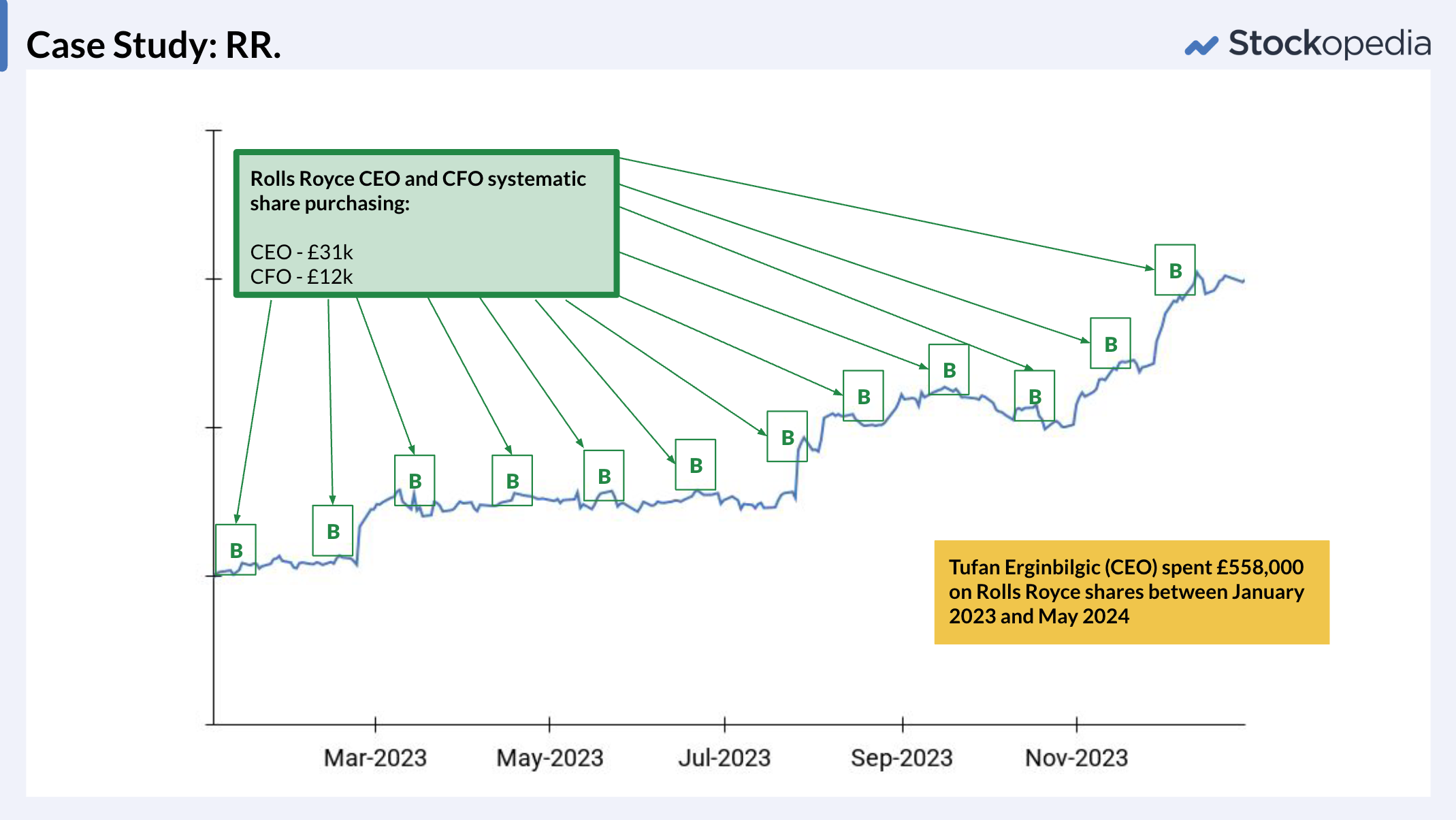

In the early summer of 2022, Rolls-Royce was in the midst of a turnaround, but few investors paid attention. Insiders, however, were quietly buying—snapping up shares at rock-bottom prices. Fast forward two and a half years to early 2025, and those who followed their lead would have seen a fivefold return (with further gains since). So, how can private investors spot signals like this?

Our newly updated Smart Money Playbook sets out to answer that question. Since first conducting this research over a decade ago, we’ve expanded our analysis—digging into further academic studies, dissecting more financial theories, and building a database tracking over 105,000 director deals in the UK alone. Now, our latest findings take the initial findings a step further, uncovering powerful insights into insider trading, analyst recommendations, and fund manager positioning.

The goal? To help private investors identify the smart money signals that matter—and use them to gain an edge in the market.

Decoding Director Dealings

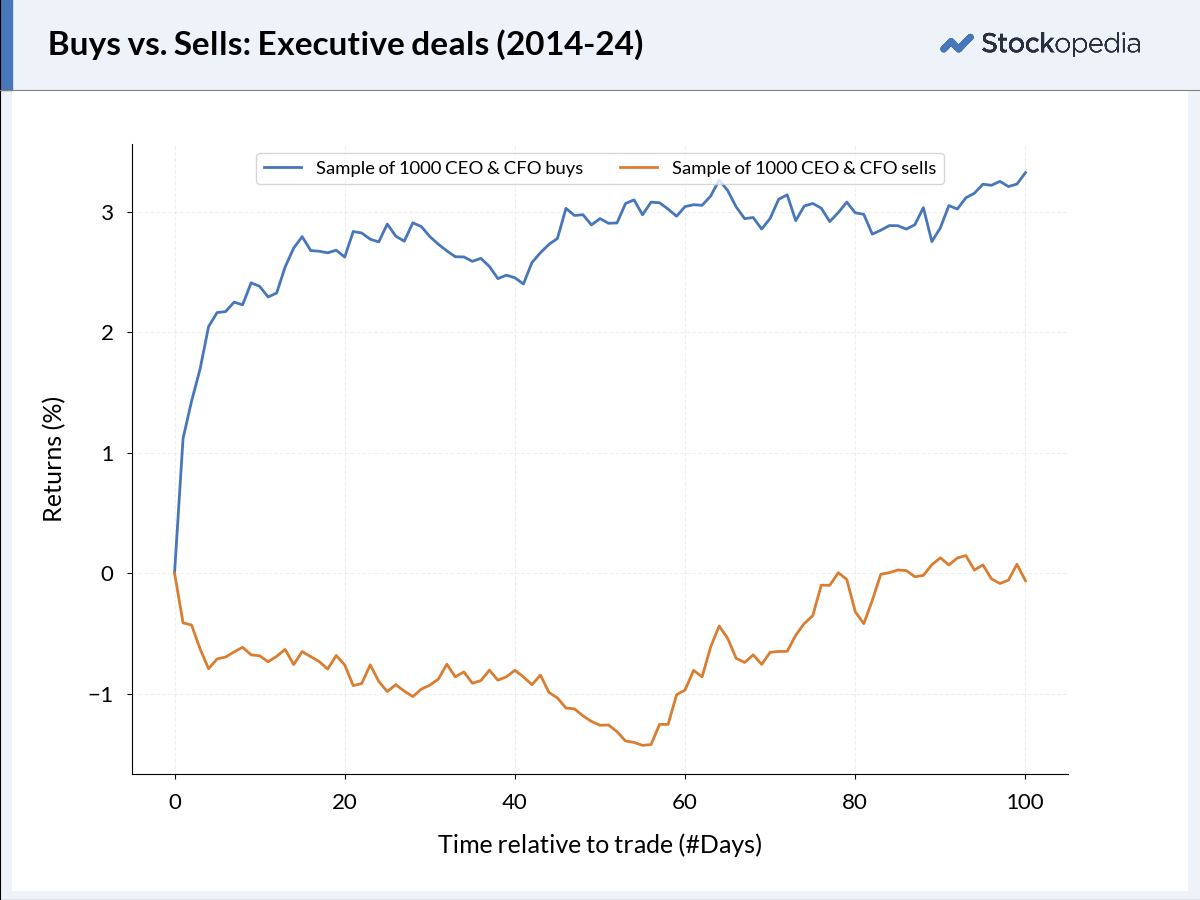

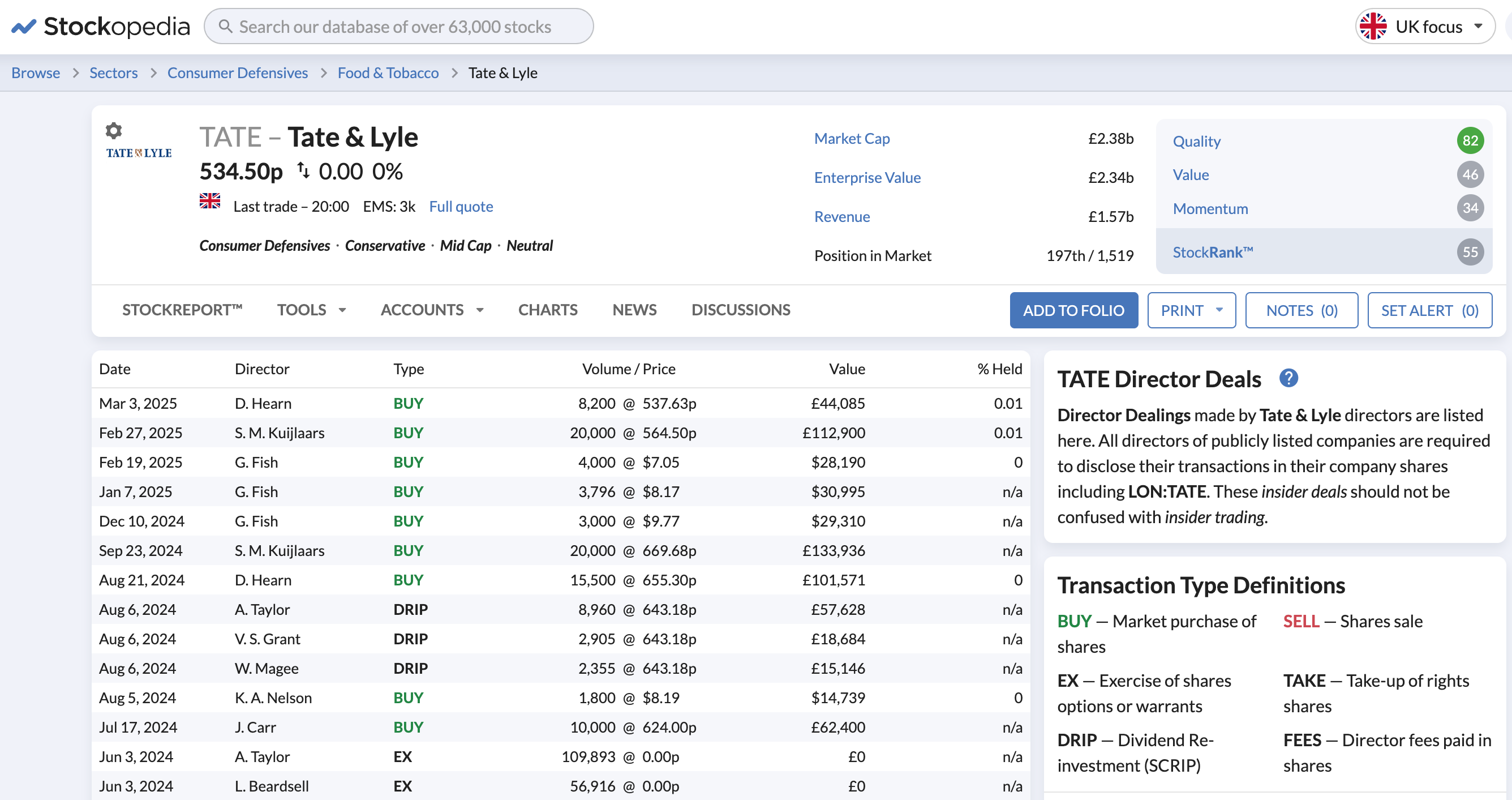

Company directors and executives possess unmatched insight into their firms' prospects. Their trading activity offers valuable clues about future performance—but only when they are interpreted correctly. While insider purchases are generally more informative than sales, our research has now identified the specific types of director buys that provide the most reliable signals.

Key principles for evaluating insider activity:

- Look for clusters of buying. When multiple directors purchase shares around the same time, it signals strong confidence in the company's future.

- Pay attention to key decision-makers. Transactions by CEOs and CFOs often carry more weight than those by other executives.

- Size matters. Large insider purchases, particularly in smaller companies, indicate high conviction.

- Director sales in struggling firms. If a company has weak fundamentals and its leadership is selling, it often foreshadows further declines.

- R&D-heavy sectors. Insider purchases in research-intensive industries may signal upcoming breakthroughs or strong growth potential.

Analyst Insights: Beyond the "Buy" Ratings

Sell-side analysts devote their careers to researching companies and issuing investment recommendations. However, blindly following their ratings isn't a winning strategy. The real value lies in analysing their revisions and forecasts.

What to watch for:

- Upgrades and downgrades. Significant shifts in analyst recommendations can drive meaningful share price moves.

- Earnings revisions. Stocks with frequent upward earnings estimate revisions tend to outperform.

- Earnings surprises. Companies that beat expectations often experience sustained price momentum…