Hello and welcome to the latest edition of the Week Ahead!

The first full week of 2026 is behind us, and it has been a strong start for the markets.

The S&P 500 is already up 1.3% year-to-date:

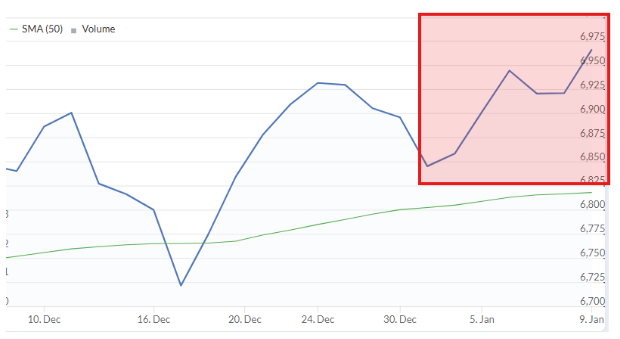

And the FTSE is already up 2%:

I’ve spent the past week or two trying to ignore global politics - particularly Trump’s intervention in Venezuela, and also the unrest in Iran.

The markets haven’t been ignoring it, however. And the ramifications of these events, however grisly this might be, have been positive.

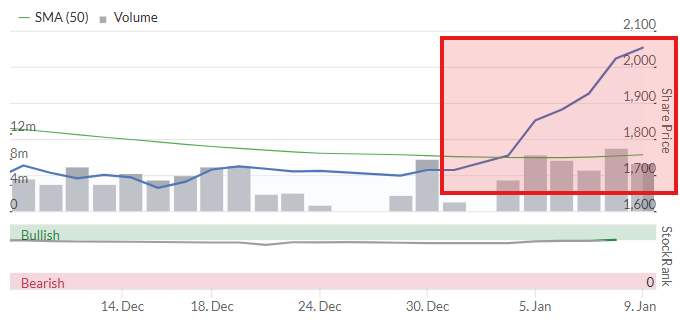

BAE Systems (LON:BA.) , for example, is up by a remarkable 20% year-to-date.

The saying “elephants don’t gallop” has never really been true, and certainly not for defence stocks during times of international tension.

BAE hasn’t even issued a relevant announcement - the price action of this £60bn stock has been entirely driven by external news. President Trump, in particular, has asked for US military spending to rise by over 50% to $1.5 trillion in 2027 (2026 budget: $901 billion).

Such a spending bonanza would ripple through the entire defence sector both in the US and internationally, generating windfall gains for these companies and their suppliers (if they even have the capacity to fill orders of this magnitude?).

Trump has argued that the spending could be paid for through tariff income. According to official figures, US Customs collected over $200 billion in tariffs in 2025, in a year when tariffs were not raised until April. So perhaps there is some plausibility to this claim?

Either way, there is a long road ahead for his defence spending idea: his administration first has to produce an actual proposal for FY 2027 (expected in early February), and then it will slowly work its way through Congress, perhaps being approved in time for the start of the new fiscal year in October. Although based on how previous budgets have been received, it could be quite a bit later than that.

For defence stocks this means a potentially long wait until we find out how realistic is Trump’s $1.5 trillion idea. But his intent is clear!

Looking ahead in the short-term, next week will see updates from various companies…