Two property franchise specialists released full year updates this week: Property Franchise (LON:TPFG) and Belvoir (LON:BLV). I am interested in this business model because of its recurring revenues, strong cash generation, low capex and franchise networks.

I hold a small position in TPFG but it is Belvoir that has wowed the market with revenue growth of some 43% year-on-year. Belvoir is also significantly cheaper, trading at just c11 times forecast earnings and paying out a forecast yield of 4.73%. By comparison, TPFG is on 15 times forecast earnings and is set to pay out a 3.8% dividend.

Have I backed the wrong horse here?

The Property Franchise Group

Market cap: £59.39m

Revenue: £11.14m

Forecast PE ratio: 15x

Here are the headline figures from TPFG’s full year trading update, released on 28 January:

- In line with market expectations

- Much of the impact of the tenant fee has now been mitigated

- Record performance for lettings revenue

- Overall revenue +1.79% to £11.4m

- Management service fees +2.12% to £9.6m

- Number of tenanted managed properties serviced +5.45% to c.58,000

- Net cash now up to £4m

The outlook also sounds quite sunny:

“Early indications of improving market conditions underpin our expectation that the volume of house sales should increase in 2020. The lettings market is also anticipated to remain healthy, with rising rents and increased confidence leading to more opportunities for the Group's franchisees to acquire competitors' books than were available in 2019.”

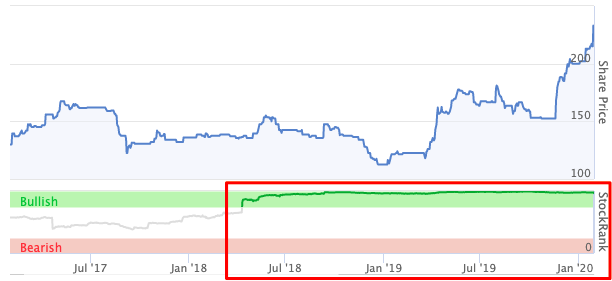

TPFG has been a 90+ StockRank stock for nearly two years now and in that time its share price has increased by 70% to 231p.

TPFG is the UK’s leading property franchise specialist. The Company was founded in 1986 and now operates through six brands:

- Martin & Co: a national lettings focused brand

- EweMove: a national, digitally enabled, hybrid sales and lettings brand

- CJ Hole: a full-service estate agency serving the West Country for 151 years

- Ellis & Co: a full-service estate agency serving London for 168 years

- Parkers: a full-service estate agency serving the M4 corridor for 70 years

- Whitegates: a full-service estate agency serving the Midlands and North of England for 40 years

TPFG’s growth trajectory has been remarkably consistent over the years. Revenue, profit, and cash from operations have increased at pace since 2013 (when it listed on AIM as MartinCo). The growth feels so controlled because a large part of…

.jpg)