So, what do the UK bakery Greggs and Warren Buffett got to do with one another?

Greggs has similar characteristics to a Coca-Cola or more appropriately See Candy in the U.S. has been reporting ever growing consistent earnings. And we know Warren Buffett like his long-term growth companies, especially when he can hold on to it forever!

Okay, so what is this “equity bond” got to do with Buffett and Greggs?

To explain the equity bond, let start with the bond part

For example, if you own 10 bonds worth £100 each it totals £1,000. The bonds pay you a 5% yields or £50 each year, this is fixed till maturity.

The same concept applies to equity. Let say you bought $1,000 worth of Apple’s shares at $100 each and the iPhone maker earns $7/share (EPS) giving it an earning yield of 7%, also assumes it grows by 10% each year for the next 10 years.

On the dividends front, Apple pays $3/share or 3% dividend yield; it too will grow by 10% each year for the next 10 years.

Let’s ignore share price appreciation and focus on earnings yield and dividends growth.

By the end of year 10, Apple will earn $18.16/share and be paying a dividend of $7.78/share. The initial 7% earnings yield would have grown to 18.16% and its 3% dividend yield would swell to 7.78%.

But if you were holding bonds for 10 years, you would continue to earn the 5% yield with no uplift; this is because stocks are riskier and required more skills in understanding the business competitive advantages and its competitions.

That is where Warren Buffett came up his equity bond concept.

How would Greggs do?

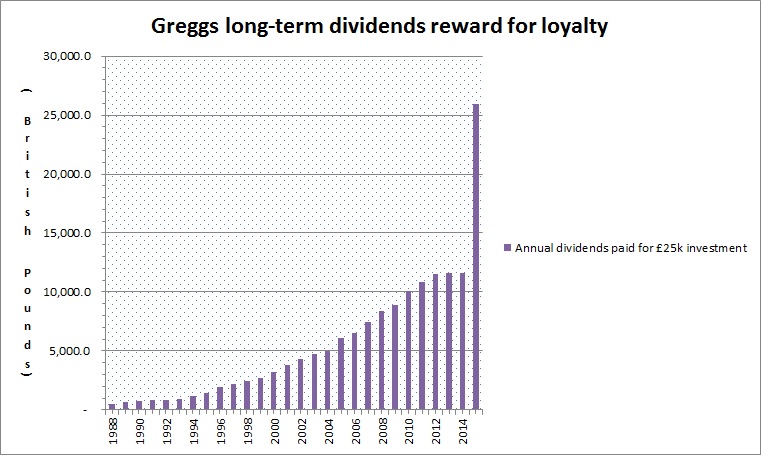

Assume putting your life-savings on Greggs and say the amount is £25,000.

In 1988, Greggs share price average £4.17/share with a market value of £45.9m and share issue was 11m.

Therefore, £25k/£4.17/share = 5,995 shares.

The dividend per share is £0.0818 or 8.18pence/share meaning the yield is 1.96%; the annual return is £490.39.

Fast-forward 27 years, Greggs share price is £11.34/share, but you would be holding 59,995 shares due to a 10-for-1 share split back in 2009.

In 2015, Greggs paid out £0.432/share in dividends or £25,917.84 annually, which would give you a yield from your original investment of 103.7% (if only you knew you would get 0.25% on your savings)!

Source: Greggs…