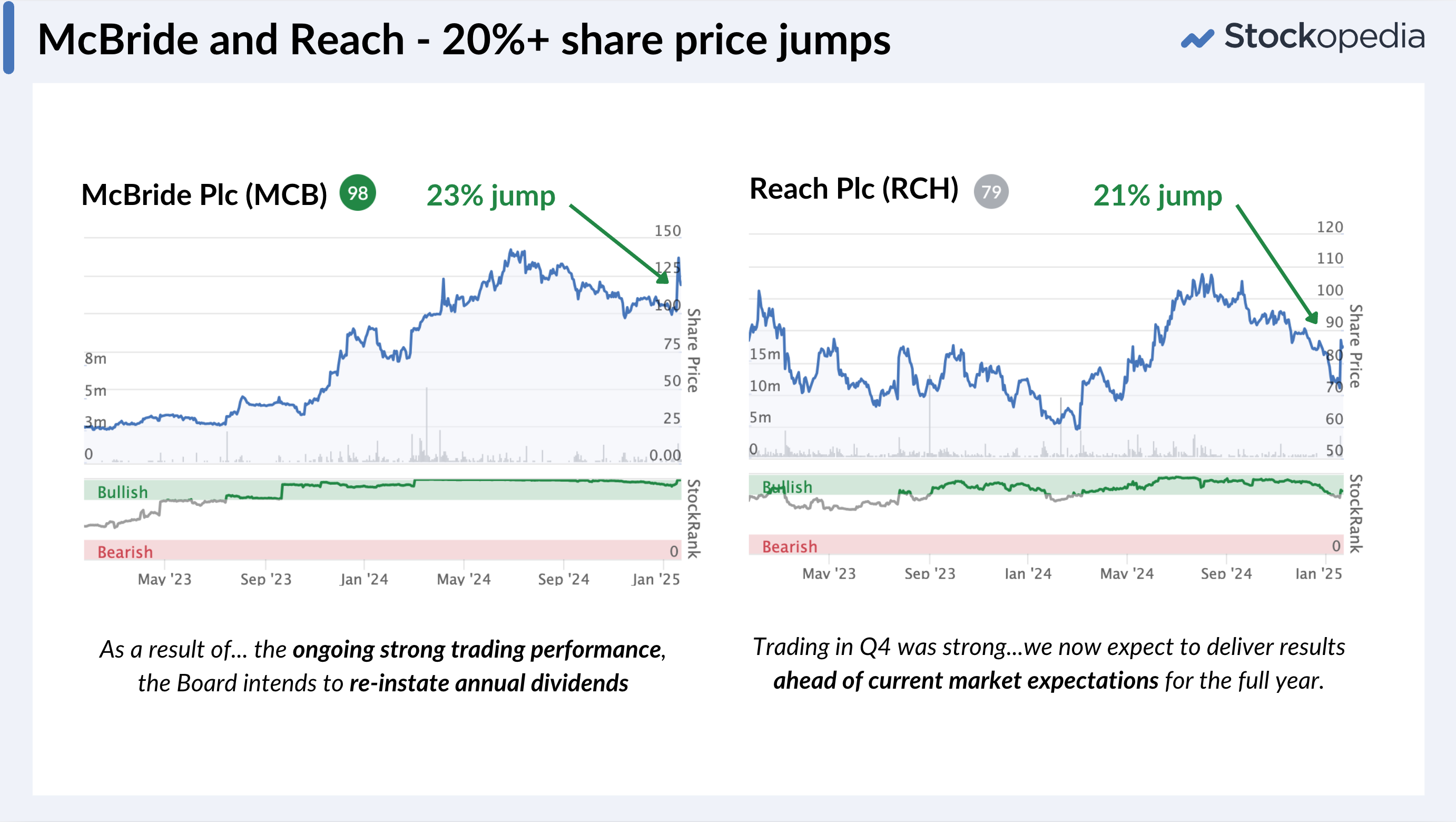

It’s trading statement season. Every January, a flood of company announcements hit the RNS newswire. There are often 25-30 every morning. It feels like a tsunami of information and can be overwhelming to take in. It’s daunting reading every one, and most serious investors barely get through a fraction of them. But what if there was an easy way to identify the ones that matter? Just this week we’ve seen two small cap companies jump 20% or more on a trading statement. What is this signalling to the market? What should you do as a shareholder, or potential shareholder? That’s what we’ll dive into today, and identify some simple rules of thumb that work.

Why UK trading statements are unique

Trading statements are a real cultural artefact of the LSE reporting environment. In the USA, companies report their financials quarterly, rather than every 6 months as in the UK, so the gaps between announcements are much shorter. UK companies routinely fill this gap with “Trading Statements” which give a good read whether the company is “ahead”, “inline” or “below” expectations.

These public trading statements kick off a round of discussions with city brokers and company analysts, leading to earnings forecast upgrades or downgrades. This creates a cycle where analysts revise their expectations, research is disseminated to clients, and buying or selling intent feeds into the market. As a private investor, getting ahead of these cycles is key, which is why trading statements matter.

The impact of trading statements on prices

In my piece before Christmas, “ahead of expectations” I noted how the academic research shows that when there is a surprise on the upside or downside, the share price tends to drift in the same direction in the coming months.

In the last few reporting days, we’ve seen two popular small caps, McBride (LON:MCB) and Reach (LON:RCH), release trading statements that caused their share prices to jump 20% in a single day. As an ex-Reach shareholder, my immediate thought was “I knew that was going to happen” and then went off to research other shares. But in the light of the academic research, this may not be a rational decision.

New insights from our own research

While academic research from the US is valuable, the UK environment is different. So we’ve kicked off a research…