The Bank of England left its main interest rate unchanged at 4% this week, but it was a finely-balanced decision – the Bank’s Monetary Policy Committee voted 5-4 in favour of a rate freeze, with four members supporting a cut to 3.75%.

Arguably, this makes a rate cut in December more likely, assuming the Bank’s view that inflation has peaked proves correct.

Interestingly, two members of the MPC already believe that monetary policy [interest rates] are “significantly over-restrictive”. In their view, this has the potential to “unduly damage [economic] activity and possibly lead to an undershoot in inflation in the medium term”.

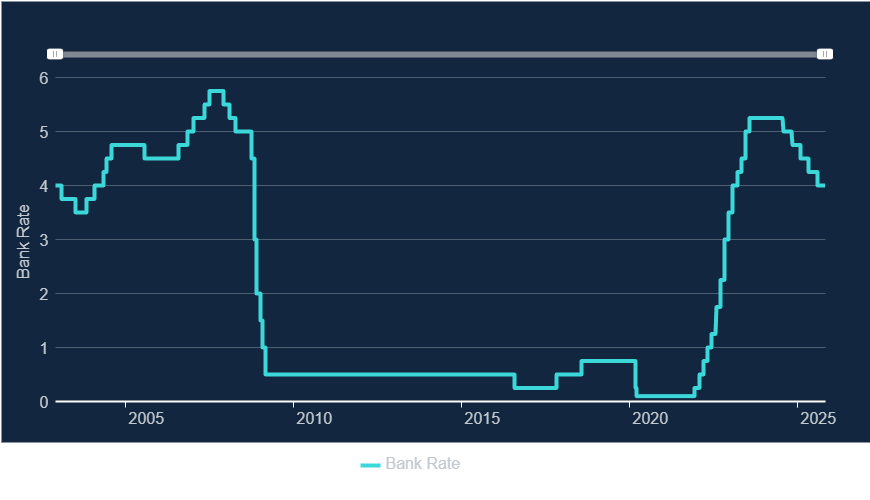

A post-2003 chart of interest rates suggests that the current rate is in a relatively normal range, with plenty of room to move lower if needed:

Source: Bank of England

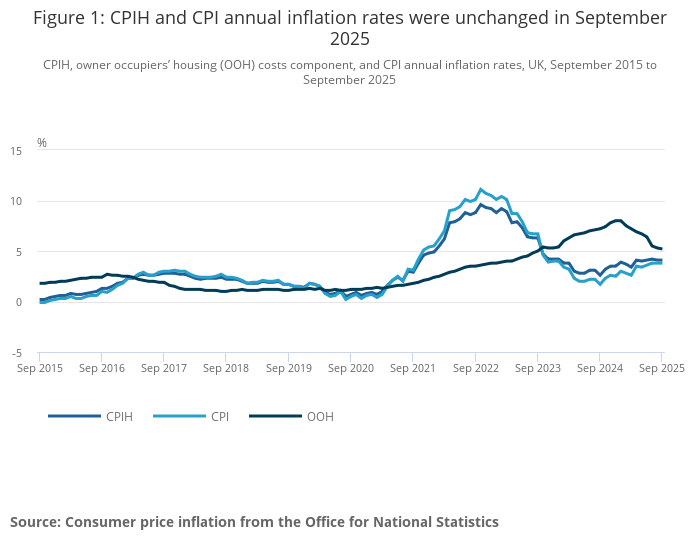

However, this chart from the Office for National Statistics (ONS) suggests that weakening inflation isn’t yet making its way through to the official stats, except in relation to home ownership:

We’ll have to see if inflation data for October and November support the view of some MPC members that inflation is weakening.

My impression is that managing interest rates and inflation is as much art as science, but I am inclined to think that a rate cut is increasingly likely once the uncertainty attached to November’s Budget has passed.

Looking ahead, I suspect that UK economic data published over the next couple of weeks – including GDP – is likely to continue being overshadowed by speculation and leaks about the content of the Budget.

Debate has continued this week over whether the Government will break its election pledge not to raise Income Tax, or find other ways to control inflation while supporting the economy. Measures rumoured in the press this week have included per-mile charges for electric cars and the removal of VAT from utility bills.

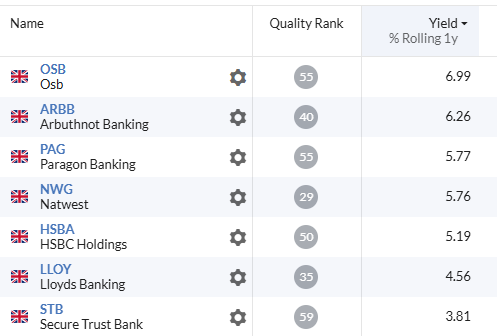

Fortunately for investors, the big UK banks are expected to avoid any additional profit levies. That should help to support the generous dividends on offer from several of these lenders:

Not all companies are expecting to escape scot-free from the Budget, while some are already suffering due to consumer uncertainty. In the DSMR this week, we’ve seen companies…