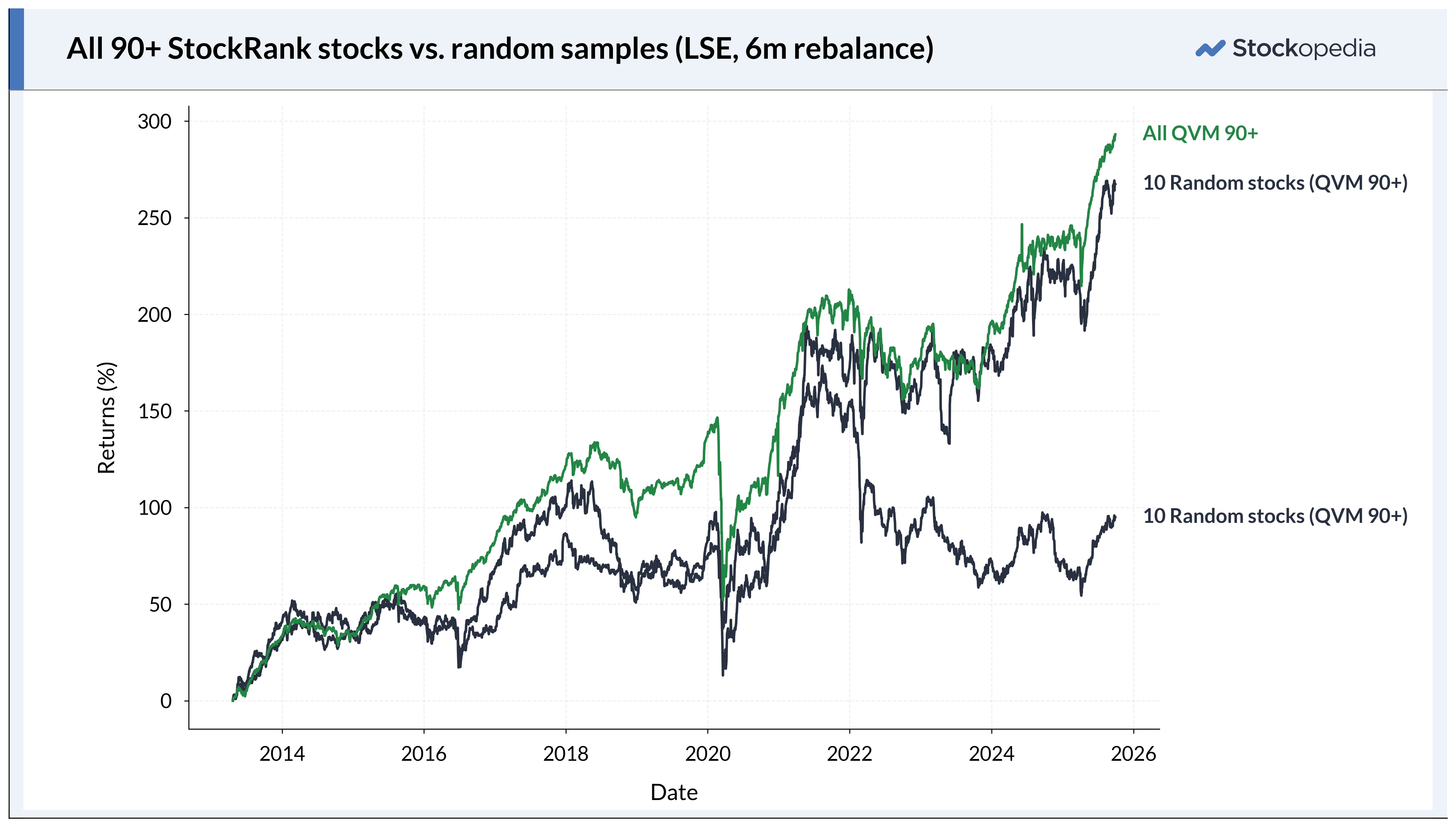

High-QVM stocks generally produce strong returns. Our simulated performance has returned around 300% since 2013 (assuming a semi-annual rebalance). The catch is that factor investing strategies work ‘on average’. If you randomly pick a handful of strong QVM stocks, your performance might not match the broader basket of all high-QVM stocks.

To successfully implement a QVM-based strategy, investors need to hold a “sufficient” number of stocks. At any given time, roughly 150 LSE stocks boast a QVM Rank above 90. Does that mean investors should own all 150? Of course not. Even a portfolio of 100 stocks would meet Peter Lynch’s definition of ‘too many.’ We can therefore rule out two approaches: the ‘random’ approach — throwing darts at high-QVM stocks —…