I’ve now been running the Stock in Focus portfolio here at Stockopedia for nearly four years. Over that time there have been some changes. I’m also aware from subscriber feedback that many newer subscribers may not be familiar with the backstory on this rules-based portfolio.

As SIF approaches its fourth birthday in April, I’ve decided to mix my normal stock coverage with a series of articles taking a fresh look at the portfolio. This week I’m going to start by looking at the rules I use to guide my trading decisions and the results I hope to achieve.

Over the next few weeks, I’ll also be taking a more in-depth look at some of the changes I’m considering for the year ahead.

In the beginning

In 2015, I started the Stock in Focus column here at Stockopedia. The initial idea was to bridge the gap between a stock’s story and its financials. By sticking to the Stocko philosophy that rules-based investments are likely to outperform unstructured selections, I hoped to profile stocks that would go on to perform well.

At the end of 2015, it seemed logical to round up the performance of my picks after I’d written about them. The results were encouraging. So after discussions with boss Ed, I decided to convert my weekly column into a stock portfolio.

The rules were pretty simple. All stocks would be selected using a set of screening rules that I would develop. To ensure complete transparency and provide a reliable audit trail, the portfolio would be run as a Stockopedia Fantasy Fund.

On 19 April 2016, I launched the Stock in Focus (SIF) fantasy fund (this link only works on the old Stockopedia website).

Since then, I’ve bought 94 stocks for the SIF fund and sold 78 of them. After the first year, I was encouraged by progress, so since April 2017 I’ve also been running this portfolio as a real-money fund using my own cash.

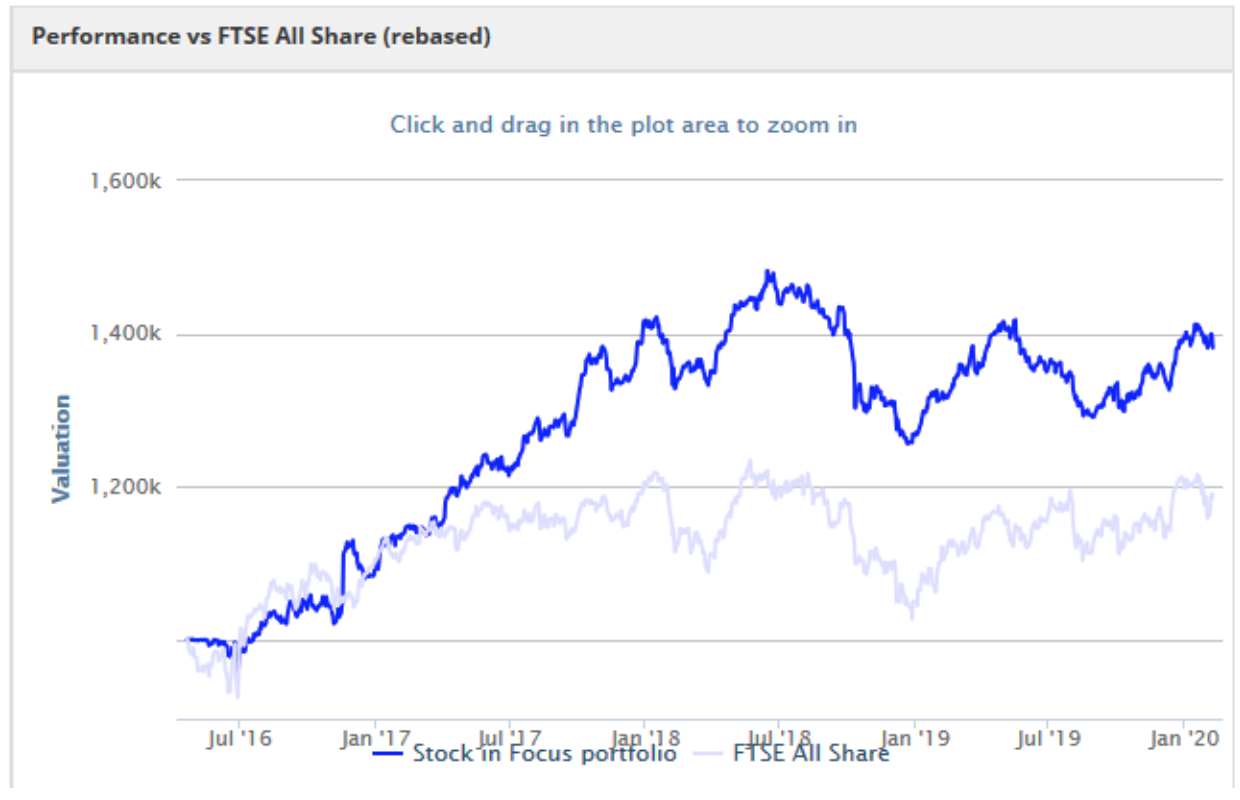

Results so far have been encouraging. Here’s how SIF has performed against its FTSE All Share benchmark:

The portfolio has delivered a total return of 47.5 percent including dividends, or 36.5 percent based on capital gains only. Over the same period, the FTSE All Share has risen by 18.5 percent. Unfortunately I don’t have…