It has been a dramatic week in politics, with a fiery Budget and a fiery response to that Budget in the House of Commons. Politicians will be politicians.

The markets have been less dramatic, once you take a step back: the FTSE rose 2% this week, which seems at odds with what you might have expected, given the headlines.

About half of those gains were racked up prior to the release of the Budget. The market then briefly wobbled during the speech, before continuing its rally.

On a 1-month view, little has changed for the FTSE:

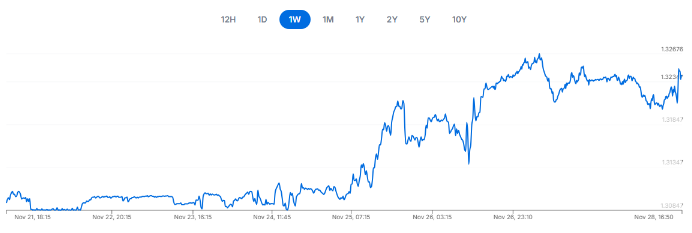

Perhaps in even better news for the ordinary person, the pound has been strong. Here’s a 1-week view (source: xe.com), with the pound gaining more than 1% against the dollar:

Prior to the Budget, the FT suggested that traders were betting heavily against the pound.

However, the tax-raising nature of the budget, and the increase in fiscal headroom accompanying it, says that the government’s borrowing needs will be lower than expected. This in turn strengthens the pound, forcing currency traders to unwind their bets as the market moved against them. Spending will be funded through higher taxation rather than through borrowing and printing.

Consistent with this logic, 10-year gilt yields have fallen post-Budget, from about 4.5% to 4.44%.

The conclusion? No major impact on markets.

For markets, the main conclusion is that government borrowing needs will be lower.

The Budget was of course a big story for individuals and for households - the lifting of the two-child benefit cap, the imposition of a mansion tax, and so on. The freezing of tax thresholds until 2031. The shrinking of cash ISAs to £12k for the under-65s. But these do not directly impact most companies and markets.

When it comes to the potential for more interest rate cuts, inflation has been a sticky subject. And the OBR has just revised up its average CPI forecast from 2.6% to 3.0%, for the period 2025-2029. But in the same paragraph, they said: “Policy measures in this Budget reduce CPI inflation by 0.3 percentage points in 2026.”

Therefore, while inflation is stubbornly remaining above the Bank of England’s 2% target, this year’s Autumn Budget is thought to be deflationary in nature. Taxation is…