Our Jim Slater ZULU Principle Screen has been the best-performing Guru screen by a large margin since its inception in 2011. This approach is based on the principles outlined by the famous UK investor in his 1992 book, The Zulu Principle – essential reading for all stockpicking investors.

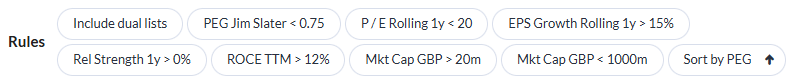

Here's a snapshot of the rules we use in the ZULU screen:

Based on quarterly rebalancing, this screen has generated a 1,350% return (excluding dividends) over the last 14 years. That’s equivalent to 21% annualised:

I know that a number of subscribers have followed this approach with some success. I am also happy to admit that Slater’s ideas also influenced the rules-based strategy I use to run the Stock in Focus (SIF) Portfolio.

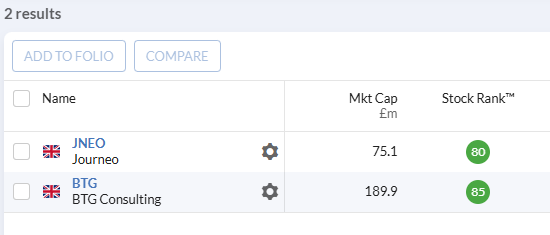

However, investing purely by following the ZULU screen results isn’t without its challenges. Very few stocks typically qualify for this screen at any one time. There are just two at the time of writing, for example:

Building a balanced, diversified portfolio with a sensible number of positions thus requires some discipline and planning, with gradual execution over time and a systematic approach to buying and selling.

These constraints should help to reduce the risk of unsustainable losses. They are also likely to restrict overall returns.

One person who has risen to the challenge of executing this strategy in a sustainable and professional way is Jim Slater’s son Mark Slater. He’s chairman and chief investment officer of UK asset manager Slater Investments.

A professional result

Slater Investments runs three main funds, but its largest and probably most successful is the Growth Fund.

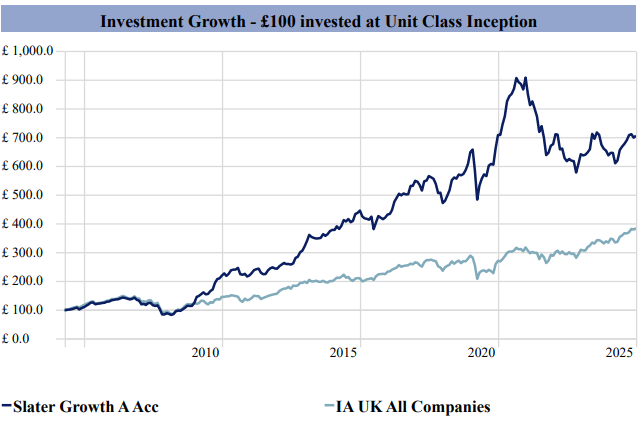

Between its inception in March 2005 and December 2025, the Slater Growth Fund grew to £445m of assets under management and delivered a 607% total return (9.8% annualised). This is nearly double the average return from UK equity funds over the same period:

Slater’s Growth Fund has also comfortably outperformed the market. Over the same 2005-2025 period, the FTSE 100 Total Return index delivered a gain of 338%, or 7.3% annualised.

In a graphic example of the power of compounding, it’s worth noting how a modest-sounding 2.5% per year outperformance versus the FTSE has…

.JPG)