One of the most important measures of a healthy stock market is the number of companies that choose to float and raise new money from investors. Company IPOs - or initial public offerings - are vital to maintaining the depth, diversity and efficiency of the market. But are they really worth investing in?

This summer, Stockopedia sets out to answer that with our new IPO Survival Guide. We wanted to discover how IPOs have performed in recent years and what investors should consider when it comes to buying into them. Using data covering 258 IPOs across the UK stock market between 2016 and 2021, we can now reveal:

- How do IPOs perform over both the short term and long term?

- Is there a difference in performance between high profile large-cap IPOs and less promoted small-cap IPOs?

- Do IPOs in certain economic sectors perform better than others?

- Does exposure to factors like Quality and Value improve the chances of success with IPOs?

- The importance of the issue price and whether the first day ‘pop’ really exists

- What investors should avoid when it comes to buying into IPOs

A hot market for new listings

IPOs have enjoyed a resurgence in the UK market in 2021. In the first six months, there were 49 new company placings, which was just short of the 50 that occurred in the entirety of 2020.

For existing shareholders - including founders, early stage investors and private equity - IPOs can be a lucrative time to exit. For the investment banks and advisers involved, new floats can be hugely profitable. Even the institutional investors who buy into them at the issue price benefit from early entry into new stocks at what can be attractive prices.

But for individual investors, the advantages are much less clear. Are IPOs an opportunity to buy into cutting edge multi-bagger opportunities, or are they a mechanism for savvy insiders to offload ex-growth companies at nose-bleed valuations? A glance back at recent history finds examples of both.

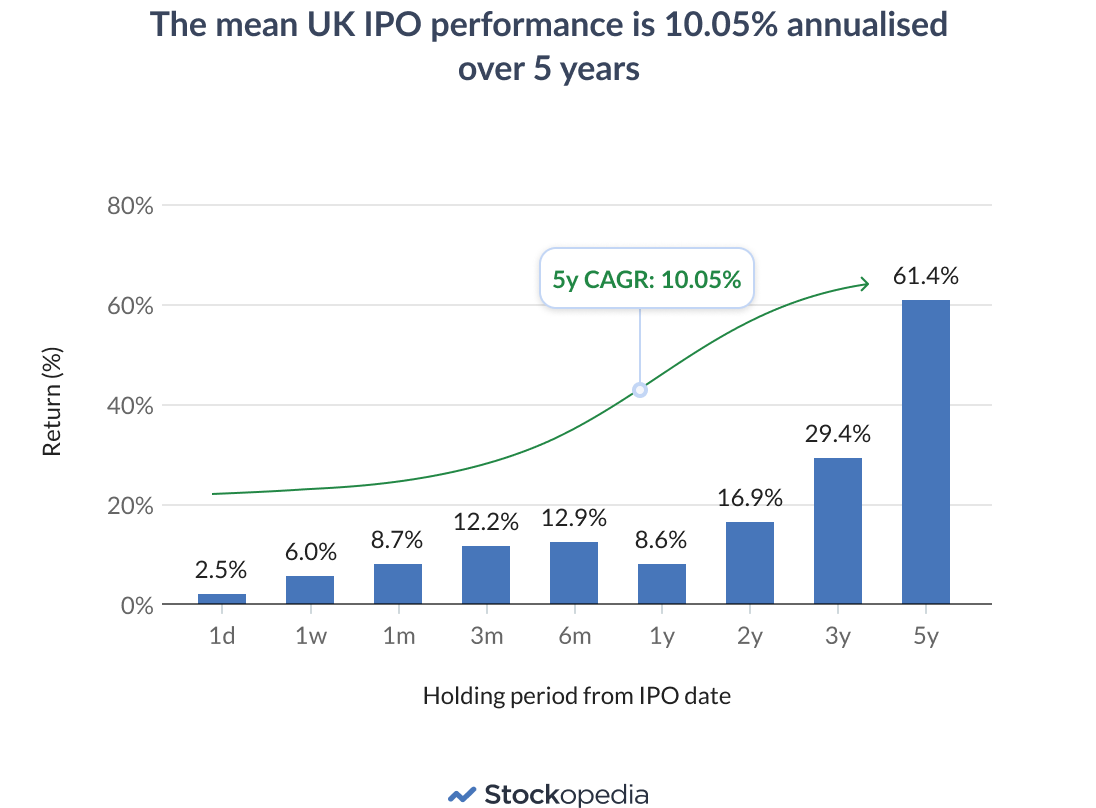

In Stockopedia’s new research, we started by exploring the performance statistics of IPOs. Across the whole market, on average, the performance of IPOs over the initial six-month period is positive, before subsequently tailing off after one year.

After one year, the average performance starts to pick up again, rising to a 61.44% average return over five years.…